Greetings!

Since launching our US ETF sector coverage on March 11, we’ve paid close attention to the VanEck Gold Miners ETF (GDX) due to the promising setups the Elliott Wave Principle indicates. This blog is part of a series of GDX forecasts featuring detailed technical analysis and trading insights.

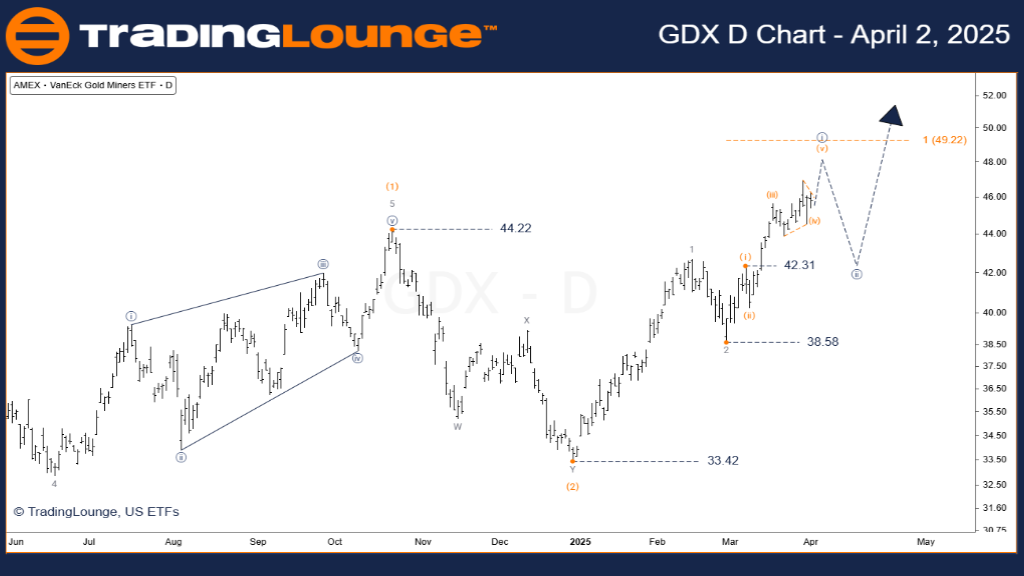

VanEck Gold Miners ETF – GDX Elliott Wave Analysis (1D) Chart

VanEck Gold Miners ETF – GDX Daily Chart Analysis

GDX Elliott Wave Technical Analysis

Function: Major trend

Mode: Motive

Structure: Impulse

Position: Wave [i] navy

Direction: Rally

Details: Wave 3 is still in its early phase. With the current rally only reaching the 61.8% Fibonacci wave extension, this implies further bullish potential for GDX.

- Subwave 1 of 3 is yet to complete, followed by a corrective subwave 2, which is expected to hold above the key support level at $38.59.

- The Wave 1 peak is anticipated to serve as strong support for the expected correction, paving the way for Wave [iii] of 3 to the upside.

Invalidation level: $38.58

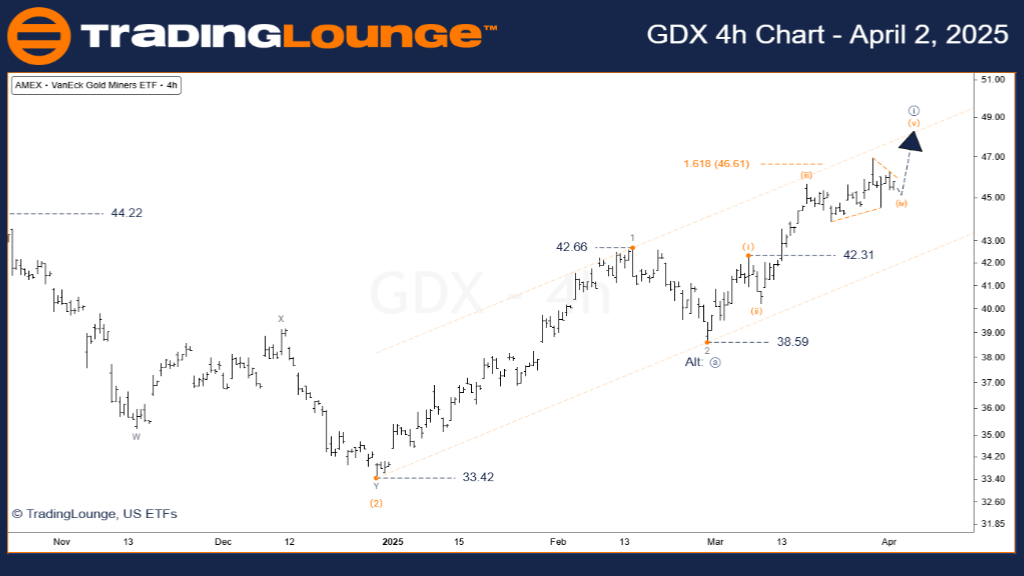

VanEck Gold Miners ETF – GDX Elliott Wave Analysis (4H)

VanEck Gold Miners ETF – GDX 4-Hourly Chart

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (iv) orange

Direction: Rally

Details:

- Wave (iv) of [i] is evolving as a contracting triangle. A small dip may complete the triangle before the post-triangle thrust begins.

- The 5th wave of [i] is expected to drive prices higher toward the $49.00 target, marking the end of wave [i] before wave [ii] commences.

Invalidation level: $44.50

Technical Analyst: Siinom

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: XLE – SPDR Energy Select Sector ETF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Here’s the summary of the Elliott Wave analysis for GDX:

- GDX remains in an early-stage uptrend.

- The upcoming post-triangle breakout presents a strong short-term buying opportunity.

- $49.00 remains the key price level for the termination of wave [i].

- A corrective wave [ii] dip could offer an ideal entry point for long positions.

- Following Elliott Wave guidelines and respecting invalidation levels is essential for risk management and consistent trading success.