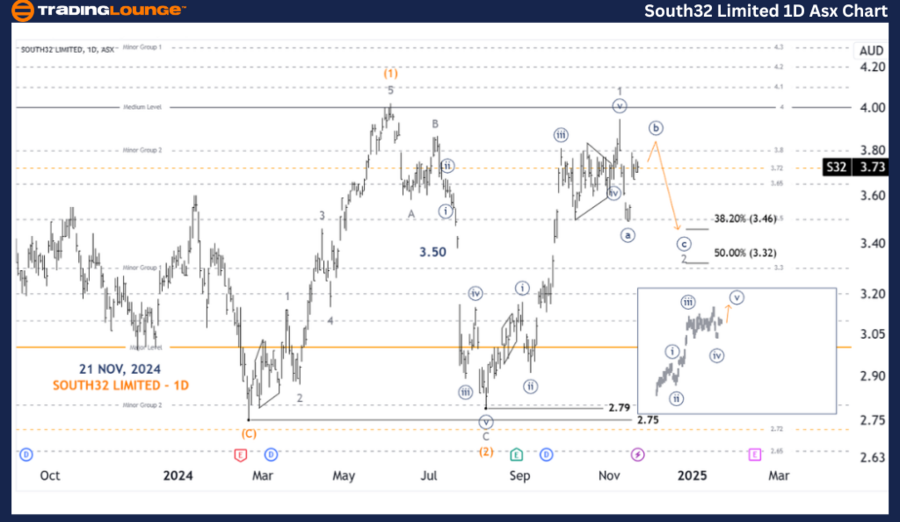

ASX: SOUTH32 LIMITED – S32 Elliott Wave Analysis TradingLounge 1D Chart

Overview of ASX: SOUTH32 LIMITED – S32 1D Chart (Semilog Scale) Analysis

Our Elliott Wave analysis today provides an updated perspective on ASX: SOUTH32 LIMITED (ASX:S32). Based on our observations, the stock is likely to experience a pullback in the near term, corresponding to wave 2-grey, before a potential surge higher with wave 3-grey.

ASX: SOUTH32 LIMITED Elliott Wave Analysis

Key Features:

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((a))-navy of Wave 2-grey

Detailed Insights:

- Wave Progression: The completion of wave 1-grey suggests the onset of wave 2-grey, which may push prices lower. Retracement targets for wave 2-grey are projected within the range of 3.46 to 3.32. Following this correction, wave 3-grey is expected to lead a significant upward push.

- Alternative Scenario: If the price continues rising instead of retracing, it may indicate that wave ((v))-navy is unfolding. However, the eventual result remains consistent with a pullback in wave 2-grey.

- Invalidation Point: A drop below 2.79 will invalidate the current wave count.

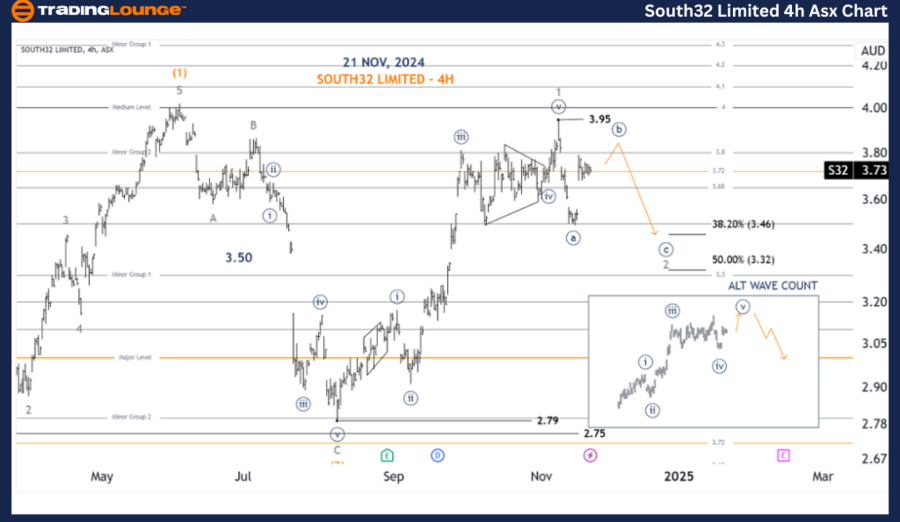

ASX: SOUTH32 LIMITED – S32 4-Hour Chart Analysis

Key Features:

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Diagonal

Position: Wave ((b))-navy of Wave 2-grey

Detailed Insights:

- Alignment with 1D Chart: The 4-hour chart aligns closely with the 1D chart. A rise above 3.95 could confirm the activation of wave ((v))-navy under the alternative wave scenario.

- Expected Completion: Upon reaching this scenario, wave 2-grey pullback remains the ultimate expectation.

- Invalidation Point: A breach below 2.79 invalidates this analysis.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SUNCORP GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our Elliott Wave analysis for ASX: SOUTH32 LIMITED (ASX:S32) provides actionable insights into current and upcoming market trends. Key retracement and invalidation levels such as 3.46 - 3.32 and 2.79 guide traders in assessing wave count accuracy and refining trading strategies. Whether adhering to the primary or alternative scenarios, we anticipate a pullback before a stronger upward trend resumes, ensuring a well-informed approach to this market.