Greetings,

This Elliott Wave analysis provides an updated outlook on Northern Star Resources Ltd (ASX:NST) and its market movement on the Australian Stock Exchange (ASX).

We observe potential upside movement for ASX:NST, but a pullback with Wave ((ii)) - navy is expected before Wave ((iii)) - navy advances. A shift in trend requires additional time, and this report outlines key price levels to help traders identify trend reversals and invalidation points.

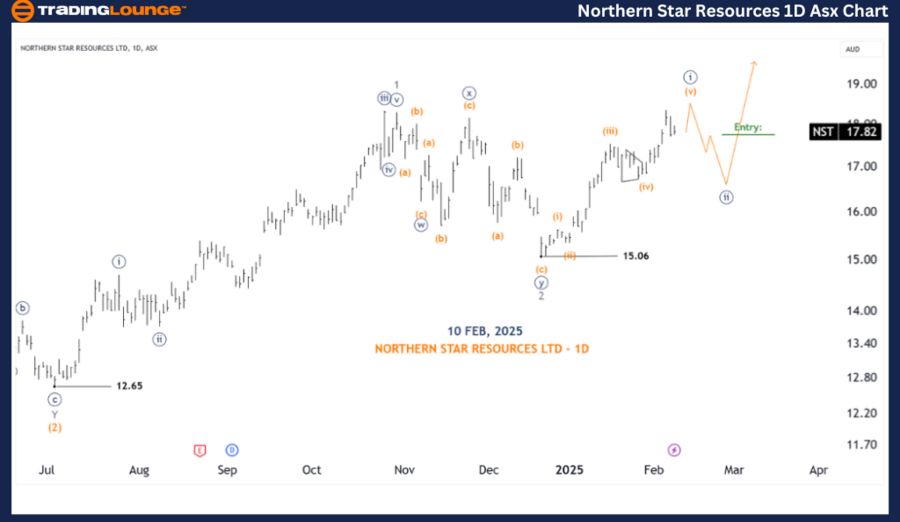

Northern Star Resources Ltd (NST) Elliott Wave Analysis (1D Chart - Semilog Scale)

ASX: Northern Star Resources Ltd 1D Chart Analysis - Semilog Scale

NST Stock Analysis Overview

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (v) - orange of Wave ((I)) - navy

NST Stock Technical Details

- The Wave 2 - grey has likely completed as a Double Zigzag, and since hitting 15.06, Wave 3 - grey is moving upward.

- Wave ((ii)) - navy appears close to completion, potentially leading to a rally with Wave ((iii)) - navy.

- Wave ((i)) - navy is concluding its five-wave formation, setting up for a pullback with Wave ((ii)) - navy.

- Traders may look for long entry positions after Wave ((ii)) - navy completes, confirming an uptrend when Wave B surges past a key resistance level.

NST Stock Key Technical Levels

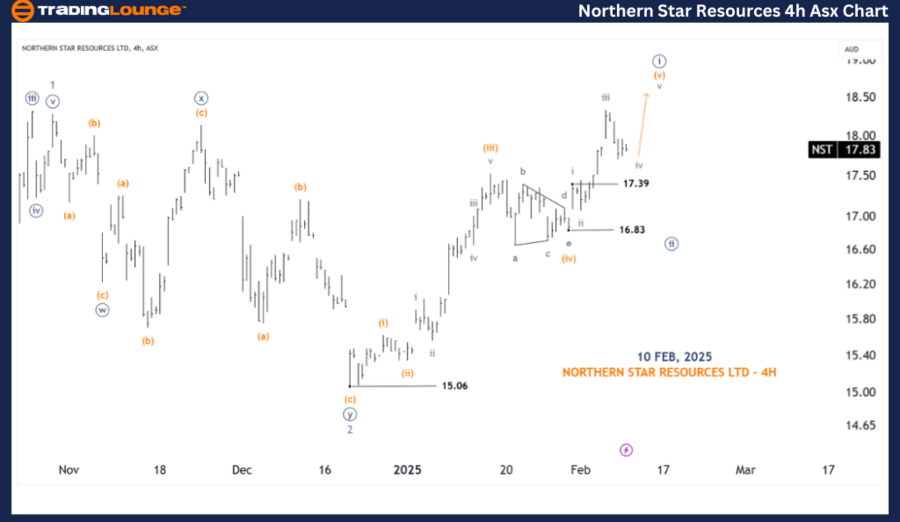

Northern Star Resources Ltd (NST) Elliott Wave Analysis (4h Chart - Semilog Scale)

ASX: Northern Star Resources Ltd 4h Chart Analysis Overview

- Function: Major trend (Minute degree, navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave (v) - orange of Wave ((v)) - navy

Northern Star Resources Ltd Technical Details

Northern Star Resources Ltd Key Technical Levels

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SANTOS LIMITED - STO Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis provides a structured market outlook and short-term forecast for ASX: Northern Star Resources Ltd (NST). We emphasize critical validation and invalidation price points, helping traders refine market confidence and decision-making.

By incorporating these technical insights, we aim to deliver an objective and professional perspective, empowering traders to strategically capitalize on market trends.