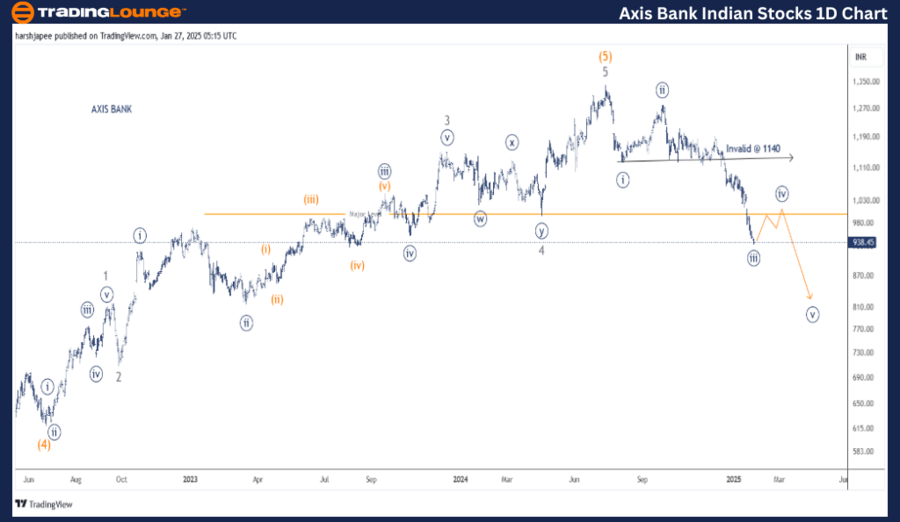

AXIS BANK LTD Elliott Wave Analysis - TradingLounge (1D Chart)

AXISBANK Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey Wave A Unfolding)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Correction

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is advancing towards the 900-920 range, with a key resistance level at 1290.

Invalidation Point: 1140 (Risk Tightened)

Daily Chart Analysis and Elliott Wave Counts

The daily chart of AXIS BANK LTD indicates that a larger corrective wave is in progress after hitting the Intermediate Wave (5) Orange peak at around 1340 in July 2024. The price action suggests a minor degree A-B-C corrective pattern, with Minor Wave A potentially evolving as an impulse.

Key observations:

- Intermediate Wave (4) Orange concluded around the 620 level in June 2022.

- The rally following this low has been subdivided into five distinct Minor Degree waves (Waves 1 through 5).

- If this Elliott Wave count holds, AXIS BANK has possibly formed a major market top at the 1340 level.

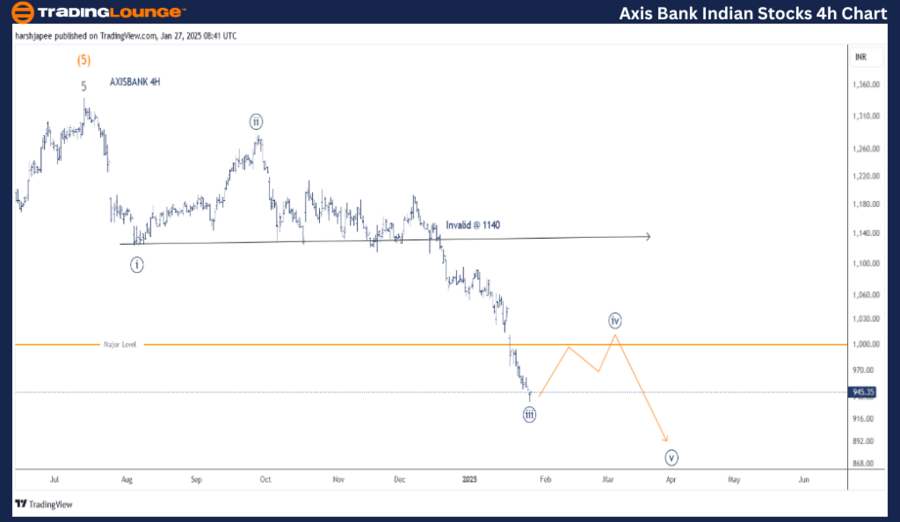

AXIS BANK LTD Elliott Wave Analysis - TradingLounge (4H Chart)

AXISBANK Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey Wave A Unfolding)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Correction

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is progressing towards the 900-920 range, with resistance at 1290. The wave might have terminated around the 930-935 region.

Invalidation Point: 1140 (Risk Tightened)

4H Chart Analysis and Elliott Wave Counts

The 4-hour chart of AXIS BANK LTD reveals detailed sub-wave formations following the 1339 peak in July 2024. The unfolding impulse wave at the Minute Degree level showcases the following key movements:

- Wave ((i)) finalized at 1140

- Wave ((ii)) retraced up to 1280

- Wave ((iii)) likely ended around the 935 zone

If the current Elliott Wave count proves accurate, the price may see an upward correction towards the 1030-1040 range, marking the completion of Wave ((iv)), before another decline resumes to complete the impulse sequence. It is crucial that prices remain under the invalidation point of 1140 to sustain the current wave structure.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: JSW STEEL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

AXIS BANK LTD is projected to approach the 1140 level to finalize the potential Minute Wave ((iv)), followed by a continuation of the downward movement. Traders should monitor resistance levels and invalidation points to gauge further price action effectively.