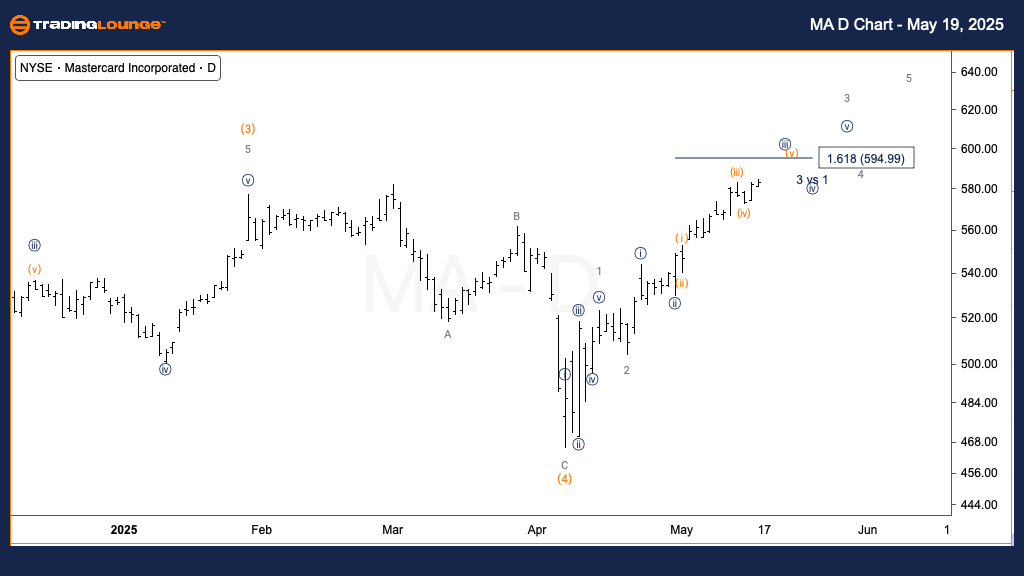

Mastercard Inc. (MA) Elliott Wave Analysis – Trading Lounge Daily Chart

MA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3

Direction: Bullish continuation in Wave 3

Technical Overview:

Mastercard (MA) is progressing within Minor Wave 3, indicating strong bullish momentum.

Price action is currently targeting the lower range of Minor Group 2, near the $650 mark, a key resistance level that may challenge the ongoing uptrend.

The current impulsive wave structure suggests a sustained bullish outlook, reinforcing upward price targets in line with Elliott Wave forecasting.

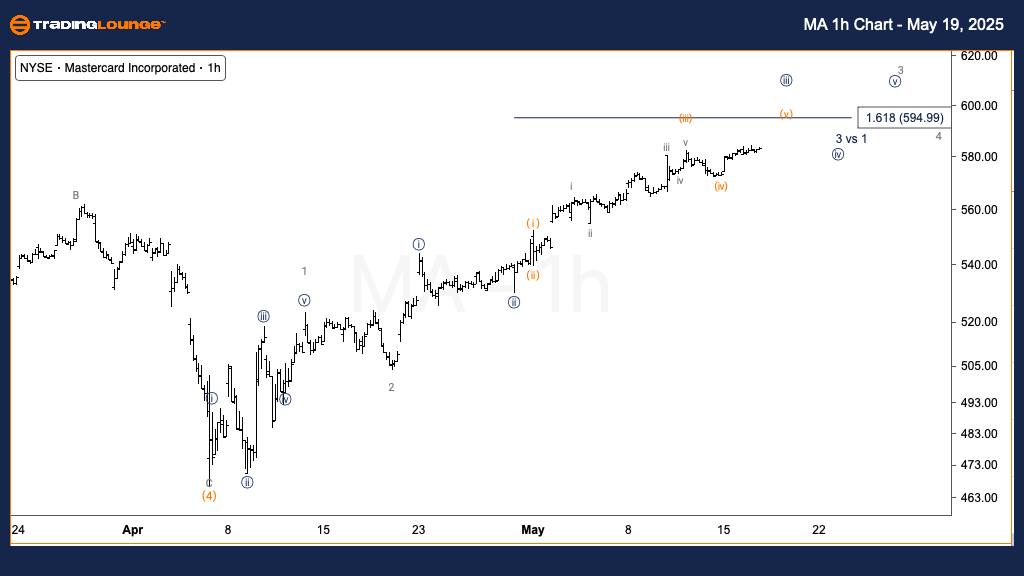

Mastercard Inc. (MA) Elliott Wave Analysis – Trading Lounge 1H Chart

MA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 3

Direction: Approaching Wave {iii} peak

Technical Overview:

Mastercard (MA) appears to be nearing the completion of Wave {iii} within Minor Wave 3.

The price is closely approaching the 1.618 Fibonacci extension level of Wave {i}, around $595. This region may serve as a resistance zone and could prompt a corrective pullback in Wave {iv}.

Short-term traders should monitor for consolidation or reversal signals before the next impulsive advance resumes.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Advanced Micro Devices Inc. (AMD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Summary

This Elliott Wave analysis of Mastercard (MA) combines insights from both the daily and intraday (1H) charts. The current wave structure supports a strong upward trajectory. Price zones near $595 and $650 are critical, as they may determine the timing and strength of upcoming wave completions. These technical levels are crucial for short-term trading setups and long-term positioning, aligned with Elliott Wave strategy and market timing principles.