ASX: SUNCORP GROUP LIMITED – SUN Elliott Wave Analysis | TradingLounge

Greetings, today’s Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) and updates insights for SUNCORP GROUP LIMITED (ASX). Our analysis indicates that ASX continues its upward trajectory in wave (iii)-orange of wave ((v))-navy.

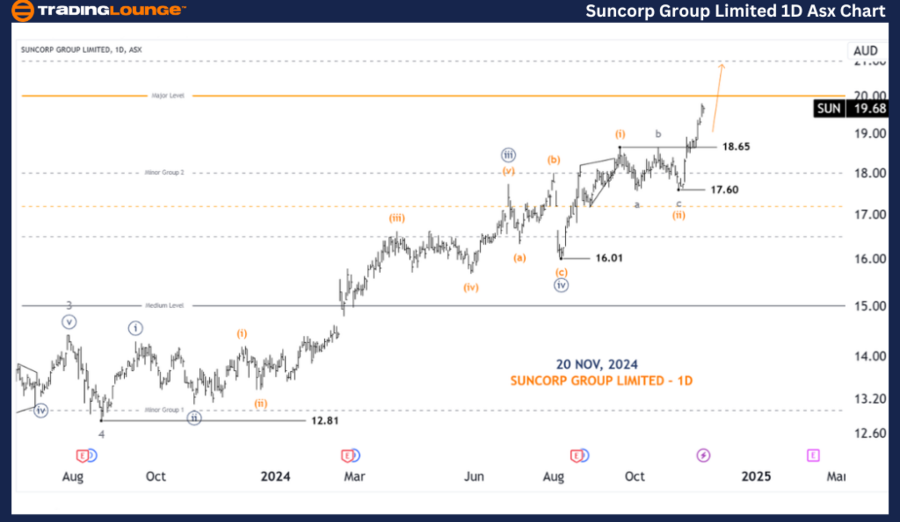

ASX: SUNCORP GROUP LIMITED – SUN 1D Chart (Semilog Scale) Analysis

SUN Elliott Wave Technical Analysis

Function: Major trend (Minuette degree, purple)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((v))-navy

Details: Wave ((v))-navy is extended, subdividing into wave (i)-orange through wave (iii)-orange.

Wave (iii)-orange is advancing and is projected to reach a target zone of 21.00 - 23.00.

Invalidation point: 18.65

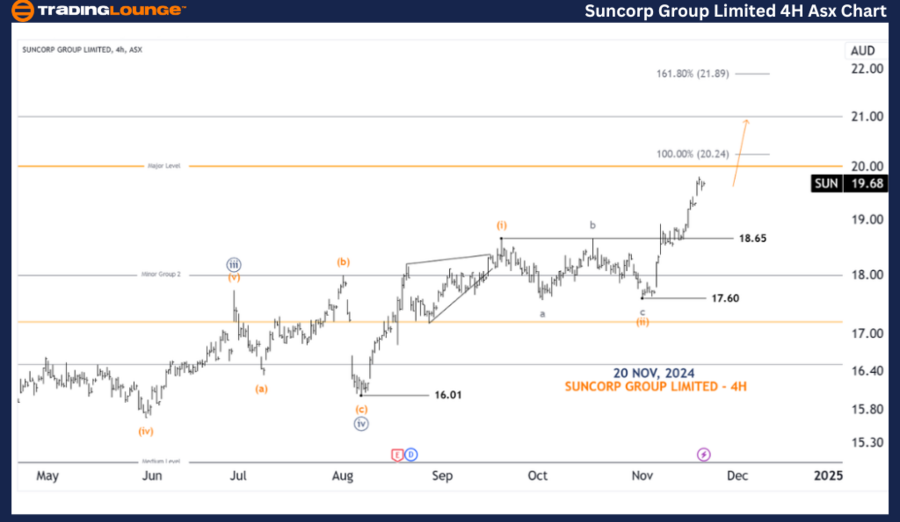

ASX: SUNCORP GROUP LIMITED – SUN 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((v))-navy

Details:

- Since hitting a low of 17.60, wave (iii)-orange has been unfolding to push higher.

- It targets 20.24 as the nearest resistance level; upon surpassing this, it is expected to climb further toward 21.89.

- The view remains valid only if the price stays above 18.65, as the fourth wave cannot retrace into the first wave’s territory.

Invalidation point: 18.65

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: REA GROUP LTD – REA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: SUNCORP GROUP LIMITED – SUN offers a detailed perspective on current market trends. With precise price levels acting as validation or invalidation signals for the wave structure, traders can leverage this information to make informed decisions. The ongoing wave (iii)-orange highlights a strong bullish trend, presenting actionable opportunities for market participants aiming to capitalize on the upward momentum.