ASX: FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED (FPH) – TradingLounge (1D Chart)

Overview

Welcome to today’s Elliott Wave analysis for FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED (ASX: FPH).

Currently, ASX: FPH shows no immediate signs of a bullish reversal, with further downside movement anticipated. This presents a strategic opportunity to monitor the stock’s corrective waves, which play a critical role in identifying potential motive wave formations for future price action.

FPH Elliott Wave Technical Analysis

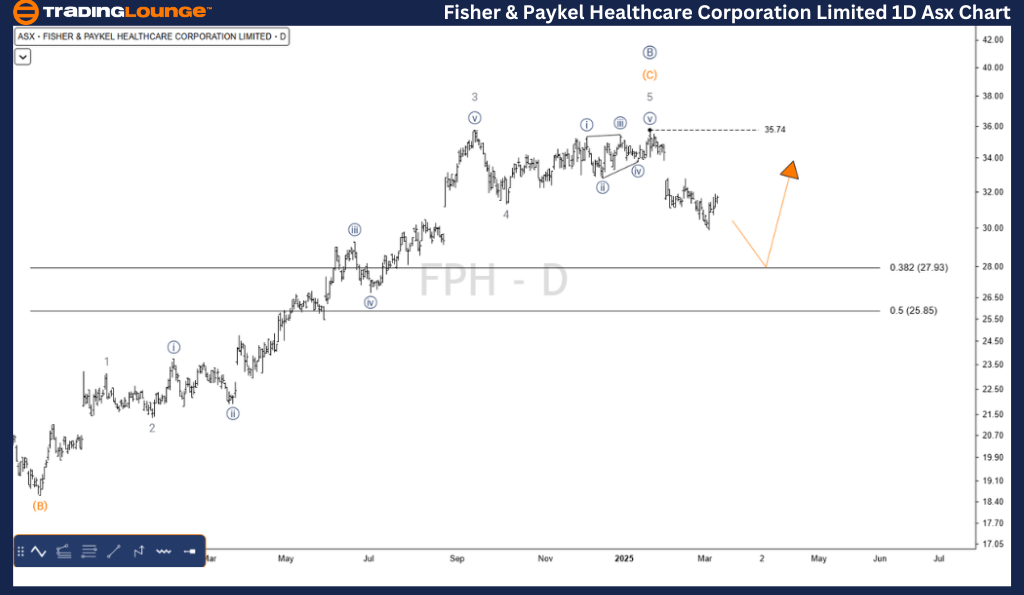

ASX: FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED (FPH) Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Function: Major Trend (Minor Degree – Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((c)) – Navy

Analysis Details: The corrective wave structure appears to be unfolding as ((a))((b))((c)) – navy, with the ((b)) – navy wave likely reaching a peak at 35.74. Currently, Wave ((c)) – navy is in progress, though alternative wave counts may also be developing.

Regardless of the precise pattern, the price remains poised to push lower, with 27.93 identified as the next major support level.

Invalidation Point: 35.74

ASX: FPH Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

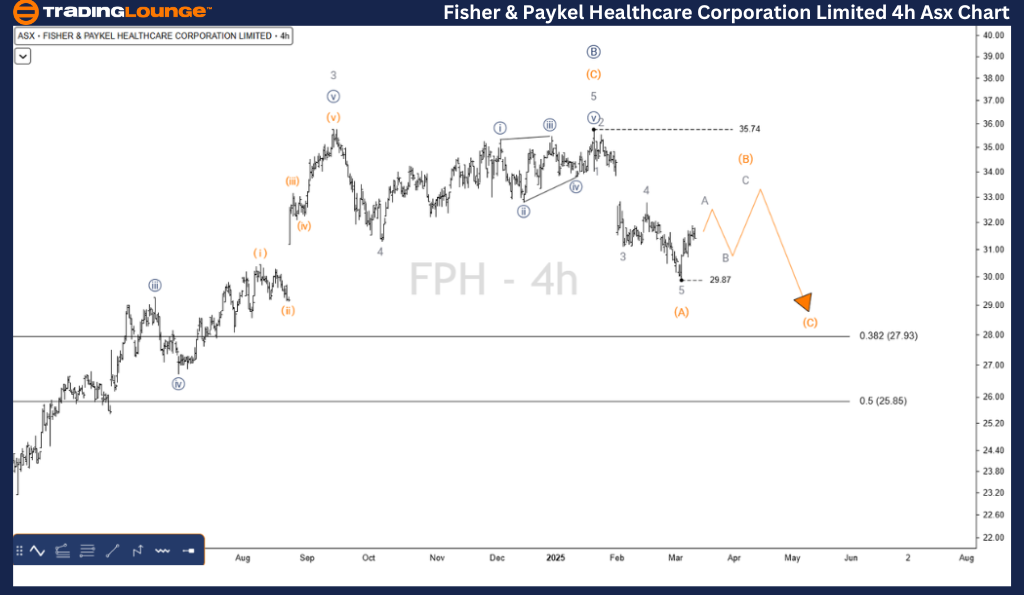

ASX: FPH Elliott Wave Technical Analysis – 4-Hour Chart

Function: Major Trend (Minute Degree – Navy)

Mode: Motive

Structure: Impulse

Position: Wave (B) – Orange of Wave ((c)) – Navy

Analysis Details: The Wave ((c)) – navy is actively progressing lower. The previous Wave (A) – orange completed a five-wave sequence, confirming its impulse structure.

Currently, Wave (B) – orange is forming a short-term corrective phase, likely preceding the continuation of Wave (C) – orange, which is expected to drive the price lower.

Invalidation Point: 35.74

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: INSURANCE AUSTRALIA GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis on FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED (ASX: FPH) offers valuable insights into the current market structure and potential trading opportunities.

By establishing key validation and invalidation points, we enhance confidence in our wave counts, equipping traders with data-driven decision-making tools. Our goal is to maintain an objective and professional perspective on price trends, helping traders capitalize on potential market movements.