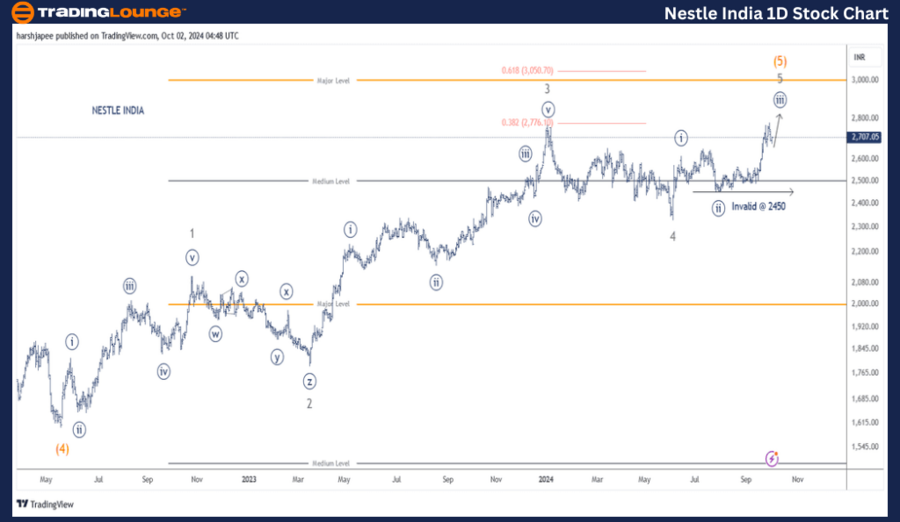

Nestle India Stock Elliott Wave Analysis – TradingLounge (1D Chart)

NESTLE India Daily Chart Analysis

NESTLE India Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is advancing within Minor Wave 5 Grey of Intermediate Wave (5) Orange. The stock is moving higher with a potential target towards 3050, against the 2450 level.

Invalidation Point: 2450

NESTLE India Daily Chart: Technical Analysis and Potential Elliott Wave Counts

The daily chart for NESTLE India is progressing upwards to conclude the fifth wave at various degrees, targeting 3050. The stock is currently subdividing within Minor Wave 5 Grey, and Minute Wave ((iii)) is set to push through the 2900 zone.

In May 2022, the stock hit a low of around 1600, marking the end of Intermediate Wave (4) Orange. Since then, the rally has formed five distinct Minor Waves, from 1 to 5, with the bulls currently in the final leg. The Minor Wave 4 low was registered on June 04, 2024, at 2330.

If this wave structure holds, the stock is now unfolding Minor Wave 5 and is currently within Minute Wave ((iii)) Navy. Prices should remain above the 2600 level to maintain the current impulse.

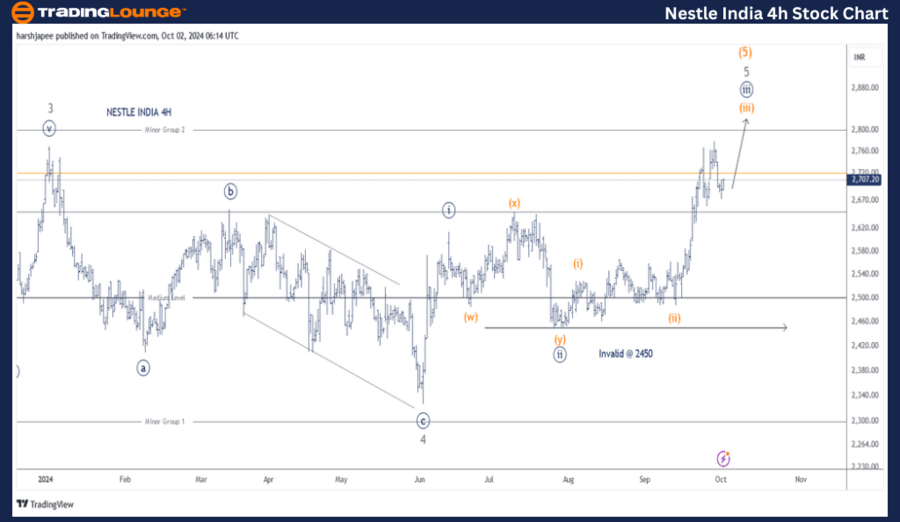

Nestle India Stock Technical Analysis – TradingLounge (4H Chart)

NESTLE INDIA – NESTLEIND Elliott Wave Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is advancing within Minor Wave 5 Grey of Intermediate Wave (5) Orange. The potential target is near 3050, with Minuette Waves (i) through (v) Orange unfolding to complete Minute Wave ((iii)) Navy towards the 2910 level.

Invalidation Point: 2450

NESTLE India 4H Chart: Technical Analysis and Potential Elliott Wave Counts

The 4H chart for NESTLE India shows sub-waves within Minor Wave 4, moving between the 2770 and 2600 range, forming a potential zigzag at the Minute degree. Within Minor Wave 5, Minute Wave ((ii)) displayed a combination pattern. Recent price action suggests that Minute Wave ((iii)) is advancing towards the 2900-2910 zone, against the 2450 invalidation level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HDFC Bank Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

NESTLE India is advancing towards the 3050 level as Minute Wave ((iii)) Navy unfolds within Minor Wave 5 Grey of Intermediate Wave (5) Orange. The key support level remains at 2450.