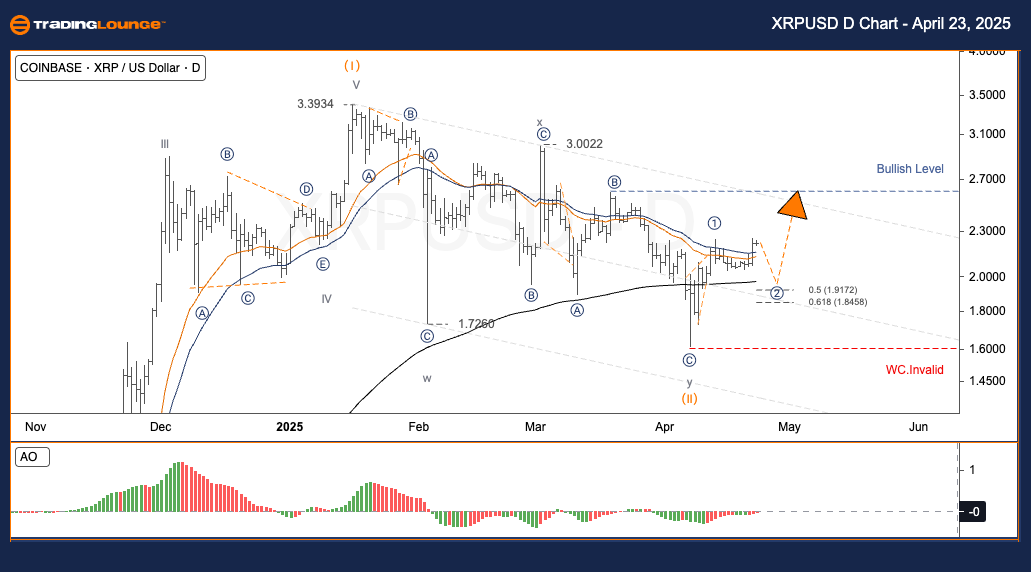

XRPUSD Elliott Wave Analysis – TradingLounge Daily Chart

XRP to U.S. Dollar (XRPUSD) Price Forecast

XRPUSD Elliott Wave Technical Outlook

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

XRPUSD Daily Elliott Wave Forecast – Trading Strategy

XRP/USD appears to have completed its extended corrective phase, finishing wave (II), and is now entering wave (III)—commonly the most powerful and fastest stage in a five-wave Elliott sequence. The previous bullish wave (I) peaked at 3.3934. The corrective wave (II) unfolded as a Double Zigzag (WXY) and found support at 1.7260. Current price action indicates the development of sub-waves 1 and 2 within the emerging wave (III). Key Fibonacci retracement levels for wave 2 are:

50% retracement: 1.9172

61.8% retracement: 1.8458

XRPUSD Daily Trading Strategy

Short-Term Swing Trade Setup:

Watch for a bullish reversal at wave 2’s retracement zone as a trigger to enter long positions targeting wave 3.

Risk Management:

The structural invalidation level for wave count is below 1.60.

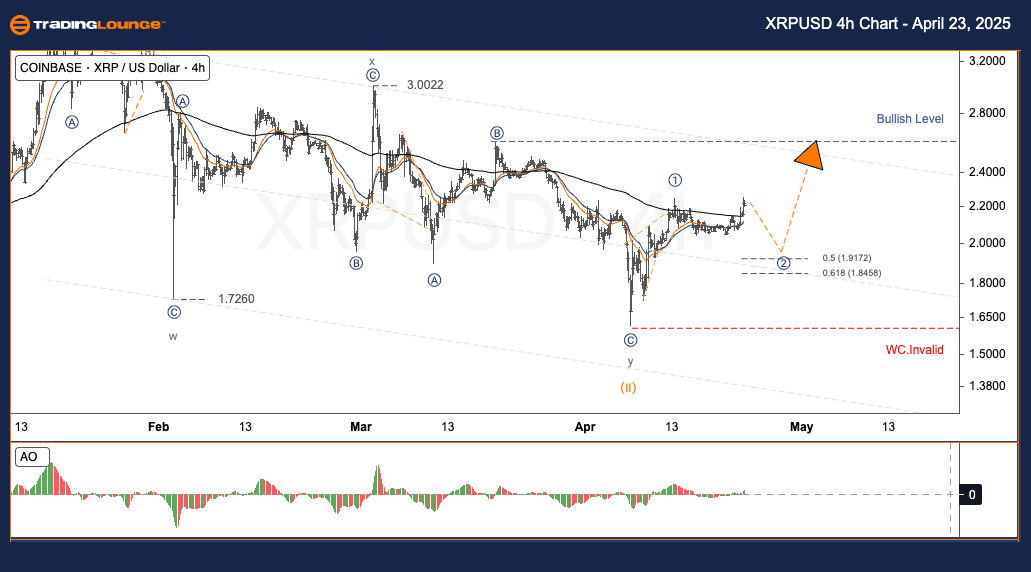

XRPUSD Elliott Wave Analysis – TradingLounge H4 Chart,

XRP to U.S. Dollar (XRPUSD) Intraday Forecast

XRPUSD Elliott Wave Technical Outlook

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

XRPUSD H4 Elliott Wave Forecast – Trading Strategy

On the 4-hour chart, XRP has likely completed wave (II) after an extended correction and is initiating wave (III), the most dynamic and aggressive leg in the Elliott Wave cycle. Wave (I) finalized at 3.3934, while wave (II), a WXY Double Zigzag, ended at 1.7260. Current movements suggest wave (III) has begun, with sub-waves 1 and 2 forming. Retracement zones for wave 2 include:

50% retracement: 1.9172

61.8% retracement: 1.8458

XRPUSD H4 Trading Strategy

Short-Term Swing Trade Setup:

Anticipate a bullish reversal from wave 2 retracement levels as an entry point into wave 3.

Risk Management:

Structural wave cancellation occurs below 1.60—any move beneath this invalidates the current wave count.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NEOUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support