JPMorgan Equity Premium Income ETF – JEPI (1D) Elliott Wave Analysis

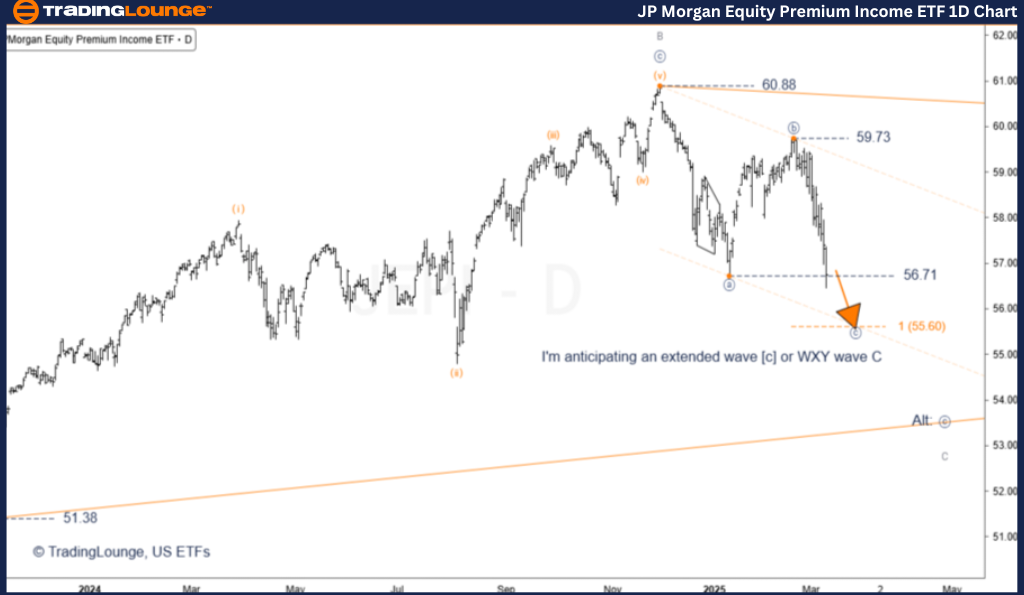

JEPI ETF Daily Chart Analysis

JEPI Elliott Wave Technical Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Triangle

Position: Wave [c] of C

Direction: Decline

JEPI ETF Analysis Overview

- The bearish trend remains in force, approaching the completion of wave C within the triangle pattern.

- The $56.71 low of wave [a] has been breached, confirming the zigzag structure.

- Signs of wave extension in wave [c] indicate that a complex zigzag may not be forming.

- Once wave [c] completes, a rally is expected in the form of three corrective major waves to form wave [d].

- If wave C follows a WXY structure, the three corrective waves will be short-lived to form wave [x] of C.

- The guideline of wave equality is expected to be fulfilled at $55.60.

Invalidation Level: $59.73

JPMorgan Equity Premium Income ETF – JEPI (4H) Elliott Wave Analysis

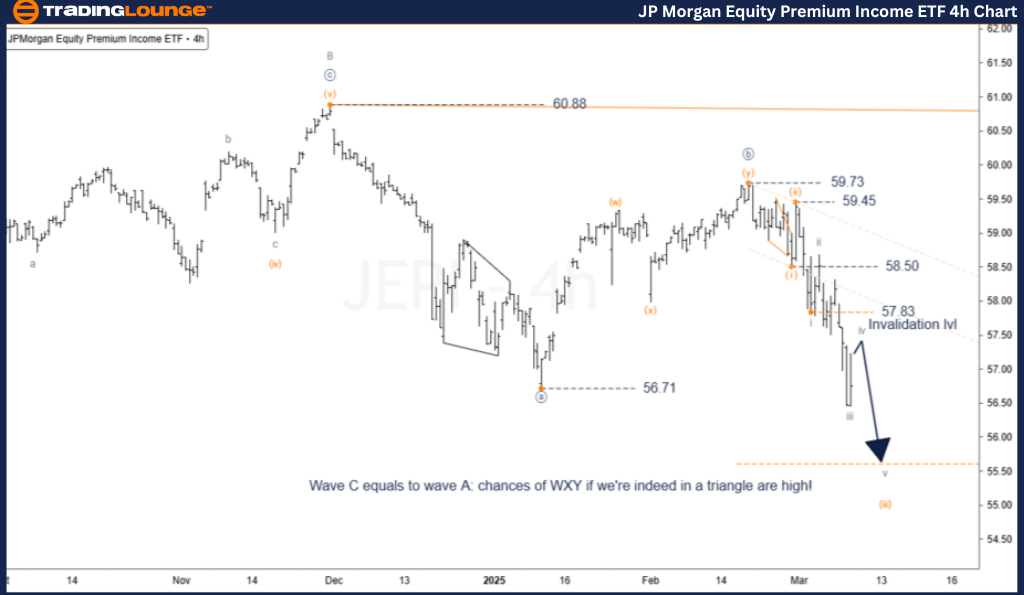

JEPI ETF Hourly Chart Technical Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Impulsive

Structure: Impulse

Position: Wave iv of (iii) within [c] of C (Minor Degree)

Direction: Decline

JEPI ETF Analysis Overview

- The downtrend is expected to resume once wave iv pullback is complete.

- Wave iv is likely to terminate around $57.50.

- The next movement should be impulsive, pushing JEPI towards the $55.60 target.

- Any movement above the invalidation level suggests that the market is in wave [x] or that wave [c] is forming a more complex structure.

Invalidation Level: $57.83

Technical Analyst: Siinom

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: iShares Bitcoin Trust ETF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

- The decline in JEPI remains ongoing, and it is premature to conclude that wave C is near completion.

- Once wave C completes, a rally forming wave D is expected.

- Strict adherence to Elliott Wave rules and monitoring invalidation levels is crucial to avoid unnecessary losses.