TradingLounge Commodity - Iron Ore Elliott Wave Analysis

Iron Ore Elliott Wave Technical Analysis

The Iron Ore Index serves as a crucial benchmark in the iron ore market, offering valuable insights for traders, miners, and steelmakers who are involved in contract settlements and managing price risks. This index is based on real transactions within the iron ore spot market, making it a reliable indicator of market trends.

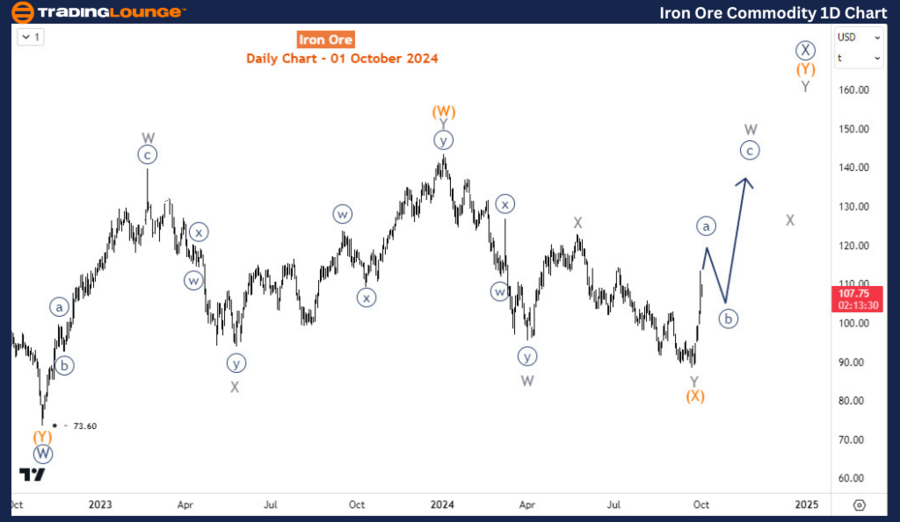

In May 2021, the index hit a historic peak of around $233 per dry metric ton, driven by strong demand from China and supply disruptions among key producers. However, this peak triggered a substantial correction, with the index plunging by over 68%, reaching $73 by October 2022. A recovery phase followed, pushing the index up to $143.5 by December 2023. Despite this recovery, 2024 saw another significant decline, with the index dropping nearly 50% before the most recent rebound in September.

Commodity - Iron Ore Daily Chart Analysis

On the daily chart, we identified the second phase of the bearish correction starting from the all-time high reached in May 2021. The first phase completed wave W (circled) of the primary degree on October 31, 2022, at $73.6. After this, the price formed another bullish zigzag structure, which was completed in January 2024, before the all-year decline began. The decline, however, has been corrective, suggesting a forecast for the second phase higher from $73.6. The most recent rally from the September low indicates that the market could push much higher for wave (Y) of X (circled).

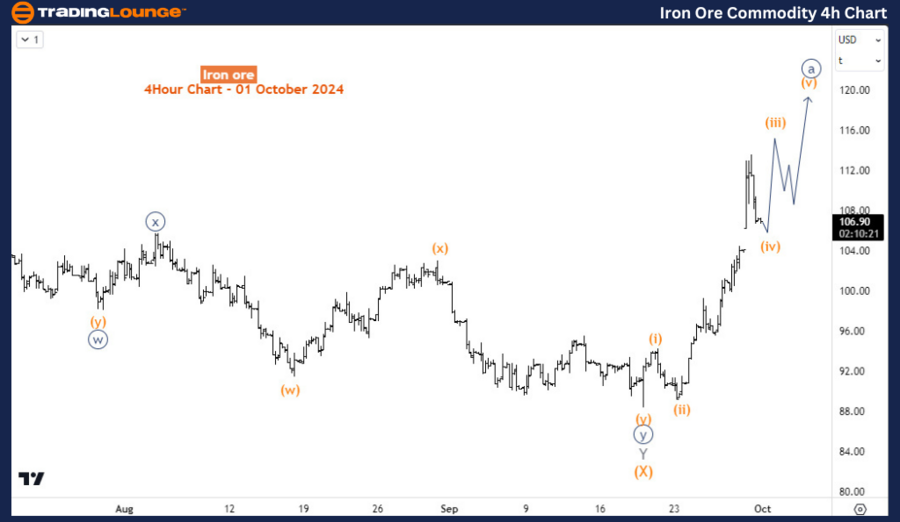

Commodity - Iron Ore H4 Chart Analysis

On the H4 chart, the recovery from the September low forms an impulse wave structure, potentially marking wave ((a)) of W of (Y). This forecast supports further upside in the short and medium term. As long as pullbacks remain above the September low, traders might consider buying the dip for wave ((b)) or X, provided the price aligns with this forecast.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support