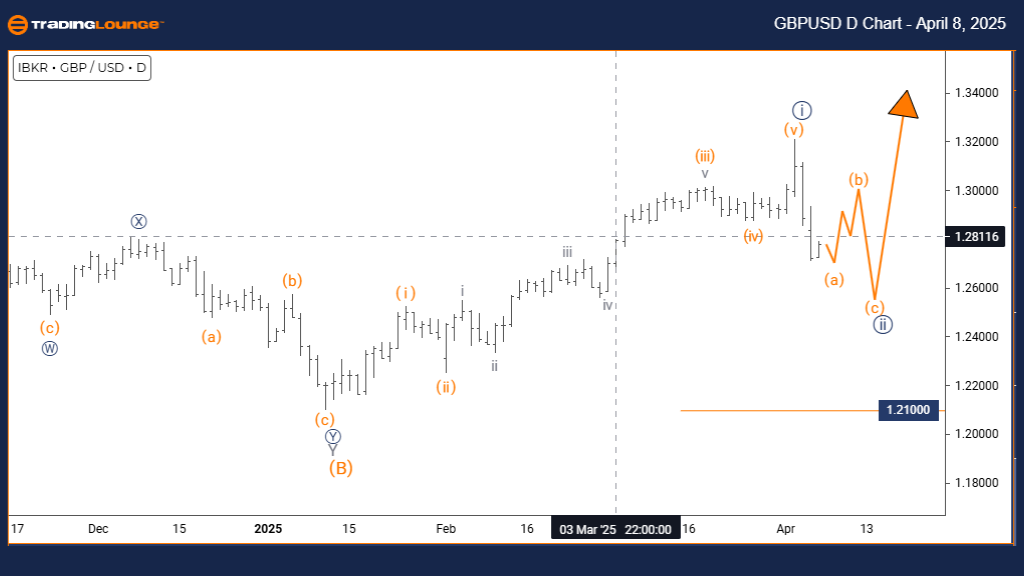

GBPUSD Elliott Wave Forecast – TradingLounge Daily Chart

British Pound / U.S. Dollar (GBPUSD) Daily Chart Analysis

British Pound / U.S. Dollar (GBPUSD) Elliott Wave Forecast & Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 1

Next Higher Degree Direction: Navy Blue Wave 3

Invalidation Level: 1.21000

Daily Analysis Summary:

In the daily GBPUSD Elliott Wave forecast, price action shows a corrective counter-trend development, specifically within Navy Blue Wave 2, inside the broader Gray Wave 1 structure.

Technical signals confirm the end of Navy Blue Wave 1, transitioning into a corrective Wave 2 phase. This signals a temporary retracement before a potential advance into Navy Blue Wave 3, aligning with the larger bullish trend.

The key invalidation level remains at 1.21000. A break below this would negate the current wave outlook and require reevaluation of the structure.

Market Outlook & Trading Strategy:

This corrective phase within Navy Blue Wave 2 is an essential part of the Elliott Wave structure, reflecting the market’s consolidation before continuation.

Traders should anticipate classic corrective patterns—such as ABC formations or sideways moves—that typically occur during Wave 2 phases of Elliott structures.

Trading Plan:

- Short-Term Traders: Monitor for signals of Wave 2 completion for strategic entries.

- Long-Term Investors: View the pullback as a setup for the next impulsive rally.

- Key Technical Level: Remain focused on the 1.21000 invalidation point.

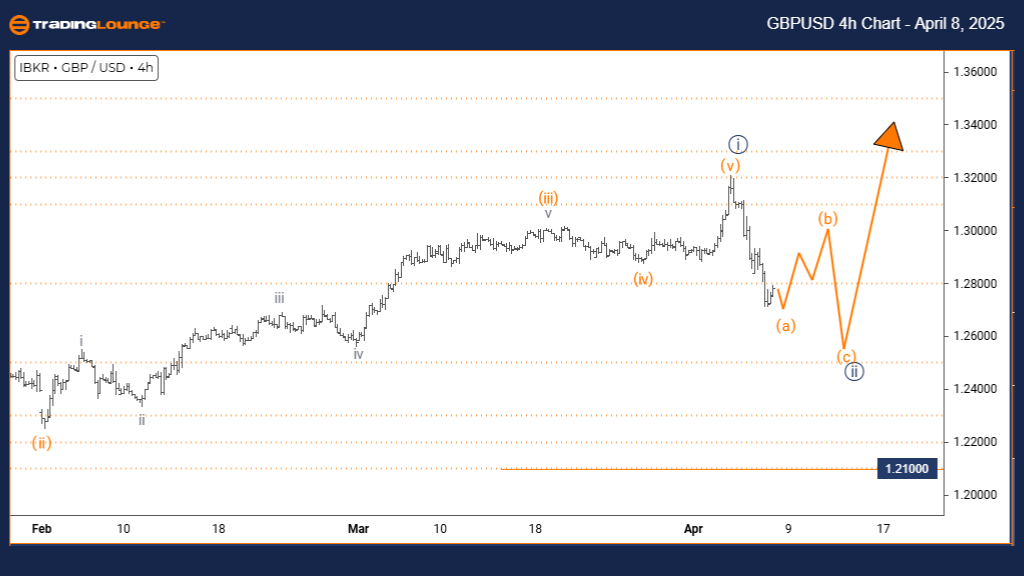

GBPUSD Elliott Wave Forecast – TradingLounge 4-Hour Chart

British Pound / U.S. Dollar (GBPUSD) Elliott Wave Forecast & Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 1

Next Higher Degree Direction: Navy Blue Wave 3

Invalidation Level: 1.21000

4-Hour Analysis Summary:

The 4-hour GBPUSD Elliott Wave forecast highlights a counter-trend scenario as the pair moves through a corrective Navy Blue Wave 2 within Gray Wave 1.

With Navy Blue Wave 1 completed, the current retracement marks a corrective phase before potential continuation higher. This presents a key opportunity to prepare for the start of Navy Blue Wave 3.

Invalidation sits firmly at 1.21000—any move below signals a need to revise the current wave count.

Wave Structure Insights & Strategy:

Wave 2 corrections often feature three-wave ABC patterns or flat consolidations. Recognizing these setups is vital for capturing trend resumption trades.

Trading Strategy:

- Short-Term Focus: Take advantage of corrective dips within Wave 2.

- Long-Term View: Anticipate entry into Wave 3’s impulse phase.

- Risk Level: Stay vigilant on the 1.21000 invalidation level.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: USDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support