Natural Gas Elliott Wave Analysis - prices approach key resistance zone

In the dynamic world of natural gas trading, Elliott Wave Theory offers invaluable insights into market trends and potential price movements. Currently, natural gas prices are on the verge of encountering a critical resistance zone, suggesting a compelling opportunity for traders and investors to strategize their positions. Let's delve into the Elliott Wave analysis to understand the unfolding market dynamics.

Trend Function: Impulsive

Trend Mode: Impulsive

Wave Structure: Impulse Wave

Position: Black wave 4 of red wave (3)

Direction: Black wave 5 of red wave (3)

Over the past couple of weeks, natural gas has exhibited an upward correction within its long-term bearish trend, which commenced back in August 2022 when prices hovered around the $10 mark. Despite this corrective move, the overarching bearish sentiment remains intact, suggesting further downside potential. The crucial question revolves around where this correction will culminate, with indications pointing towards significant price confluence zones depicted on the charts.

Natural Gas Day Chart Analysis

A glance at the daily chart reaffirms the prevailing bearish trend. The completion of the 4th wave (in blue) within the bearish impulse wave occurred at 3.666, signaling the initiation of the 5th wave. A closer examination reveals that blue wave 5 is in the process of finalizing the red sub-wave (3). As anticipated, the red wave (3) is unfolding into an impulse wave, with the current focus on completing its 4th sub-wave denoted by the black wave 4. Upon the conclusion of wave 4, a subsequent downward movement is anticipated for wave 5 of (3). From the daily chart perspective, it appears that the decline in natural gas since 2022 is nearing its culmination, with the potential to reach its lowest point in the forthcoming months. Meanwhile, scrutiny of the H4 chart provides insights into potential participation opportunities in the ensuing sell-off for wave 5 of (3).

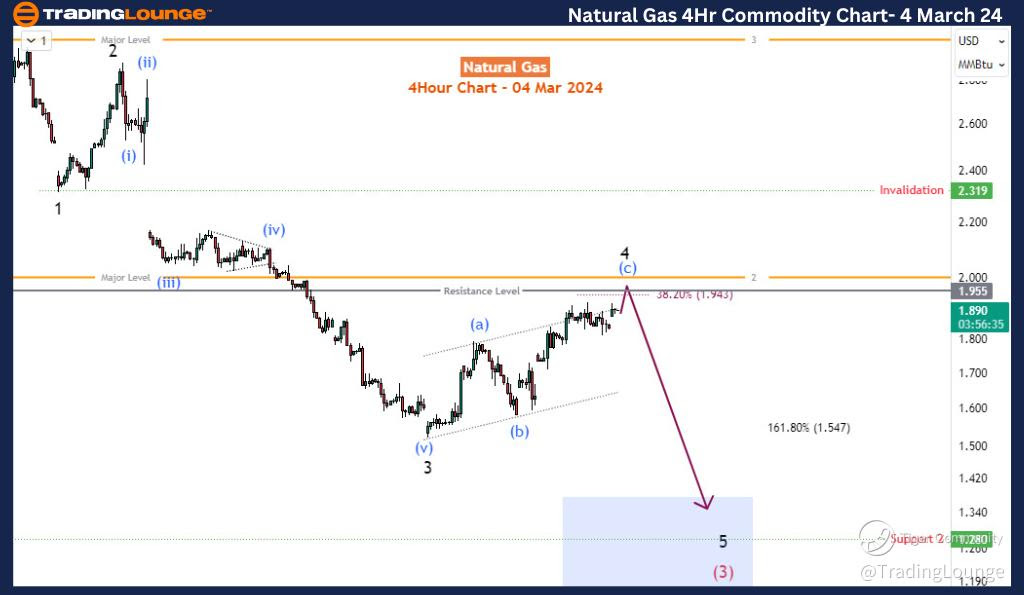

Natural Gas 4H Chart Analysis

On the H4 chart, wave 4 subdivides into a 3-wave correction, particularly the blue wave (a)-(b)-(c). An intriguing observation is the identification of a confluence zone within the range of 1.94-2, where psychological, Fibonacci and resistance levels converge, hinting at the possible termination of wave 4. The validity of the bearish impulse wave (3) could be compromised if the price surpasses the 2.32 threshold.

In summary, according to Elliott Wave Theory, the ongoing rebound in natural gas is categorized as a corrective move within a broader bearish impulse wave. As the price approaches a pivotal resistance zone, market participants can anticipate a resurgence of selling pressure, potentially propelling the commodity toward the 1.2 mark.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.