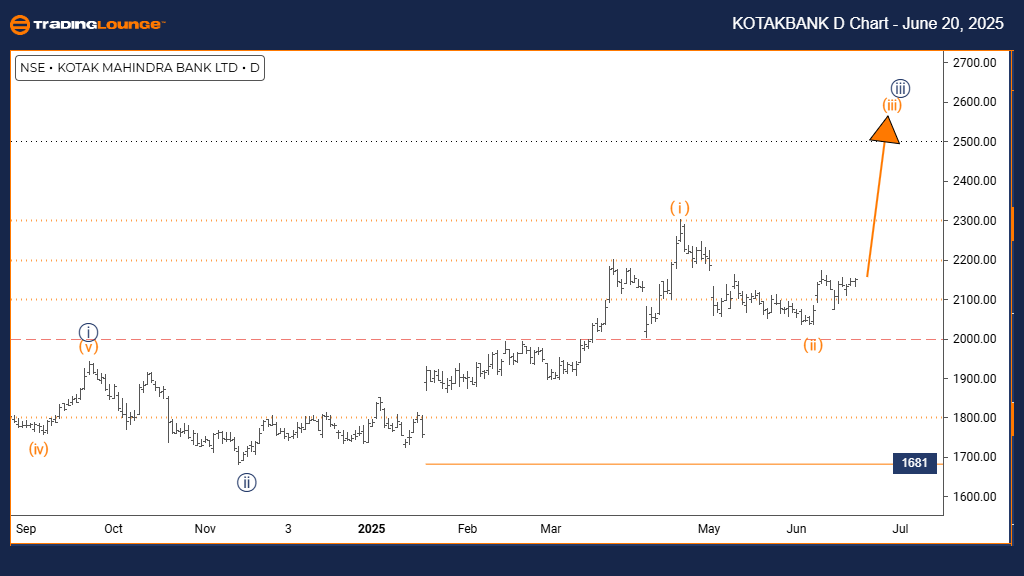

KOTAK BANK Elliott Wave Analysis | Trading Lounge Day Chart

KOTAK BANK Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange wave 3

POSITION: Navy blue wave 3

DIRECTION NEXT LOWER DEGREES: Orange wave 4

DETAILS: Orange wave 2 appears completed; orange wave 3 is unfolding.

Wave Cancel Invalid Level: 1681

The daily Elliott Wave analysis for KOTAK BANK reveals a strong bullish trend. Price behavior is moving in an impulsive wave structure, indicating consistent upside momentum. The current wave count places orange wave 3 in progress, which is a subwave of navy blue wave 3, reflecting a powerful upward phase in the stock's trend.

With orange wave 2 seemingly complete, the market has transitioned into orange wave 3, which is typically the most powerful segment of an impulsive wave structure. Traders can expect a continuation of the uptrend, followed by a corrective move in orange wave 4 once the current wave matures.

The critical invalidation point stands at 1681. A close below this level would invalidate the bullish wave count and necessitate a reevaluation. As long as price action holds above this threshold, the bullish outlook for KOTAK BANK remains solid.

In conclusion, KOTAK BANK is showing signs of strong bullish continuation. The active orange wave 3 suggests intensified buying pressure and potential for higher price levels in the near term.

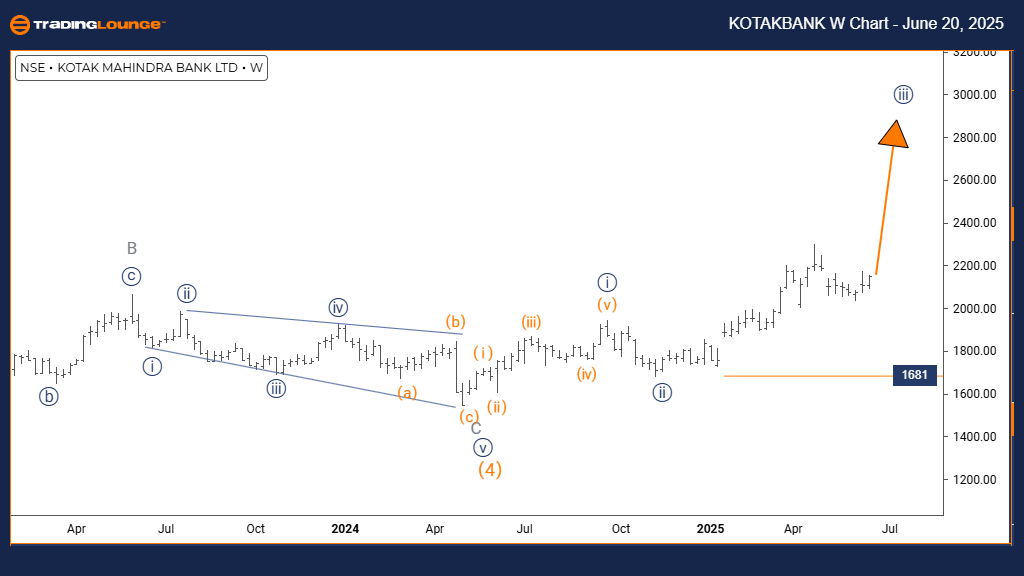

KOTAK BANK Elliott Wave Analysis | Trading Lounge Weekly Chart

KOTAK BANK Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 3

POSITION: Gray wave 1

DIRECTION NEXT LOWER DEGREES: Navy blue wave 3 (developing)

DETAILS: Navy blue wave 2 is likely complete; navy blue wave 3 is now progressing.

Wave Cancel Invalid Level: 1681

The weekly Elliott Wave analysis for KOTAK BANK supports a medium-term bullish trend. Price progression continues in impulsive mode, aligning with a strong upward market phase. The current wave analysis indicates navy blue wave 3 is unfolding as part of the broader gray wave 1, suggesting the early development of a significant bullish cycle.

Following the apparent completion of navy blue wave 2, the stock has entered the impulsive navy blue wave 3, typically known for delivering sustained upward movement. The internal substructure of this wave is expected to evolve further, enhancing the bullish sentiment.

As with the daily chart, the invalid level for this wave count remains at 1681. A fall below this mark would negate the current bullish scenario, prompting a revised wave interpretation. While price remains above this key level, KOTAK BANK retains its upward bias.

Overall, the weekly chart underscores a robust bullish setup. The development of navy blue wave 3 within gray wave 1 hints at prolonged upward momentum driven by persistent buying activity.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: STATE BANK OF INDIA Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support