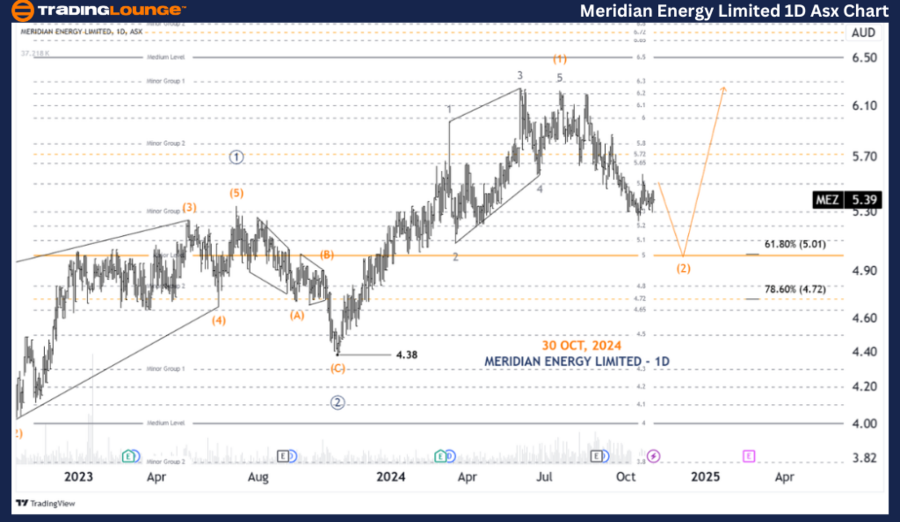

Meridian Energy Limited (MEZ) Elliott Wave Analysis TradingLounge (1D Chart)

Greetings, today's Elliott Wave analysis focuses on Meridian Energy Limited (ASX: MEZ). Our insights reveal a continued downward movement for MEZ.ASX, with a transition expected back to wave (3)-orange once wave (2)-orange concludes.

ASX: Meridian Energy Limited – MEZ 1D Chart Analysis (Semilog Scale)

MEZ Elliott Wave Technical Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave (2)-orange

Details: Wave (1)-orange appears completed as a Diagonal structure, and wave (2)-orange is developing lower, targeting the 5.22 level. Following a Diagonal, the second wave often undergoes a deep retracement, indicating that wave (2)-orange may not be complete.

Invalidation Point: 4.38

ASX: Meridian Energy Limited – MEZ 4-Hour Chart Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((c))-navy of Wave C-grey within Wave (2)-orange

Details: Examining wave (2)-orange in closer detail, it forms as a Zigzag with sub-waves A, B, and C-grey. Wave C-grey continues its downward move, developing into a Diagonal pattern. Wave ((v))-navy is expected to push lower.

Invalidation Point: 6.18

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Origin Energy Limited – ORG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis of ASX: Meridian Energy Limited (MEZ) delivers actionable insights into the prevailing market trend and offers guidance on effectively leveraging these market movements. This forecast incorporates specific price validation and invalidation points to substantiate our wave count, supporting a confident, data-backed perspective on current market dynamics. Our goal is to equip readers with a clear, objective, and professional understanding of ASX: MEZ trends.