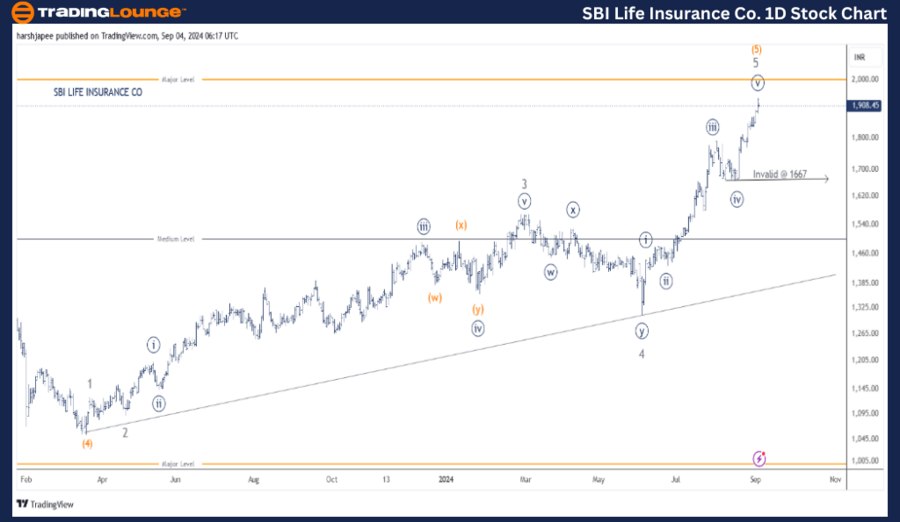

SBI LIFE INSURANCE CO – SBILIFE Elliott Wave Analysis (1D Chart)

SBI LIFE Stock Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Grey

Details: Minute Wave ((v)) appears complete near 1940 or could be nearing its end within Minor Wave 5 Grey of Intermediate Wave (5) Orange. Traders are encouraged to book profits at this level.

Invalidation Point: 1667

SBILIFE Elliott Wave Technical Analysis

SBI Life Insurance Co Daily Chart Technical Analysis and Potential Elliott Wave Counts

The SBI Life Insurance Co daily chart suggests a possible top forming near the 1940 level on Tuesday, September 13, 2024. The stock opened lower in line with the Nifty 50 Index and is trading near 1910 at the time of writing.

It’s possible that SBI Life Insurance has completed its fifth wave across multiple degrees, including Minute, Minor, and Intermediate, as indicated on the daily chart. The rally, which began from the March 2023 low of 1050, may now be over.

If these wave counts are accurate, SBI Life could move lower, with a break below 1667, which is Minute Wave ((iv)), signaling a stronger bearish trend. Traders should consider booking profits on previously held long positions.

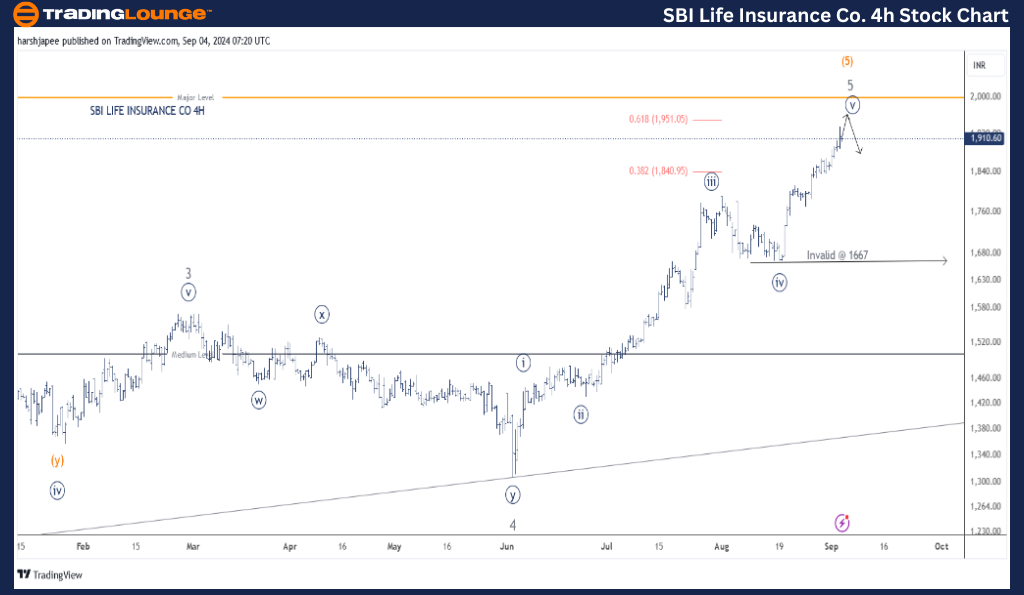

SBI LIFE INSURANCE CO – SBILIFE (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Grey

Details: Minute Wave ((v)) appears complete near 1940 and could be reaching its end near the 1950 level, within Minor Wave 5 Grey of Intermediate Wave (5) Orange. Traders are advised to book profits at these levels.

Invalidation Point: 1667

SBI Life Insurance Co 4H Chart Technical Analysis and Potential Elliott Wave Counts

The SBI Life Insurance Co 4H chart also shows that Minute Wave ((v)) Navy might have completed at the 1940 high. The stock’s near-term support is around 1838, and a break below this level could signal a more significant reversal. Resistance may also be encountered around the 1950 level.

Additionally, the Fibonacci 1.618 extension of Minor Wave 5 indicates a potential resistance near 1951. Bulls may make a final upward move before the trend reverses. Either way, a top appears to be forming.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ICICI BANK Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

SBI Life Insurance Co could have completed Minute Wave ((v)) within Minor Wave 5 Grey of Intermediate Wave (5) Orange near the 1940 level.