ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Forecast and Technical Analysis

TradingLounge

Greetings, traders!

Welcome to our latest Elliott Wave Forecast focused on the Australian Stock Exchange (ASX), specifically BLOCK, INC - XYZ (SQ2).We have identified that ASX:XYZ may have found a key bottom around the 61.42 level, marking the completion of a five-wave decline. Following this, wave 1) - orange appears to be approaching its final phase. A corrective move in wave 2) - orange could soon occur, setting up the conditions for a significant rally in wave 3) - orange.

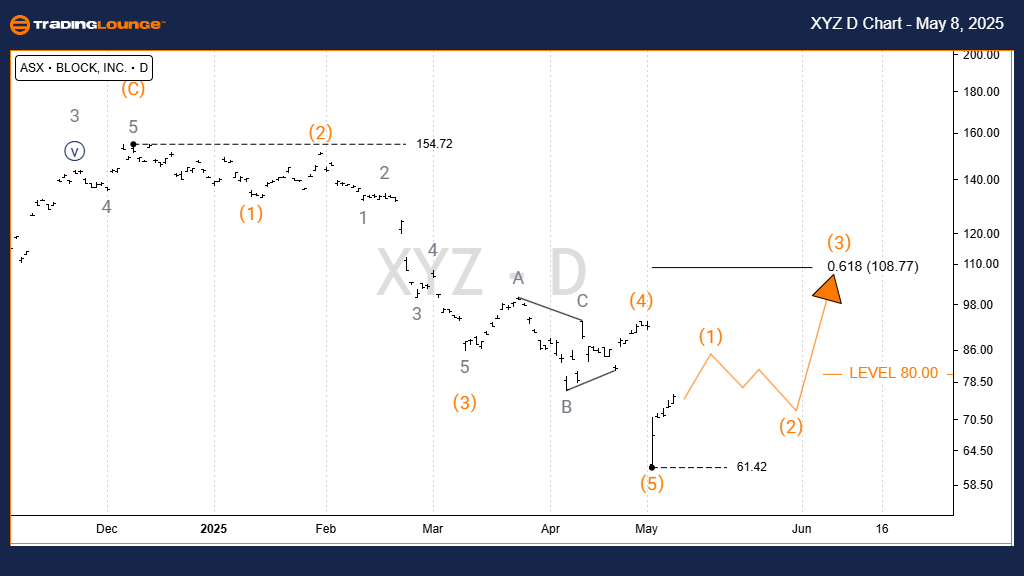

ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Forecast 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 1) - Orange

Details:

There is a strong possibility that XYZ has bottomed near 61.42, completing a full five-wave sequence from the 154.72 high. A new bullish phase could initiate shortly.

Once wave 1) - orange finalizes, we expect a downward retracement in wave 2) - orange. The successful identification of wave 2) - orange will be key in confirming the start of the next major upward move in wave 3) - orange.

Invalidation Point: 61.42

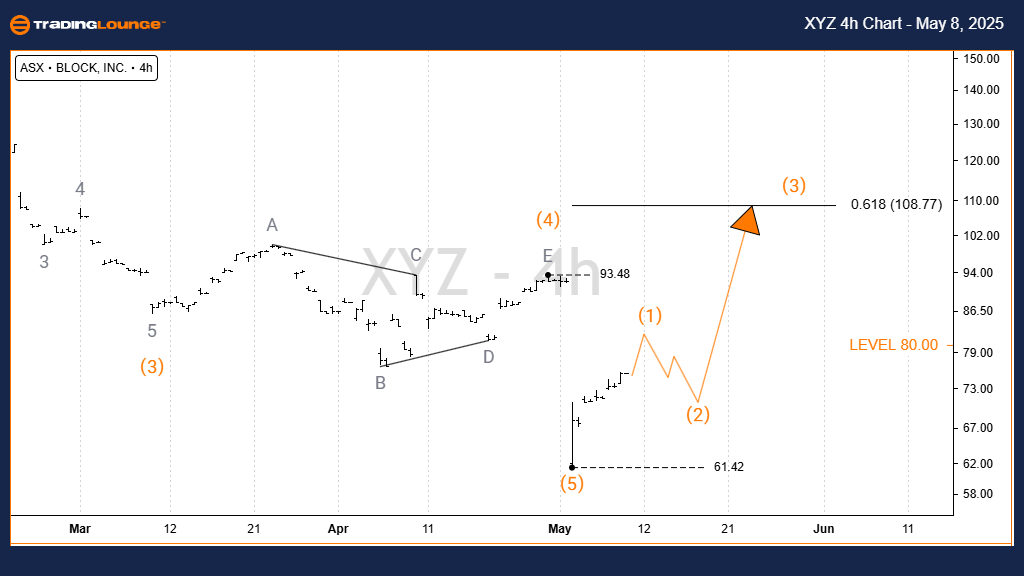

ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis TradingLounge | 4-Hour Chart

ASX: BLOCK, INC - XYZ (SQ2) 4-Hour Chart Forecast

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 1) - Orange

Details:

Price action indicates that XYZ could have completed its decline at the 61.42 support after falling from 154.72. We expect the completion of wave 1) - orange soon, followed by a downward correction in wave 2) - orange.

A clear completion of wave 2) - orange should set the stage for a bullish breakout in wave 3) - orange.

Invalidation Point: 61.42

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our updated Elliott Wave Analysis provides insights into the potential market path for ASX: BLOCK, INC - XYZ (SQ2).

We offer precise validation and invalidation levels to enhance trader confidence in our Elliott Wave counts. By combining in-depth technical study with strategic price action, we aim to deliver a clear, professional outlook for market participants.