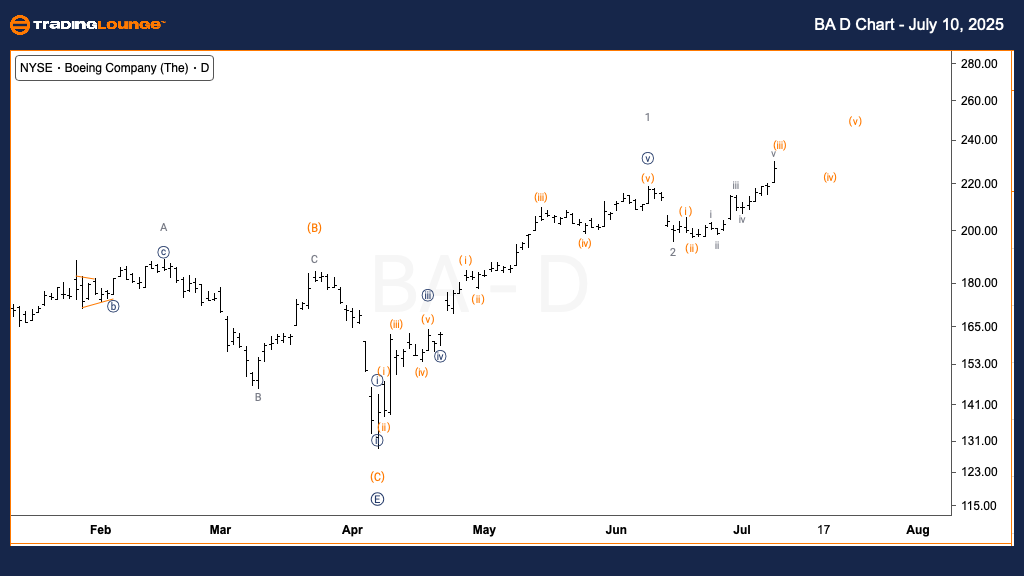

BA Elliott Wave Analysis - Trading Lounge Daily Chart

The Boeing Company (BA) Daily Chart Analysis

BA Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {i} of 3

DIRECTION: Upside in Wave {i}

DETAILS: Wave 2 appears to have bottomed sooner than projected, as the stock continues to climb in an impulsive structure.

Daily Chart Overview

The daily Elliott Wave analysis for Boeing stock (NYSE: BA) highlights a bullish trend development. Recent price action suggests wave 2 likely concluded earlier than forecast, allowing wave {i} of 3 to take shape. This indicates the start of a larger impulsive wave cycle. The emerging motive wave structure supports further gains, pointing to increasing bullish momentum and strengthening upside prospects for BA stock.

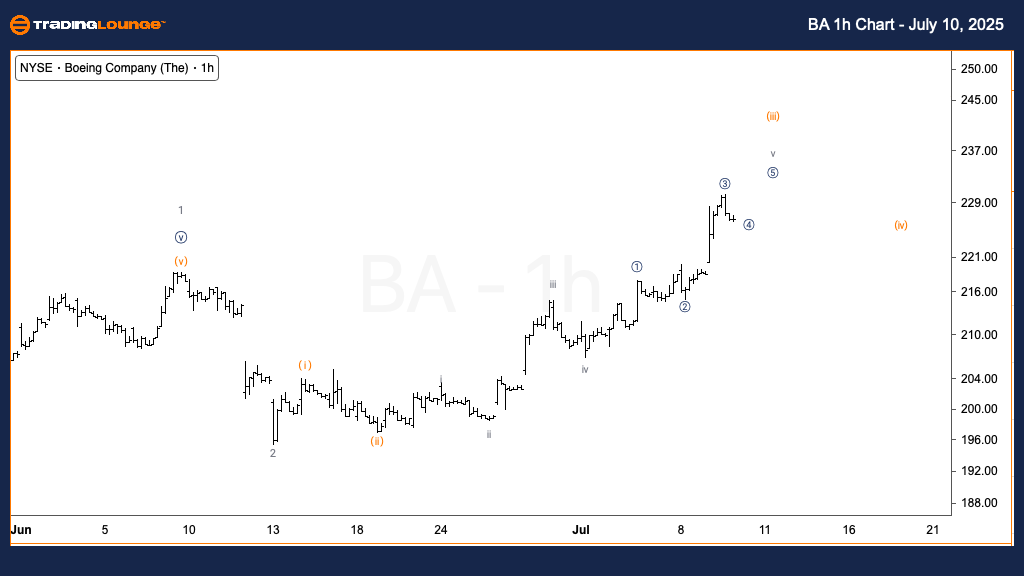

The Boeing Company (BA) US Stock 1H Chart Outlook

BA Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave v of (iii)

DIRECTION: Upside in Wave v

DETAILS: Wave v is advancing toward the $230 resistance level, a critical zone within MinorGroup1.

1-Hour Chart Analysis

On the 1-hour timeframe, Boeing stock continues its short-term uptrend, currently moving through wave v of (iii). The price is nearing the $230 level, a key resistance area that may define the top of MinorGroup1. This bullish phase is part of an extended impulsive pattern, yet traders should remain cautious. A corrective wave (iv) may follow once this wave v concludes. While upward momentum remains strong, attention to reversal signals near this level is essential.

Technical Analyst: Alessio Barretta

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: SuperMicro Computers Inc. (SMCI) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Summary

Boeing (BA) is exhibiting a robust impulsive move according to Elliott Wave analysis across both daily and hourly charts. Wave {i} of 3 is in progress on the daily chart, while wave v of (iii) is close to its potential peak on the 1H chart. With the $230 resistance level acting as a pivotal zone, traders should monitor for potential trend continuations or pullbacks. The current wave structure supports further upside in Boeing stock price in the near term.