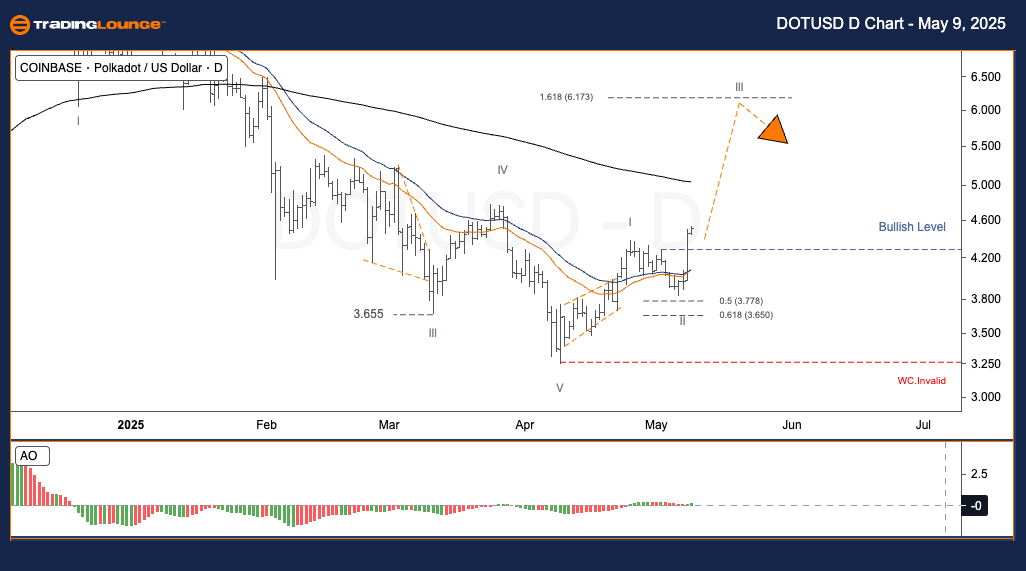

DOTUSD Elliott Wave Analysis – TradingLounge Daily Chart

Polkadot/U.S. Dollar (DOTUSD) Daily Chart Analysis

DOTUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulse

Current Wave Position: Wave 3

Next Higher Degree Direction: Uptrend

Wave Cancel Invalid Level: Below Support Zone

DOTUSD Trading Strategy – Daily Chart

Polkadot (DOT) shows a bullish momentum, signaling the start of wave III after completing wave II as a Zigzag correction within the 50%–61.8% Fibonacci retracement zone. A confirmed breakout above the Bullish Level underscores a strong impulsive phase, consistent with Elliott Wave Theory's expectations for wave III. The immediate target price stands at $6.17. Traders are advised to align long entry positions with this advancing wave count to capitalize on DOT's potential upside.

Trading Strategies

Primary Strategy

✅ Swing Traders (Short-Term)

Entry Signal: A confirmed breakout above $4.40 (Bullish Level) suggests the beginning of wave III.

Risk Management

🟥 Stop Level: A drop below the red invalidation zone voids the current Elliott Wave structure.

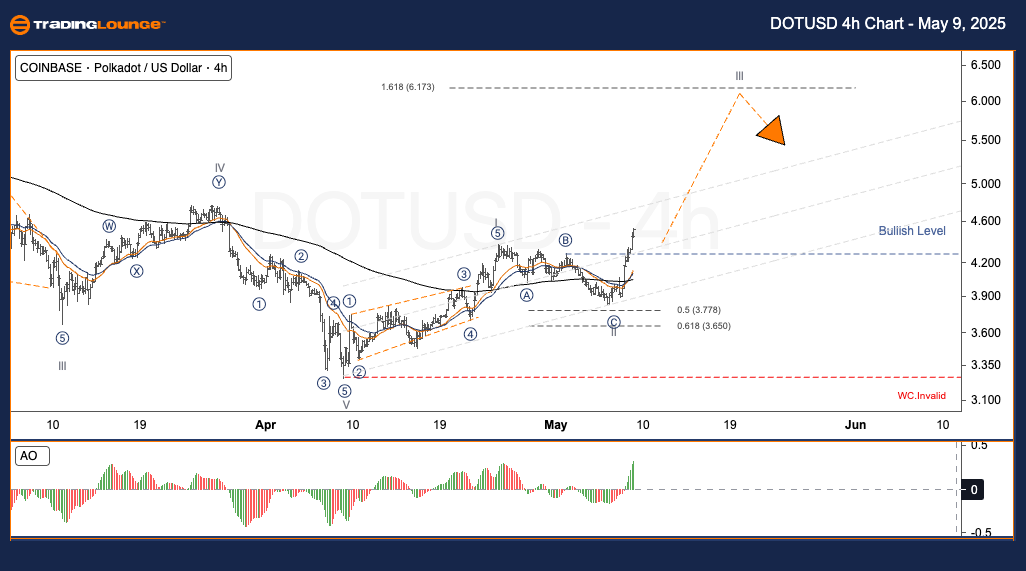

DOTUSD Elliott Wave Analysis – TradingLounge H4 Chart

Polkadot/U.S. Dollar (DOTUSD) H4 Chart Analysis

DOTUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulse

Current Wave Position: Wave 3

Next Higher Degree Direction: Uptrend

Wave Cancel Invalid Level: Below Support Zone

DOTUSD Trading Strategy – H4 Chart

DOTUSD continues its upward trend following a Zigzag correction completing wave II near a significant Fibonacci support area (50%–61.8%). The price has clearly broken above the Bullish Level, confirming the progression into wave III. With a projected short-term price target of $6.17, traders can utilize this structure to plan strategic buy entries in alignment with the broader bullish wave.

Trading Strategies

Primary Strategy

✅ Swing Traders (Short-Term)

Entry Signal: A break above the $4.40 Bullish Level affirms wave III’s start.

Risk Management

🟥 Stop Level: A decline beneath the red invalidation line nullifies the wave projection.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support