ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis | TradingLounge

Greetings,

Today's Elliott Wave technical analysis focuses on Newmont Corporation (ASX: NEM) listed on the Australian Stock Exchange.

Our updated analysis suggests that ASX:NEM is currently progressing through a third wave advance.

This report outlines key target levels and invalidation points, providing traders with clear benchmarks for confirming the bullish trend or recognizing potential risks.

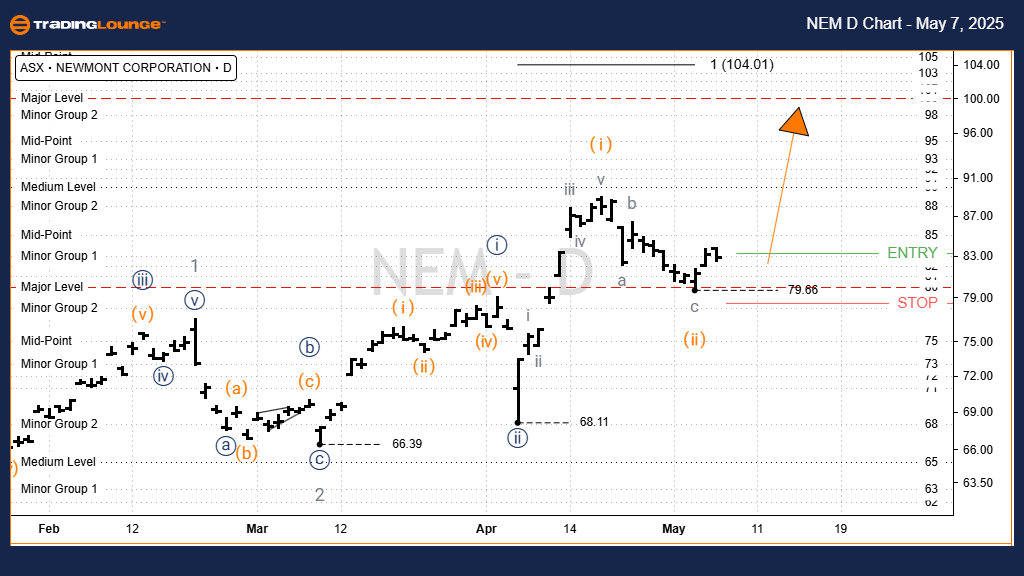

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis | 1D Chart (Semilog Scale)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 - grey within Wave (3) - orange

Details:

- Wave 2 (orange) completed near the 58.92 low.

- Wave 3 (orange) has initiated a strong upward movement.

- This wave is subdividing internally: wave 1 - grey, wave 2 - grey, and now wave 3 - grey pushing higher towards 102.37.

- The primary target for wave 3 - grey is around the 100.00 level.

Invalidation Point: 79.66

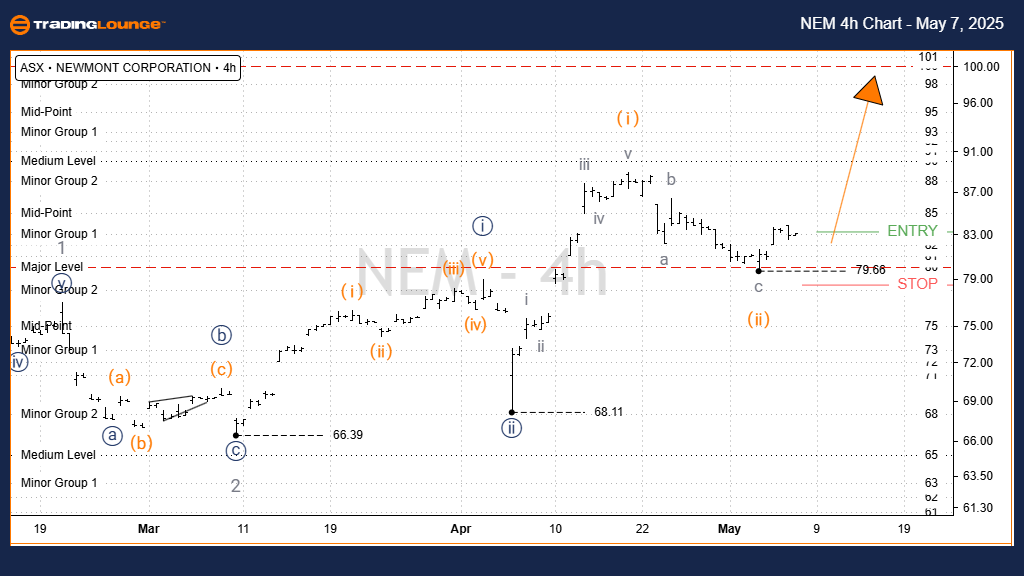

ASX: NEWMONT CORPORATION - NEM 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) - orange within Wave ((iii)) - navy of Wave 3 - grey

Details:

- From the 58.92 low, wave 3 (orange) has developed with strong upward momentum.

- Currently, wave iii) (navy) is unfolding, with a projected target around 100.00.

- Maintaining a price above 79.66 is critical to support the bullish Elliott Wave count.

- In the near-term view, wave iii) (orange) is actively advancing from the 79.66 base towards the 100.00 mark.

Invalidation Point: 79.66

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our technical outlook for ASX: NEWMONT CORPORATION - NEM provides actionable guidance for traders monitoring Elliott Wave structures.

By emphasizing specific validation and invalidation levels, we enhance confidence in the Elliott Wave forecast.

Incorporating these key technical indicators, we offer a comprehensive and professional analysis of market movements.