In-Depth PANW Elliott Wave Analysis – Palo Alto Networks Inc. (PANW)

In this Elliott Wave Analysis of Palo Alto Networks Inc. (PANW), the focus is on identifying potential trading opportunities by analyzing PANW's price movements through the Elliott Wave framework. This analysis is broken down into the daily and 1-hour charts, providing a clearer outlook on the stock's short-term and long-term trends.

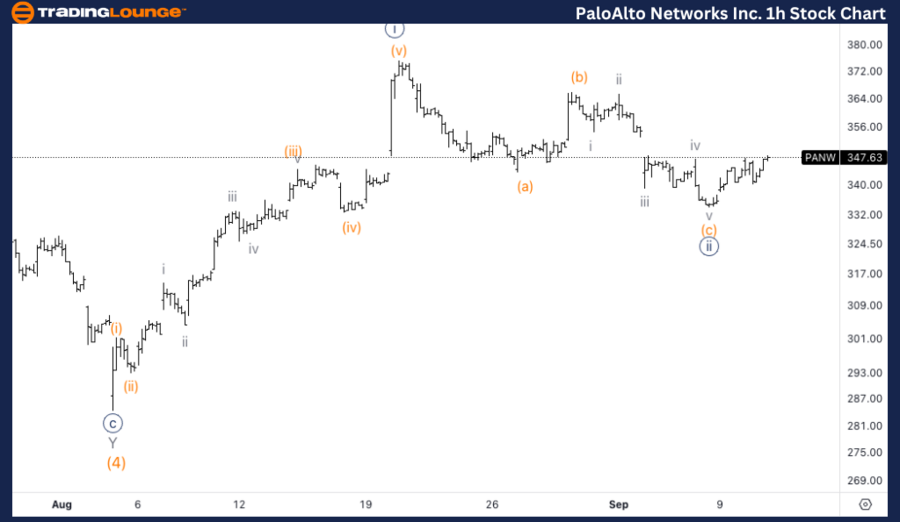

PANW Elliott Wave Analysis – Trading Lounge Daily Chart

Palo Alto Networks Inc. (PANW) Daily Chart

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 1 of (5)

Direction: Upside into wave 1

Details: The daily chart analysis shows a potential resumption of the uptrend after a three-wave correction in wave (4). The price is currently positioned between TL3 and $400, signaling an upward movement as wave 1 progresses.

PANW Elliott Wave Technical Analysis – Daily Chart

The daily chart shows Palo Alto Networks (PANW) is currently in an impulsive uptrend. The stock is progressing within Minor wave 1 of Intermediate wave (5). After completing a corrective three-wave pattern in wave (4), PANW looks set to resume its uptrend, heading towards higher price levels. Traders should monitor the movement between TL3 and $400 for further validation.

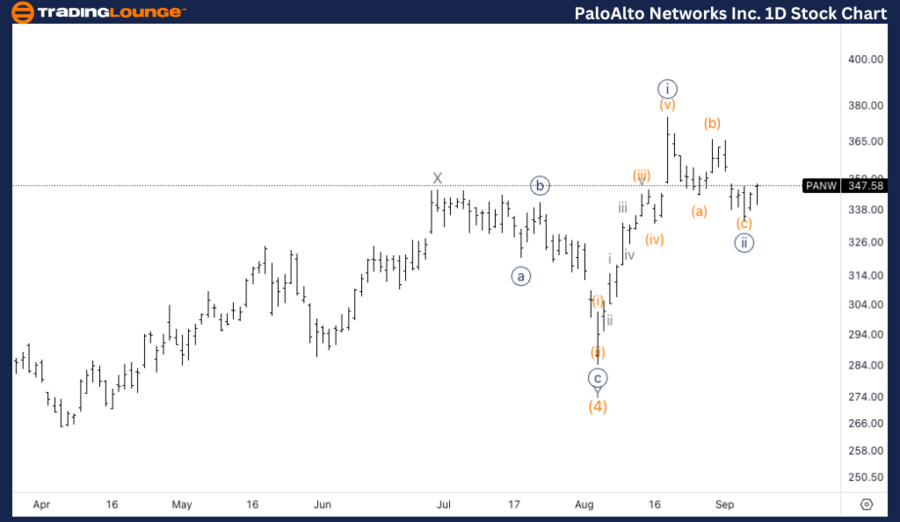

PANW Elliott Wave Analysis – Trading Lounge 1H Chart

Palo Alto Networks Inc. (PANW) 1H Chart

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 1

Direction: Bottom in wave {ii}

Details: The 1-hour chart suggests that PANW may have already completed wave 2 instead of wave {ii}, marking the end of a corrective phase. The stock is now likely moving into wave {iii}, supported by a clear three-wave correction in wave {ii}.

PANW Elliott Wave Technical Analysis – 1H Chart

The 1-hour chart analysis highlights that PANW is advancing within wave {iii} of 1, a strong impulsive phase. The stock appears to have bottomed in wave {ii}, indicating the end of the correction. The clear three-wave pattern into wave {ii} supports the expectation that wave {iii} is now unfolding, offering potential upside opportunities.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Netflix Inc. NFLX Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support