Caterpillar Inc. (CAT) Elliott Wave Analysis - Trading Lounge Daily Chart

CAT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Complex

Position: Wave {iv} of 3

Direction: Bottom in {iv}

Analysis Details:

Caterpillar Inc. (CAT) may have completed wave {iv}, suggesting a strong overall trend. If wave {iv} is indeed complete, the next uptrend into wave 5 could soon begin. Alternatively, there’s a possibility that only wave (a) of {iv} has been completed, indicating the potential for a deeper correction before resuming the primary trend. A decisive breakout will confirm the trajectory.

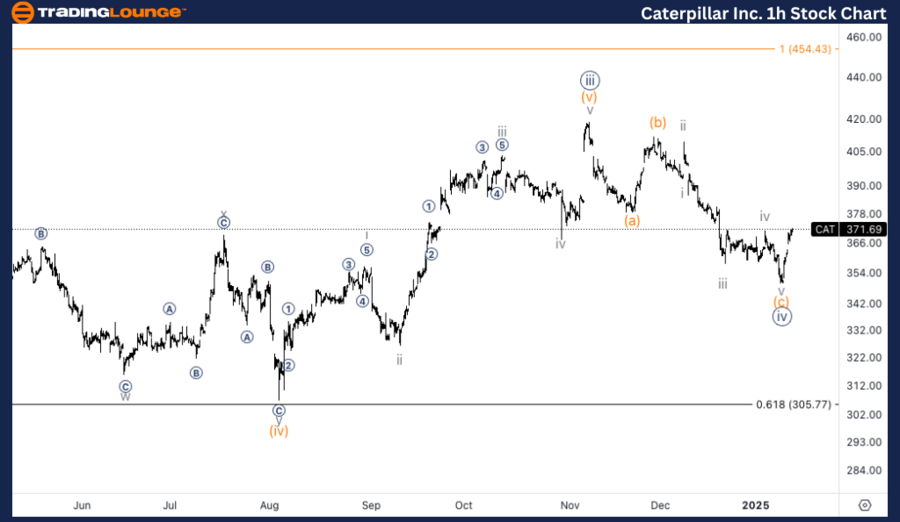

CAT Elliott Wave Technical Analysis – Daily Chart

Caterpillar Inc. (CAT) appears poised for a possible bottom formation in wave {iv}, which is a critical juncture in its Elliott Wave pattern. This development points to a continuation of the dominant trend, assuming wave {iv} is finished. If this scenario holds true, the next stage could lead to a strong rally in wave 5. However, traders should remain cautious, as we may still be completing wave (a) of {iv}, implying additional downside before resuming the uptrend.

Caterpillar Inc. (CAT) Elliott Wave Analysis - Trading Lounge 1H Chart

CAT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Complex

Position: Wave {i} of 5

Direction: Bottom in wave {iv}

Analysis Details:

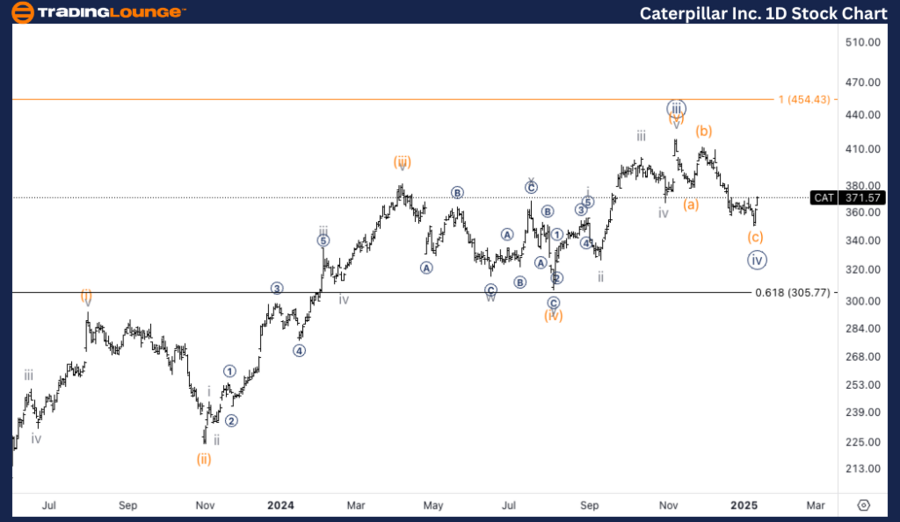

The 1H chart reveals a clear three-wave correction with an intricate subdivision in wave (c). Wave {iv} appears shorter than wave (iv) of the previous degree, suggesting the possibility of still being within wave (a) of {iv}. Should wave {iv} hold, the upside target for wave 5 aligns at $450, based on the projection of equality between wave 3 and wave 1.

CAT Elliott Wave Technical Analysis – 1H Chart

On the 1H timeframe, Caterpillar Inc. (CAT) exhibits a structured corrective move with a well-defined subdivision in wave (c). Despite the relatively short duration of wave {iv} compared to the same wave of a lesser degree, there remains the potential for wave {iv} to extend further as wave (a). If this support level holds, the projection for wave 5 points toward an upside target of $450, derived from the wave 3 vs. wave 1 equality analysis.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Fortinet Inc. (FTNT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support