XLE – SPDR Energy Select Sector ETF | Elliott Wave Analysis

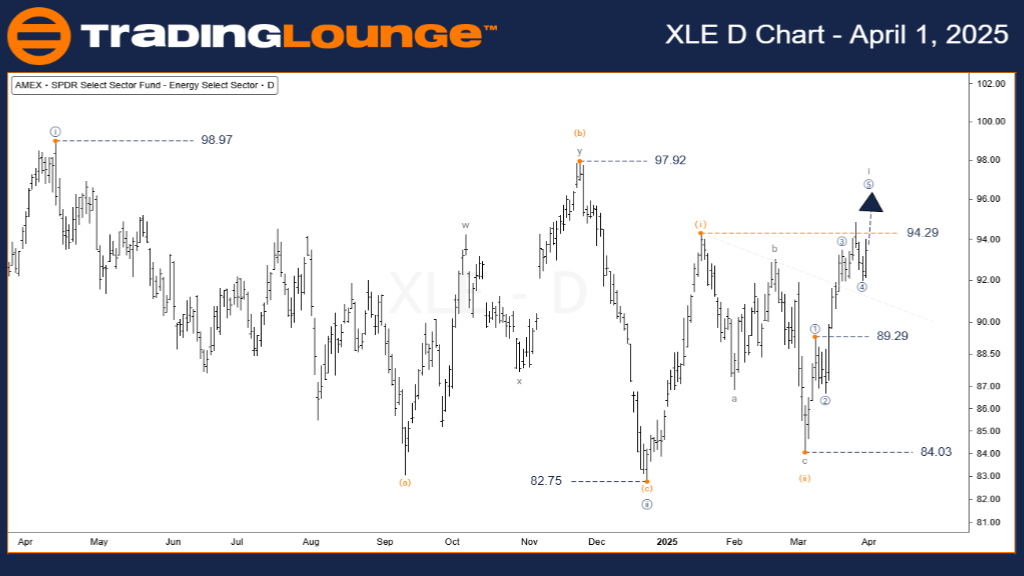

XLE – SPDR Energy Daily Chart Overview (1D)

XLE – SPDR Energy ETF Elliott Wave Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse Wave

Current Position: Wave i of (iii)

Direction: Uptrend

Invalidation Level: $84.03

Details: The current Elliott Wave pattern on the daily chart of XLE indicates an early-stage rally in wave (iii), with wave i nearing its completion.

A corrective move in wave ii is projected next, potentially providing a favorable buying setup for long-term investors.

The key bullish phase—wave iii of (iii)—has not yet begun, highlighting XLE as a top candidate for active monitoring among energy ETFs.

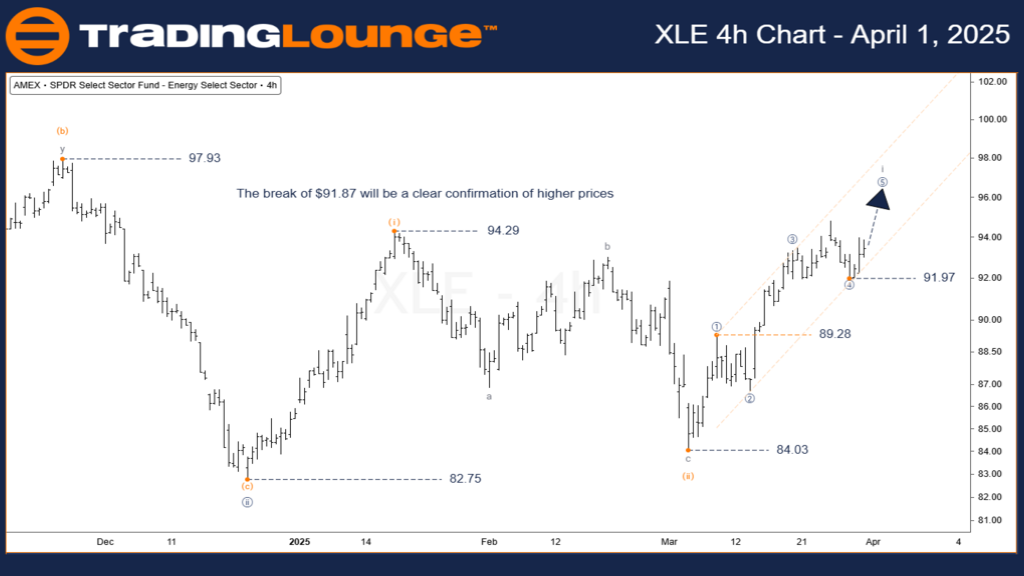

XLE – SPDR Energy Select Sector ETF Elliott Wave Analysis

XLE – SPDR Energy 4-Hour Chart Overview (4H)

Function: Major Trend

Mode: Motive

Structure: Impulse

Current Position: Wave [5] of i

Direction: Uptrend

Invalidation Level: $91.97

Details: On the 4-hour timeframe, XLE is progressing through wave [5], targeting the final stage of wave i in the broader bullish impulse.

This movement could offer a tactical opportunity for intraday or short-term traders looking for entry within an established uptrend.

Price action suggests that the $94.29 resistance is likely to be breached as wave [5] develops further.

Technical Analyst: Siinom

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Energy Select Sector ETF (XLE) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Wave i is approaching completion, and the upcoming wave ii correction could present a strategic long-entry opportunity.

Resistance is projected near the $96.00 level, marking a potential ceiling for the current leg up.

Traders focused on energy sector ETFs should closely monitor XLE for long setups during this anticipated pullback.

Adherence to Elliott Wave principles and vigilant observation of invalidation levels remain essential for risk control.