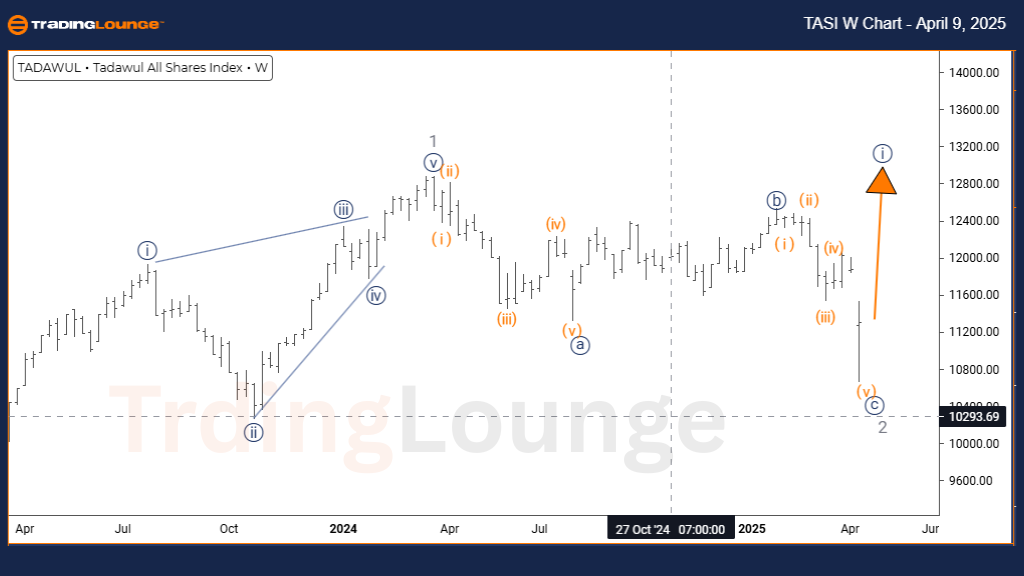

TASI INDEX Elliott Wave Analysis | TradingLounge Daily Chart

TASI INDEX Daily Chart Forecast

TASI INDEX Elliott Wave Technical Forecast

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: The Completion of Gray Wave 2 is confirmed, with Navy Blue Wave 1 of 3 actively developing.

The TASI INDEX Elliott Wave Daily Analysis reveals a bullish Elliott Wave structure for the Saudi stock market index. The current impulse phase shows Navy Blue Wave 1 building within the broader Gray Wave 3, suggesting the beginning of a strong upward move. With Gray Wave 2’s correction complete, the market now enters the early stages of Navy Blue Wave 1 of 3, indicating a new bullish cycle.

This daily Elliott Wave chart helps traders identify the trend setup and strategic entry points aligned with impulsive market behavior. Once Navy Blue Wave 1 concludes, a corrective Navy Blue Wave 2 is anticipated, followed by a continuation higher into Wave 3.

Understanding wave degrees is key—Navy Blue Wave 1 not only offers a short-term trade setup but also contributes to the formation of the larger Gray Wave 3 structure. Look for early trend signals such as increasing momentum and volume.

Overall, the TASI INDEX Elliott Wave Forecast supports long-position strategies with proper risk controls, aiming to capitalize on this early bullish wave within the Saudi financial market.

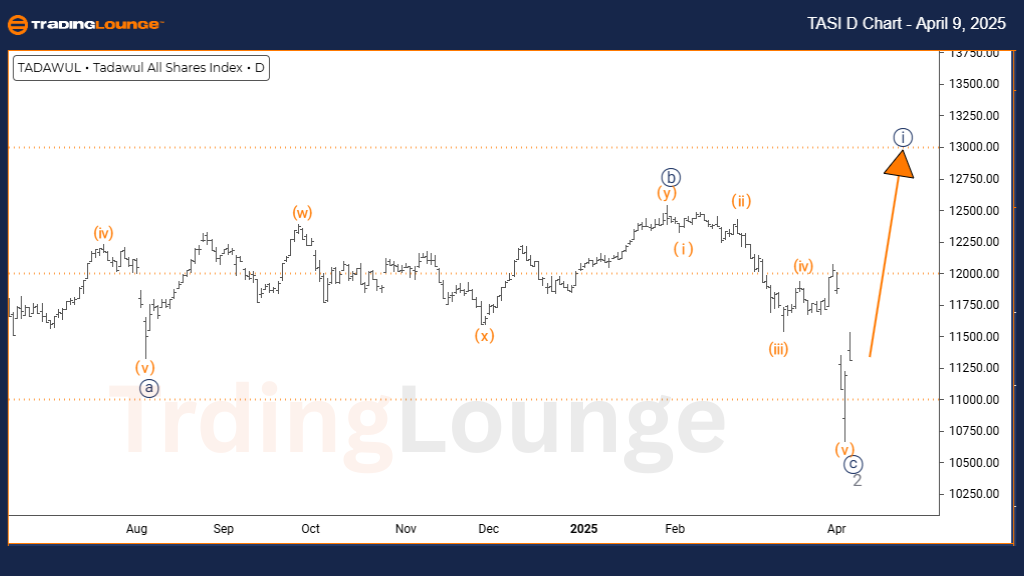

TASI INDEX Elliott Wave Analysis | TradingLounge Weekly Chart

TASI INDEX Wave Technical Forecast

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 looks complete, with Navy Blue Wave 1 of 3 now in progress.

The TASI INDEX Elliott Wave Weekly Analysis confirms a long-term bullish Elliott Wave setup for the Saudi market. The impulsive wave structure marks the beginning of Navy Blue Wave 1 within the larger Gray Wave 3 framework. With Gray Wave 2 completed, the index advances through the initial stages of Navy Blue Wave 1 of 3, suggesting a potentially robust uptrend.

The weekly timeframe offers investors a macro view of wave alignment and trend structure, highlighting the current wave’s significance within a major bullish phase. Upon the completion of Navy Blue Wave 1, a corrective Navy Blue Wave 2 is expected, preceding the next rally in Wave 3.

This Elliott Wave interpretation underlines the importance of degree clarity—Navy Blue Wave 1 reflects a medium-term trade opportunity and a key component of the larger bullish development. Key confirmation signals include rising volume and momentum, classic characteristics of a wave one impulse.

With favorable conditions emerging, this weekly Elliott Wave forecast supports long-position strategies in the TASI INDEX, appealing to swing and position traders seeking to benefit from sustained upside potential in the Saudi equity market.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NIKKEI 225 (N225) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support