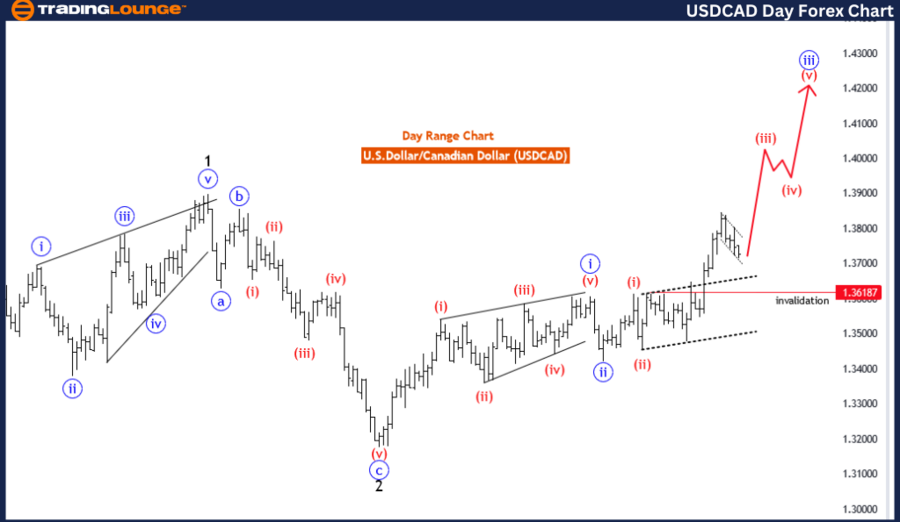

Forex Elliott Wave Analysis of U.S.Dollar /Canadian Dollar (USD/CAD)

U.S. Dollar / Canadian Dollar (USD/CAD) Day Chart Analysis

USD/CAD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Red Wave 3

Position: Blue Wave 3

Direction Next Lower Degrees: Red Wave 4

Details: Red wave 2 of blue wave 3 is completed, and now red wave 3 is in play. Wave Cancel invalid level: 1.36187

Overview of USD/CAD Elliott Wave Analysis

The USD/CAD Elliott Wave Analysis for the day chart delves into the dynamics between the U.S. Dollar and the Canadian Dollar, utilizing Elliott Wave theory to discern major trends and forecast potential price movements.

Function Analysis

The analysis identifies the primary function as "Trend," emphasizing the overall market direction. This could indicate a robust continuation of the existing market trend, offering valuable insights for trading strategies.

Mode Description

The analysis is characterized as "impulsive," which points to a pronounced trend with substantial directional price movements. This mode generally represents the more vigorous phases in the Elliott Wave sequence, where corrective waves appear smaller and of shorter duration.

Structural Insights

Described as "Red wave 3," the structure indicates a vigorous impulsive phase within the overall Elliott Wave cycle. This wave is often associated with significant price adjustments, potentially resulting in substantial market gains or losses.

Positioning Details

The analysis mentions "blue wave 3" as the position, detailing the current degree of the analyzed structure. This phase usually follows corrective waves and is often the longest in terms of both duration and price movement.

Directional Forecast for Lower Degrees

According to the forecast, a shift to "red wave 4" is expected next. This suggests a forthcoming corrective phase after the completion of the current wave before the trend resumes its course.

Additional Details

The analysis notes that "red wave 2 of blue wave 3" has concluded, marking the end of a corrective wave and the start of a new impulsive phase. The ongoing "red wave 3" indicates a strengthening of the upward trend, providing crucial insights for traders and investors.

Critical Threshold - Wave Cancel Invalid Level

The specified invalid level at 1.36187 is critical. Exceeding this price point could negate the current Elliott Wave configuration, necessitating a reevaluation of the analysis. This level is an essential benchmark to assess the continuity of the prevailing trend and wave structure.

Conclusion

The comprehensive analysis of the USD/CAD Elliott Wave configuration on the day chart outlines the impulsive wave currently in play and provides insights into broader market trends. This information is pivotal for traders and analysts aiming to predict the near-term directions of the USD/CAD pair.

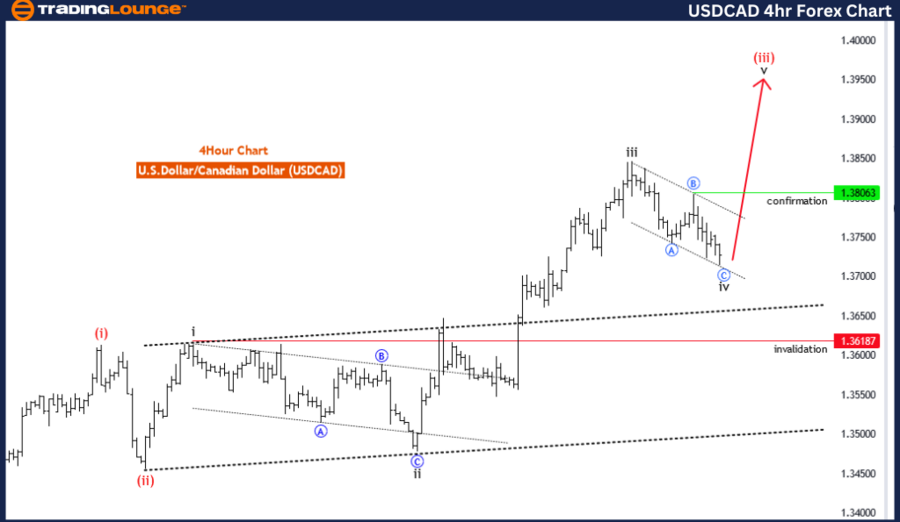

Elliott Wave Analysis Trading Lounge 4-Hour Chart

U.S. Dollar / Canadian Dollar (USD/CAD) 4-Hour Chart Analysis

Function: Trend

Mode: Corrective

Structure: Black Wave 4

Position: Red Wave 3

Direction Next Higher Degrees: Black Wave 5

Details: Black wave 3 of 3 completed, now black wave 4 is in play and near to end. Wave Cancel invalid level: 1.36187

Function Examination

The function of this analysis on the 4-hour chart is labelled "Trend," suggesting alignment with a broader upward or downward movement, which might signal opportunities for trend-based trading strategies.

Mode Overview

The mode here is defined as "corrective," indicating a phase within the Elliott Wave cycle characterized by more intricate price movements, reflecting a pause or reversal in the broader trend.

Structural Analysis

Labelled "black wave 4," the structure provides insights into the current phase of the Elliott Wave cycle. Typically, wave 4 represents a corrective stage in a larger trend, characterized by complex and consolidated price action.

Position Context

The current wave cycle's position is "Red wave 3," providing a context within the Elliott Wave hierarchy and insight into the overall wave pattern.

Higher Degree Directional Forecast

The analysis suggests that the next phase will be "black wave 5," indicating that the broader trend is expected to resume, with the next higher-degree wave forecasting continued upward or downward movements.

Additional Insights

The section details that "black wave 3 of 3 is completed," signalling the conclusion of the impulsive wave segment within the current wave cycle. With "black wave 4" nearing completion, this implies that the corrective phase may soon conclude, opening up opportunities for the subsequent impulsive move.

Critical Risk Management Reference Point

The stated wave cancel level at 1.36187 serves as an essential risk management reference, providing traders with a crucial benchmark for decisions and risk management in their trading strategies. These insights are valuable for guiding trading decisions and effectively managing risk

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: U.S.Dollar/Swiss Franc (USD/CHF)

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE