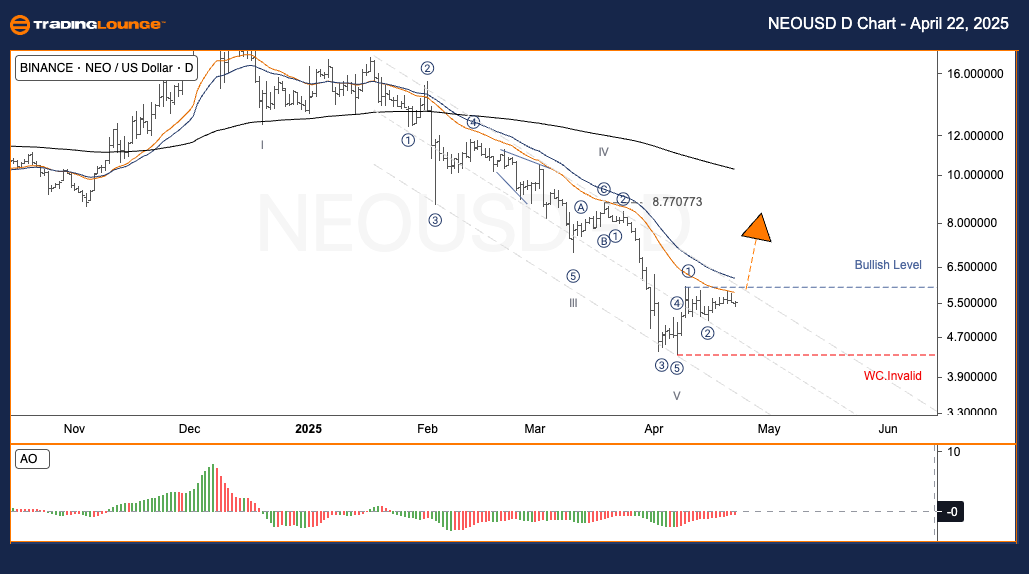

NEOUSD Elliott Wave Analysis – TradingLounge Daily Chart

NEO/USD (NEOUSD) Daily Chart Analysis

NEOUSD Elliott Wave Technical Overview

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Next Major Direction: Wave Y

Wave Invalidation Level: Not defined

NEO/USD Trading Strategy – Daily Chart

NEO continues its bearish trajectory, in alignment with Elliott Wave analysis since early 2025. The final leg of Wave (V) appears complete, suggesting the market is approaching a critical reversal zone. A confirmed move above the 6.60 resistance level could initiate a powerful Wave III rally.

Trading Strategy Overview

✅ Swing Trade Opportunity (Short-Term Traders)

A bullish breakout through 6.60 may signal the start of Wave III—typically the most impulsive and high-velocity phase in Elliott Wave sequences.

⚠️ Risk Management Tip

If the price declines below the invalidation threshold (W.C. Invalid), the bullish scenario is negated. A fresh Elliott Wave count will be required to realign with market structure.

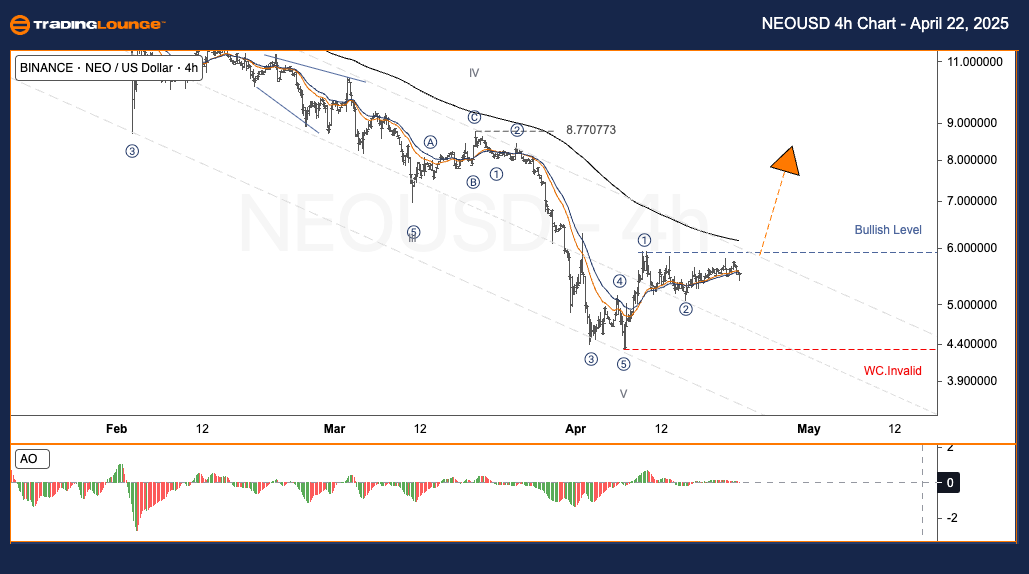

NEO/USD (NEOUSD) Elliott Wave Analysis – TradingLounge H4 Chart

NEOUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Next Major Direction: Wave Y

Wave Invalidation Level: Not defined

NEO/USD Trading Strategy – H4 Chart

NEO’s downward movement continues in accordance with Elliott Wave theory. Signs now point to a completed five-wave structure within Wave V, positioning the market near a potential bullish reversal. A confirmed break above 6.60 could launch Wave III, offering traders a high-momentum opportunity.

Trading Strategy Overview

✅ Swing Trade Opportunity (Short-Term Traders)

A move beyond the 6.60 resistance presents a potential entry for riding Wave III’s strong upward momentum.

⚠️ Risk Management Tip

Failure to hold above the invalidation level cancels the bullish outlook. Traders should reevaluate the wave count and wait for renewed confirmation.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DOTUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support