XRPUSD Elliott Wave Analysis | TradingLounge Daily Chart

XRP/ U.S. Dollar (XRPUSD) Daily Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave 2

Next Higher Degree Direction: Pending

Invalidation Level: Not Specified

XRP/ U.S. Dollar (XRPUSD) – Trading Strategy:

After a strong rally in Wave 1, XRP/USD reached a peak around $2.40. The ongoing Wave 2 correction is developing into an A-B-C Elliott Wave structure, with Wave C yet to complete. A bullish reversal from the anticipated support zone could trigger the start of Wave 3, offering a prime trading opportunity to target new highs in XRP.

Trading Strategies

Approach

Short-Term Trading (Swing Trade)

- Track the completion of Wave C within the target support range of $1.90 to $1.88.

- Watch for bullish confirmation signals or divergences to enter long positions for Wave 3.

Risk Management

- Invalidation occurs if XRPUSD breaks below $1.6165, negating the current bullish Elliott Wave count.

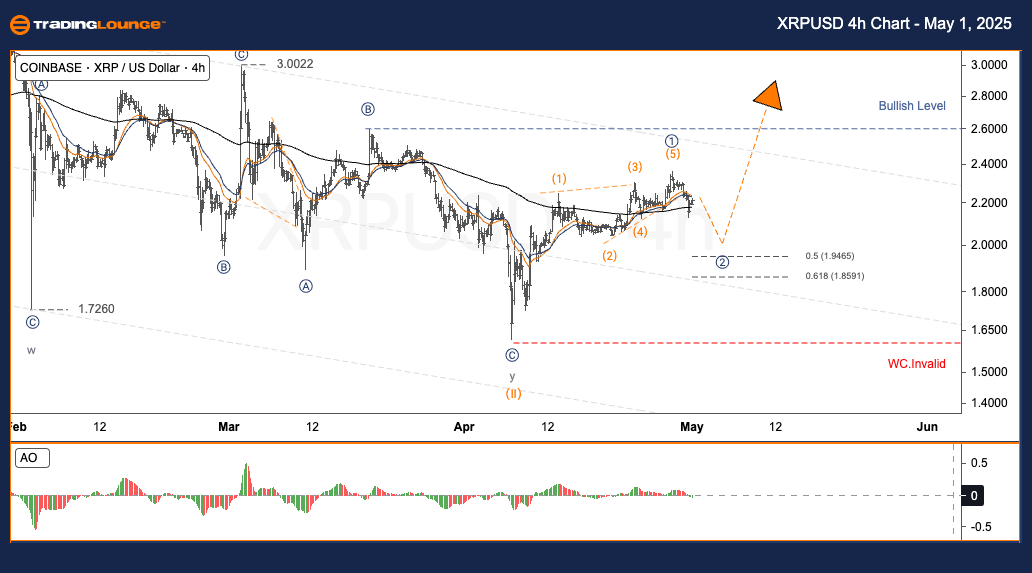

XRPUSD Elliott Wave Analysis | TradingLounge H4 Chart

XRP/ U.S. Dollar (XRPUSD) 4-Hour Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave 2

Next Higher Degree Direction: Pending

Invalidation Level: Not Specified

XRP/ U.S. Dollar (XRPUSD) – Trading Strategy:

XRPUSD surged impressively during Wave 1, topping out near $2.40. The cryptocurrency is now retracing in Wave 2, forming an expected A-B-C Elliott Wave correction, with Wave C still in progress. A bullish reaction from the forecasted support zone could launch a powerful Wave 3 rally, aiming to break previous resistance levels.

XRPUSD Trading Strategies

Approach

- Short-Term Trading (Swing Trade)

- Wait for Wave C to complete within the $1.90–$1.88 support area.

- Look for bullish setups or divergences to confirm long entries for Wave 3.

Risk Management

- The bullish scenario is invalidated if XRPUSD drops below $1.6165.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support