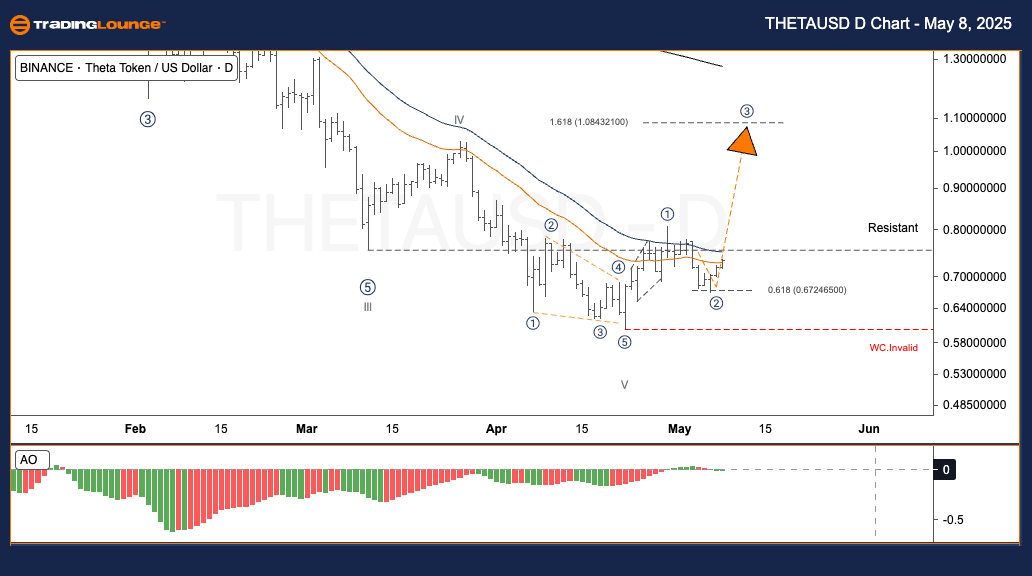

THETAUSD Elliott Wave Analysis TradingLounge Daily Chart

Theta Token / U.S. Dollar (THETAUSD) Day Chart Analysis

THETAUSD Elliott Wave Technical Analysis

Function: Following the trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

Theta Token / U.S. Dollar (THETAUSD) Trading Strategy:

In early April, Theta Token (THETAUSD) completed wave V, establishing a strong support base. From there, it initiated a fresh upward trend with wave ①. Following the rally, the price entered a consolidation phase, retracing into the 61.8% Fibonacci support area during wave ②. A strong bounce from this key Fibonacci zone now points to the possible development of a powerful wave ③.

Trading Strategies:

Strategy

Approach

For short-term traders (Swing Trade):

If the price confirms a bullish reversal above $0.74 alongside rising volume, traders may consider entering long positions targeting wave ③.

Risk Management:

Wave Cancellation (W.C.) Invalid:

A price decline below $0.60 would invalidate the bullish wave structure, signaling a need to reassess the trade setup.

THETAUSD Elliott Wave Analysis TradingLounge H4 Chart

Theta Token / U.S. Dollar (THETAUSD) 4-Hour Chart Analysis

THETAUSD Elliott Wave Technical Analysis

Function: Following the trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

Theta Token / U.S. Dollar (THETAUSD) Trading Strategy:

During early April, Theta Token (THETAUSD) formed a strong base by completing wave V. This confirmed the start of a new bullish cycle with wave ①. Since then, THETA entered a corrective phase within wave ②, reaching the 61.8% Fibonacci retracement zone. The sharp rebound suggests the potential early formation of a dynamic wave ③.

Trading Strategies:

Strategy

Approach

For short-term traders (Swing Trade):

Upon confirmation of a breakout above $0.74 with increasing trading volume, traders are advised to consider long entries, positioning for the expected wave ③ rally.

Risk Management:

Wave Cancellation (W.C.) Invalid:

Should the price fall below $0.60, the current Elliott Wave structure would be invalid, requiring strategy revision.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ADAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support