DOW JONES – DJI Elliott Wave Analysis Trading Lounge Day Chart

DOW JONES – DJI Elliott Wave Technical Analysis

The Elliott Wave analysis for the Dow Jones (DJI) on the daily chart reveals that the market is in a bullish trend, operating in an impulsive mode. The current structure is Gray Wave 3, which highlights the continuation of upward momentum. This bullish phase is a part of a larger wave structure, suggesting that the market's upward trajectory is expected to continue.

Presently, the market is positioned in Orange Wave 3, a subdivision of the larger Gray Wave 3. This phase reflects strong upward movement, characterized by higher highs and higher lows. The prior Gray Wave 2 appears to have been completed, giving way to the ongoing advance of Gray Wave 3. This impulsive wave is expected to drive the market further upward.

As per the analysis, Gray Wave 4 is anticipated next, following the completion of Gray Wave 3. This upcoming phase is likely to represent a corrective pullback or consolidation before the bullish trend resumes.

Traders are closely watching the wave cancellation level at 41,823.80. If the price falls below this level, the current wave structure would be invalidated, leading to a re-evaluation of the Elliott Wave count. As long as this level holds, the bullish trend is expected to persist, with Gray Wave 3 continuing its development.

Summary

The Dow Jones daily chart shows a strong bullish trend, with the market currently in Gray Wave 3, particularly within Orange Wave 3. The completion of Gray Wave 2 has triggered the current impulsive upward movement, with Gray Wave 4 expected next. The key level to watch for invalidation is 41,823.80.

DOW JONES – DJI Elliott Wave Analysis Trading Lounge Weekly Chart

DOW JONES – DJI Elliott Wave Technical Analysis

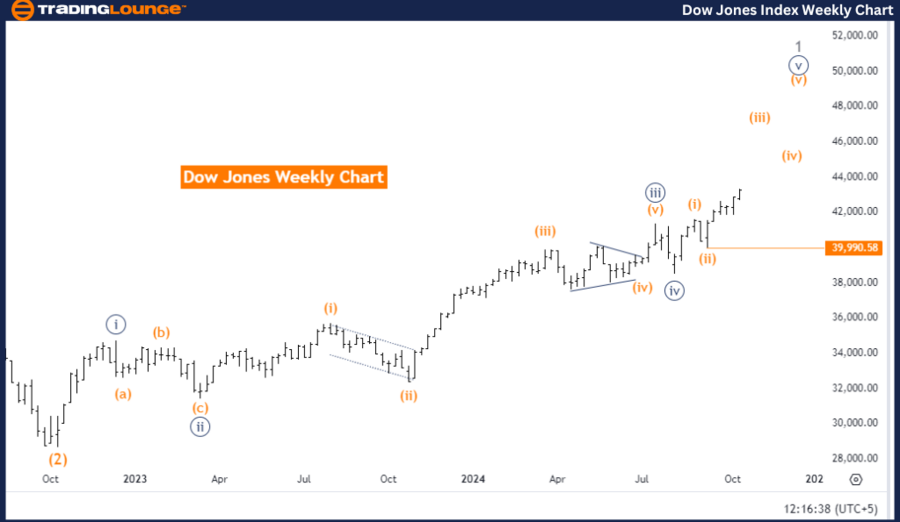

The Elliott Wave analysis for the Dow Jones (DJI) on the weekly chart highlights a continued bullish trend, operating in impulsive mode. The focus is on Orange Wave 3, which reflects ongoing upward momentum. This impulsive phase suggests strong buying pressure and a likely push towards higher prices.

The market is currently positioned in Navy Blue Wave 5, which is part of the larger Orange Wave 3 structure. The prior Orange Wave 2 appears to have completed, signaling the end of the corrective phase and the resumption of the bullish trend. The development of Orange Wave 3 is expected to propel the market higher, reinforcing the overall positive outlook.

Following the completion of Orange Wave 3, the next phase is anticipated to be Orange Wave 4, likely a corrective pullback or consolidation. However, for now, the emphasis remains on the progression of Orange Wave 3, which is driving the current bullish movement.

The wave cancellation level at 39,990.58 is crucial for traders. If the price falls below this level, the current wave structure will be invalidated, necessitating a reassessment of the Elliott Wave analysis. As long as this level holds, the market is expected to continue its upward trend, with Orange Wave 3 leading the charge.

Summary

The Dow Jones weekly chart reflects a bullish trend, with the market situated in Navy Blue Wave 5, a part of the broader Orange Wave 3. The completion of Orange Wave 2 has led to the current bullish rise in Orange Wave 3, with Orange Wave 4 expected as the next corrective phase. The critical invalidation level is set at 39,990.58.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: CAC 40 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support