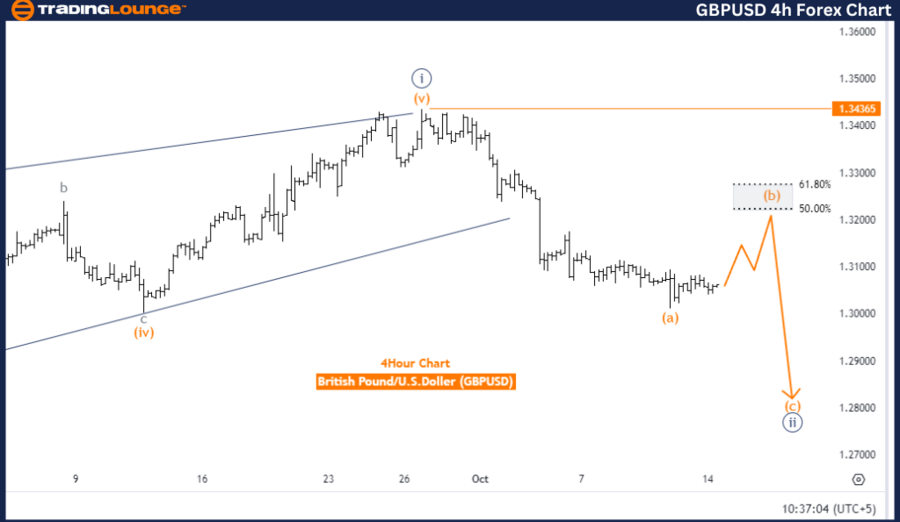

GBPUSD Elliott Wave Analysis – Trading Lounge Day Chart

British Pound/US Dollar (GBPUSD) – Daily Chart Overview

GBPUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 3

Direction (Next Higher Degree): Navy Blue Wave 3

Details: Navy Blue Wave 1 completed, Navy Blue Wave 2 unfolding

Wave Cancel Invalid Level: 1.34365

Analysis Overview

The daily Elliott Wave analysis of GBPUSD reveals that the currency pair is undergoing a corrective counter-trend phase, marked by navy blue wave 2. This correction follows the completion of Navy Blue Wave 1, indicating that the market is in a retracement stage before continuing the larger upward trend.

Wave Structure & Position

Key Details

Summary

GBPUSD is presently navigating navy blue wave 2, a corrective phase following wave 1. The broader trend is expected to resume with the development of navy blue wave 3 once this correction concludes. This analysis holds as long as GBPUSD remains below the invalidation level of 1.34365.

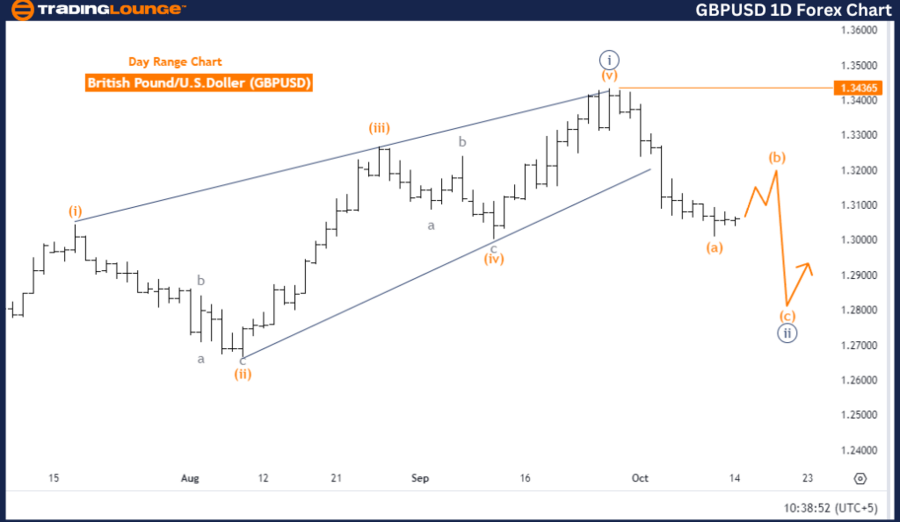

British Pound/US Dollar (GBPUSD) – 4-Hour Chart Overview

GBPUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave B

Position: Navy Blue Wave 2

Direction (Next Lower Degree): Orange Wave C

Details: Orange Wave A of 2 completed, Orange Wave B of 2 currently developing

Wave Cancel Invalid Level: 1.34365

Analysis Overview

The 4-hour Elliott Wave analysis indicates that GBPUSD is in a corrective phase, currently forming orange wave B within navy blue wave 2. The market remains in the broader corrective structure initiated by the previous orange wave A.

Wave Structure & Position

Key Details

-

Orange wave A has finished, and orange wave B is currently in progress.

-

This corrective phase suggests a temporary pullback before the market resumes its next move.

- Wave Cancel Invalid Level: If GBPUSD surpasses 1.34365, the current wave count will be invalidated, requiring fresh analysis.

Summary

In the 4-hour time frame, GBPUSD is progressing through orange wave B, part of the larger navy blue wave 2 correction. Once wave B completes, the market is expected to enter orange wave C, extending the correction. The wave structure remains valid unless GBPUSD breaks above 1.34365.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: U.S. Dollar / Japanese Yen (USDJPY) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support