AXIS BANK Elliott Wave Analysis – Trading Lounge Daily Chart

AXIS BANK Indian Stock Daily Chart

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Orange Wave 4 is likely completed; Orange Wave 5 appears in progress.

CANCEL INVALID LEVEL: 932

The AXIS BANK daily chart presents a clear bullish structure through Elliott Wave analysis. Current price movement is classified as impulsive, indicating solid upward momentum. The active wave, Orange Wave 5, is part of the broader Navy Blue Wave 1, suggesting this marks the concluding stage of the primary impulse within an ongoing uptrend.

Technical readings point to a completed Orange Wave 4 corrective phase. Development of Orange Wave 5 has started, typically characterized by sharp price increases. Following this wave, a correction—Navy Blue Wave 2—is anticipated, aligning with Elliott Wave theory.

The 932 level serves as a critical invalidation point. A price drop beneath this would call for a revision of the current wave count and reevaluation of the bullish scenario. Above this level, the structure remains intact, projecting further gains.

In summary, AXIS BANK appears in the final phase of an impulsive wave sequence, with strong bullish momentum underpinning Orange Wave 5. While the trend remains positive, traders should stay cautious as the completion of Navy Blue Wave 1 nears.

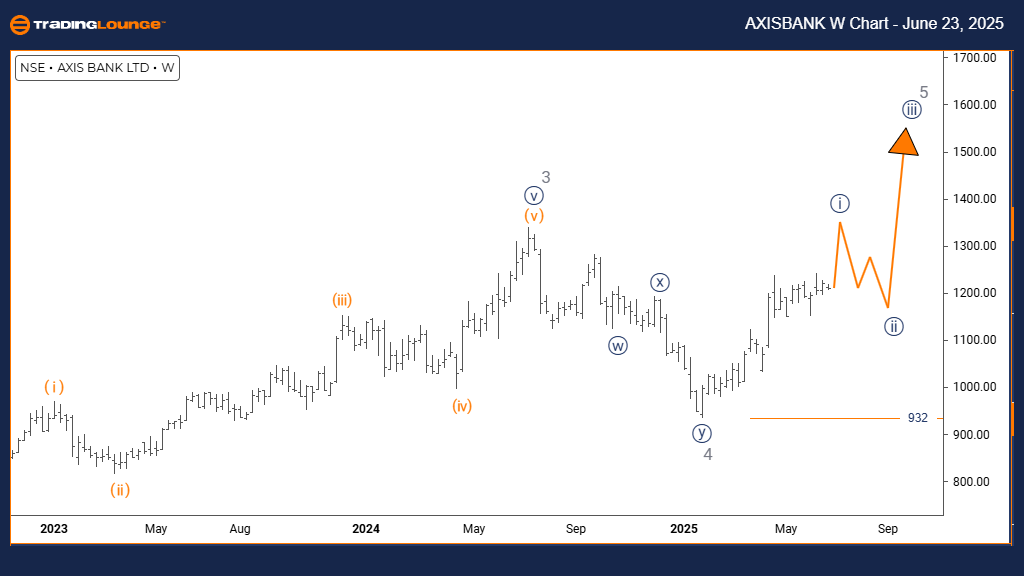

AXIS BANK Elliott Wave Analysis – Trading Lounge Weekly Chart

AXIS BANK Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 5

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 4 appears completed; Navy Blue Wave 1 is currently forming.

CANCEL INVALID LEVEL: 932

The AXIS BANK weekly chart maintains a bullish Elliott Wave pattern. The market is showing impulsive behavior, consistent with a strong trend. This phase is labeled Navy Blue Wave 1, which fits within the broader Gray Wave 5. This suggests a developing final wave in the long-term bullish setup.

Following the conclusion of Gray Wave 4, Navy Blue Wave 1 has emerged, initiating the final upward movement. This wave often indicates strong momentum and sets the stage for future corrections, notably Navy Blue Wave 2, expected once Wave 1 ends.

The 932 level remains a critical pivot. A decline below this would invalidate the current Elliott count and weaken the bullish projection. So long as the price stays above it, the technical outlook continues to favor the upside.

Overall, AXIS BANK is in a favorable position with the first segment of the final bullish wave active. The impulsive nature of Navy Blue Wave 1 supports continued buying pressure. Still, traders should remain alert to signals of a potential trend reversal as the pattern unfolds.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: KOTAK BANK Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support