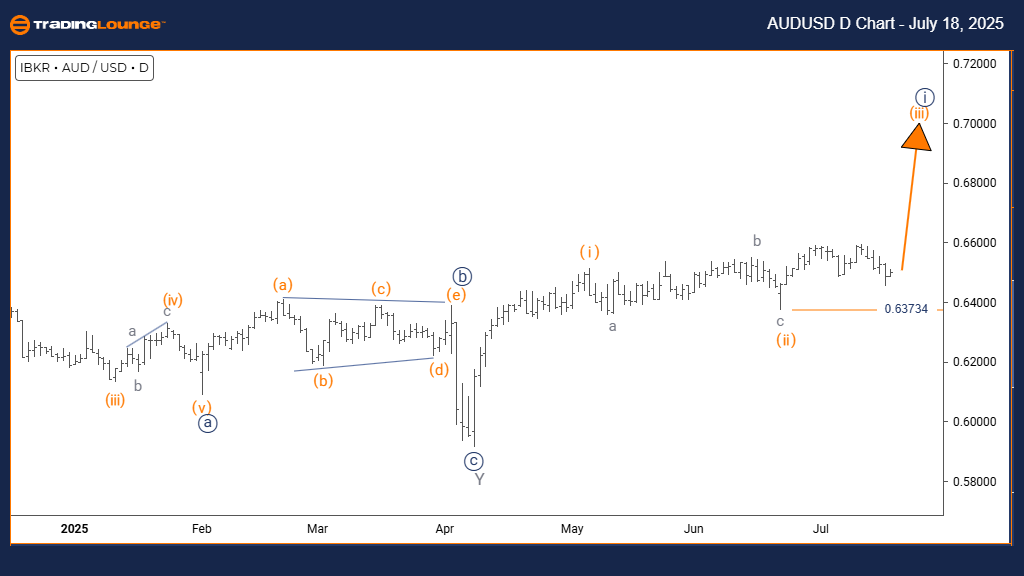

AUDUSD Elliott Wave Analysis | Trading Lounge Day Chart

Australian Dollar/U.S. Dollar (AUDUSD) Day Chart Analysis

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (Active)

DETAILS: Orange Wave 2 appears complete, and Orange Wave 3 is progressing.

Wave Cancel Invalid Level: 0.63734

The daily Elliott Wave analysis of AUD/USD reveals a solid upward trend based on the impulsive market structure. The chart illustrates Orange Wave 3 developing within a larger Navy Blue Wave 1, signaling that the pair has entered a robust bullish phase in the Elliott Wave cycle. As Orange Wave 2 looks finished, price action now advances into Orange Wave 3, a segment commonly associated with powerful upward moves in forex markets.

This impulsive formation supports sustained bullish momentum, characterized by rising highs and increasing trading volume, often linked with institutional interest. Positioned inside Navy Blue Wave 1, Orange Wave 3 has the potential to anchor a broader uptrend. The key invalidation level at 0.63734 serves as an important technical reference to uphold this bullish view.

This Elliott Wave chart suggests that AUD/USD has exited its corrective structure and transitioned into a new impulsive leg. This progression from Wave 2 to Wave 3 is usually where momentum strengthens, delivering clearer price surges and trend confirmation.

Key Takeaways:

- Focus on price continuation in Orange Wave 3.

- Use 0.63734 as a critical stop-loss level.

- Bullish momentum remains intact, supporting further upside potential.

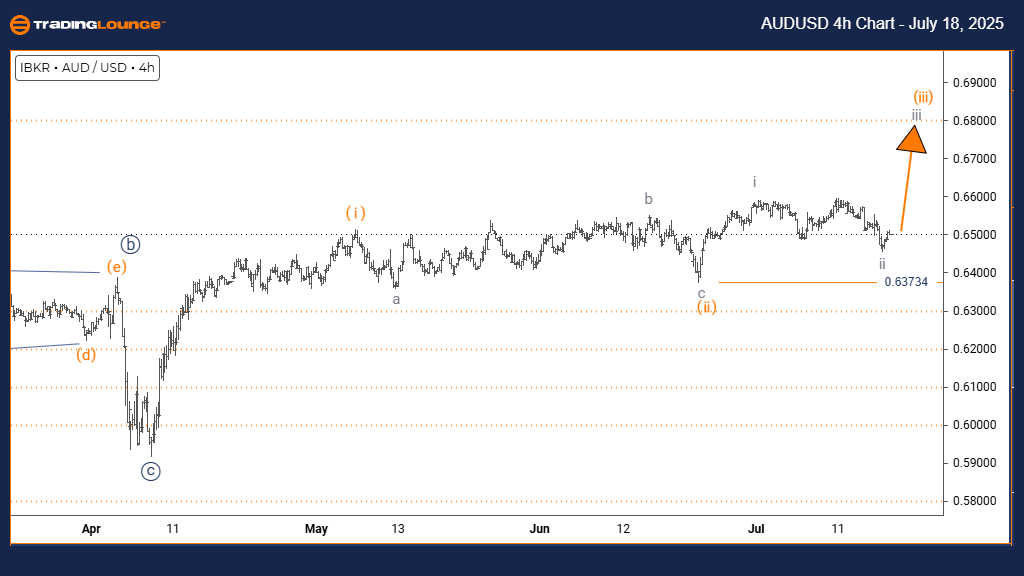

Australian Dollar/U.S. Dollar (AUDUSD) 4-Hour Chart Analysis

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 3

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3 (Active)

DETAILS: Gray Wave 2 appears complete, and Gray Wave 3 is unfolding.

Wave Cancel Invalid Level: 0.63734

The 4-hour Elliott Wave chart of AUD/USD highlights a strong impulsive trend as Gray Wave 3 evolves within the broader Orange Wave 3. This phase reflects sustained bullish energy, indicating that the market is actively engaged in a powerful Elliott Wave pattern. Following the apparent completion of Gray Wave 2, the pair has transitioned into Gray Wave 3, a leg historically known for its strong directional moves and acceleration.

The price action confirms this trend with consistent higher highs and growing buyer interest, suggesting continued strength. Nestled within Orange Wave 3, this Gray Wave 3 phase signifies one of the trend’s most dynamic movements. The invalidation point remains at 0.63734, providing a key threshold for maintaining a bullish forecast.

The chart setup aligns with Elliott Wave principles indicating that AUD/USD has moved from consolidation to a full trend extension. The ongoing momentum provides a favorable environment for trend-following strategies with defined risk levels.

Key Takeaways:

- Gray Wave 3 confirms strong bullish sentiment.

- Watch the 0.63734 level as a safeguard.

- Continued price growth likely as wave structure matures.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support