Netflix Inc., Elliott Wave Technical Analysis

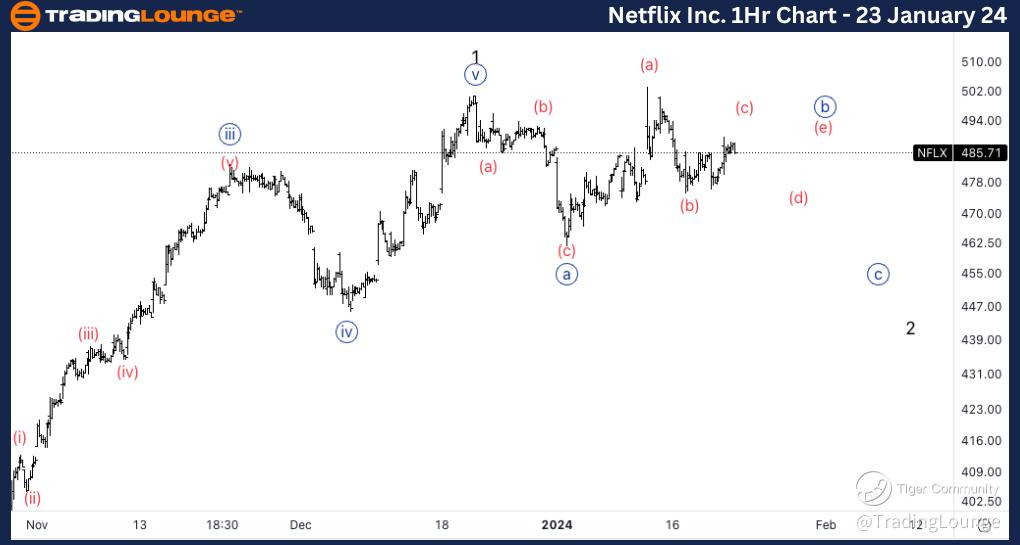

Netflix Inc., (NFLX:NYSE): 4h Chart 23 January 24

NFLX Stock Market Analysis: We have been monitoring this wave {b} in Netflix for some time. It looks like we are starting to move sideways, confirming the bias of a wave {b}. Looking for further downside into wave {c}.

NFLX Elliott Wave Count: Wave {c} of 2.

NFLX Technical Indicators: Above all averages.

NFLX Trading Strategy: Looking longs after we find support on 500$.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

Previous: McDonald’s Corp

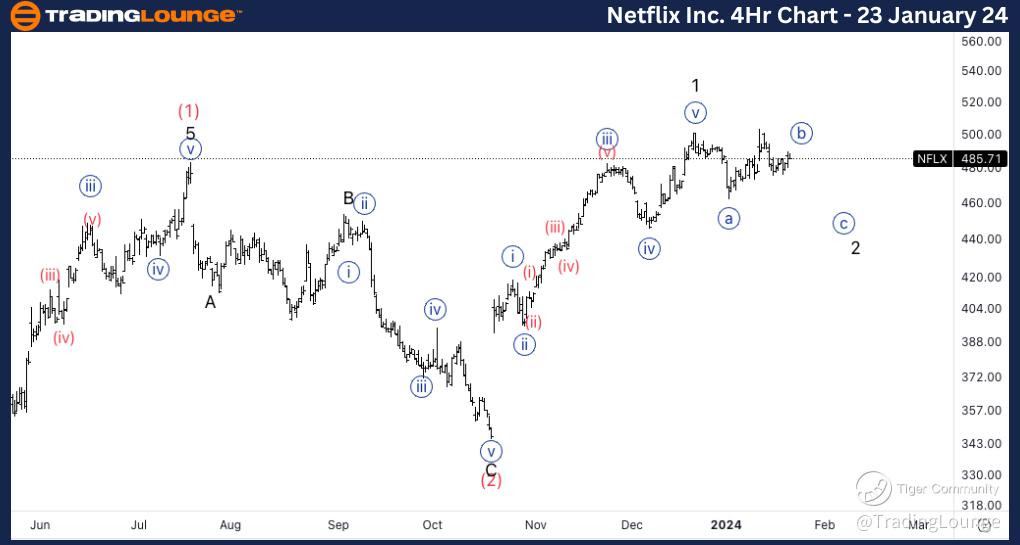

Netflix Inc., NFLX: 1-hour Chart 23 January 24

Netflix Inc., Elliott Wave Technical Analysis

NFLX Stock Market Analysis: Looking for a potential triangle in wave {b} as shown or else a simple sideways movement. As long as we find resistance on 500$ we could even look for short term shorts into wave {c} towards 450$, knowing we’d be trading against the main trend.

NFLX Elliott Wave count: Wave {b} of 2.

NFLX Technical Indicators: Above all averages.

NFLX Trading Strategy: Looking for short term shorts below 500$.