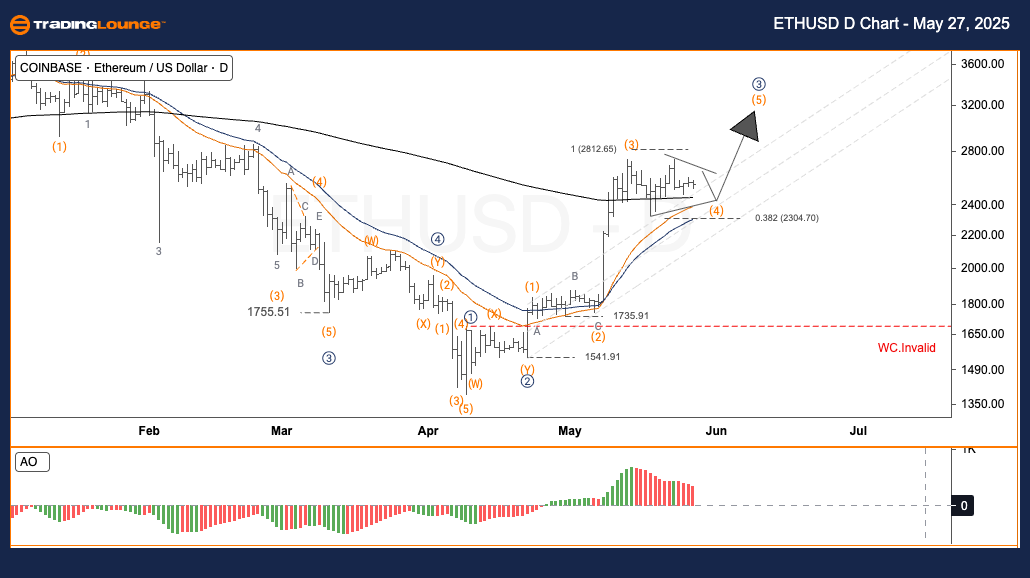

ETHUSD Elliott Wave Analysis – TradingLounge Daily Chart

Ethereum / U.S. Dollar (ETHUSD) Daily Chart Analysis

ETHUSD Elliott Wave Technical Overview

Function: Trend Following

Mode: Motive

Structure: Impulsive

Wave Position: Wave 3

Direction (Next Higher Degree): Pending Confirmation

Wave Invalid Level: Not specified

Ethereum (ETHUSD) – Daily Trading Strategy

Ethereum continues to maintain its bullish trajectory, completing a significant push in wave (3). The market then entered a consolidation zone, possibly forming a running triangle or flat correction, signaling the setup for wave (5). The previous peak near $2,736.32 confirmed an extended third wave, while price activity now points toward the formation of wave (4), preparing for the next bullish leg.

ETHUSD Trading Strategies

- Main Strategy: For short-term swing traders, closely observe the price range of $2,350–$2,400 for possible reversal signs.

- Risk Control: Place stop-loss orders below $2,320 to safeguard against a potential structural breakdown.

Ethereum Elliott Wave Analysis – TradingLounge H4 Chart

Ethereum / U.S. Dollar (ETHUSD) 4-Hour Chart Analysis

ETHUSD Elliott Wave Technical Overview

Function: Trend Following

Mode: Motive

Structure: Impulsive

Wave Position: Wave 3

Direction (Next Higher Degree): Pending Confirmation

Wave Invalid Level: Not specified

Ethereum (ETHUSD) – H4 Trading Strategy

Ethereum’s impulsive rise in wave (3) has transitioned into a sideways pattern, indicating either a running triangle or flat correction. This setup supports the view of an imminent wave (5) development. The completion of wave (3) at $2,736.32 reinforces the impulsive structure, while current price action hints that wave (4) is forming and might conclude shortly, enabling the market to resume its upward momentum.

Ethereum Trading Strategies

- Main Strategy: Short-term traders should monitor the $2,350–$2,400 zone for entry signals aligned with the anticipated trend continuation.

- Risk Control: Position stop-loss levels under $2,320 to mitigate risk from a potential structural reversal.'

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support