ASX: COMMONWEALTH BANK OF AUSTRALIA - CBA Elliott Wave Technical Analysis

Greetings,

Our updated Elliott Wave analysis focuses on the Australian Stock Exchange (ASX), with a deep dive into COMMONWEALTH BANK OF AUSTRALIA (CBA).

We anticipate continued bullish momentum in ASX:CBA, with Wave Three currently in progress. This forecast outlines target levels, key price points, and invalidation zones to assess when this view remains valid.

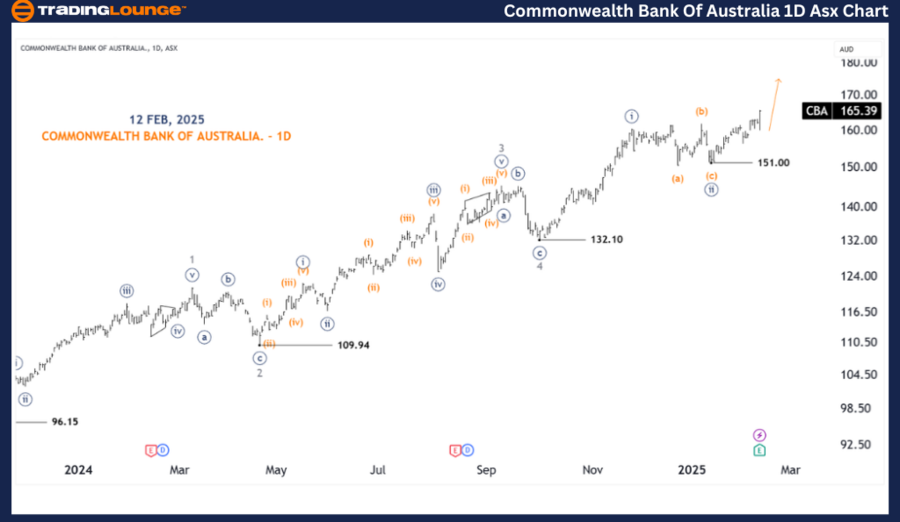

ASX: COMMONWEALTH BANK OF AUSTRALIA - CBA Elliott Wave Technical Analysis (1D Chart - Semilog Scale)

Function:

Major Trend: Minor degree (grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy of Wave 5 - grey

Details:

- Wave 5 (grey) is extending, with subwaves ((i)), ((ii)) (navy) unfolding.

- Since the low at 151.00, wave ((iii)) (navy) is gaining momentum, confirming a short-term bullish outlook.

- Next Target: 200.00

- Invalidation Level: 151.00

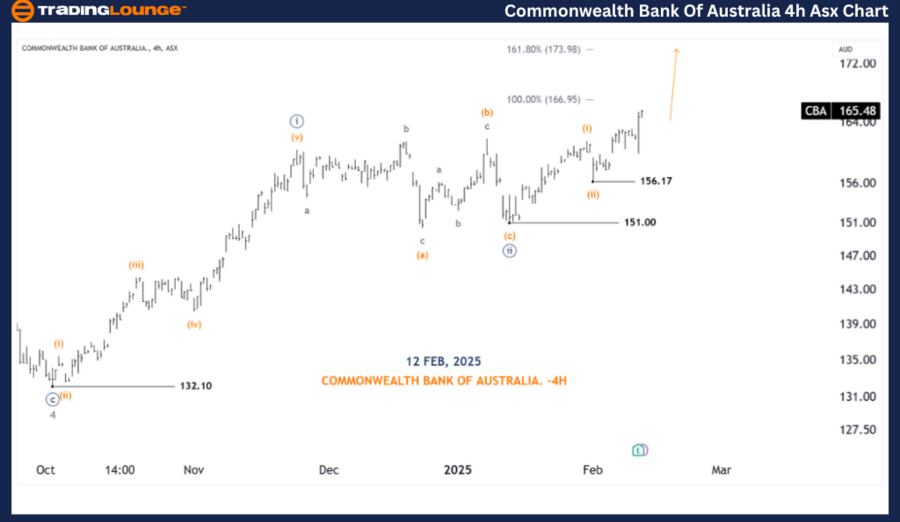

ASX: COMMONWEALTH BANK OF AUSTRALIA - CBA Elliott Wave Technical Analysis (4-Hour Chart)

Function:

Major Trend: Minor degree (grey)

Mode: Motive

Structure: Impulse

Position: Wave (iii) - orange of Wave ((iii)) - navy of Wave 5 - grey

Details:

- Within wave ((iii)) (navy), we confirm subwaves (i), (ii) (orange) have completed.

- Wave (iii) (orange) is now gaining strength, pushing toward higher price levels.

- Next Target Levels: 173.98 and potentially 180.00

- Key Invalidation Level: 156.17

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SONIC HEALTHCARE LIMITED – SHL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis of ASX: COMMONWEALTH BANK OF AUSTRALIA (CBA) provides key insights into current market trends, helping traders optimize their investment strategies.

By identifying critical price levels that confirm or invalidate the Elliott Wave count, this analysis enhances forecast reliability. Our goal is to deliver a precise, professional, and data-driven outlook on the ASX stock market trends.