Elliott Wave Analysis for Netflix Inc. (NFLX) - September 10, 2024

Welcome to our latest Elliott Wave analysis for Netflix Inc. (NFLX) as of September 10, 2024. This detailed analysis explores NFLX's price movements through the lens of Elliott Wave Theory, offering valuable insights for traders seeking to capitalize on potential opportunities based on the current market structure and trend developments. In this article, we review both the daily and 1-hour charts to provide a comprehensive understanding of NFLX’s price action.

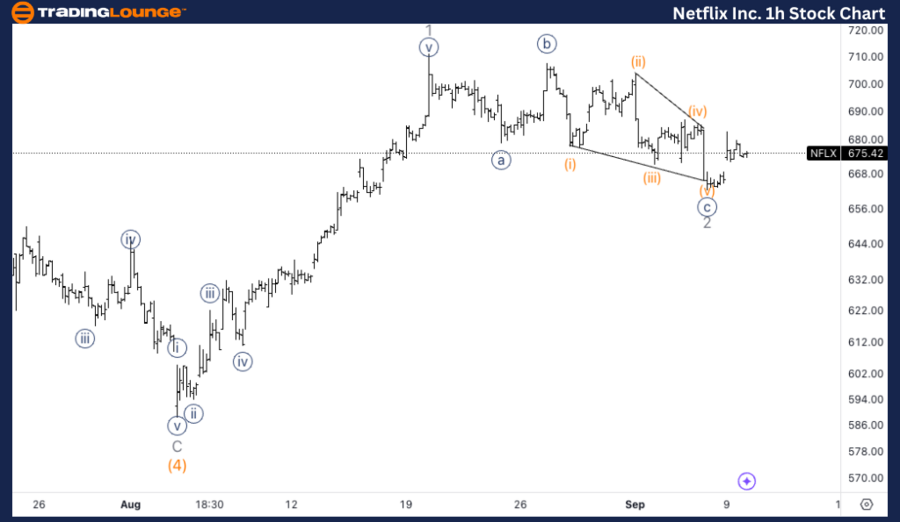

NFLX Elliott Wave Analysis - TradingLounge Daily Chart

Netflix Inc. (NFLX) Daily Chart Analysis

NFLX Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3

Direction: Upside in wave 3

Details: Anticipating upside movement into Minor wave 3 of Intermediate wave (5), with support holding above the $675 level, corresponding to the previous all-time high (ATH).

NFLX Stock Technical Analysis – Daily Chart

On the daily chart, Netflix is in a strong upward trend, driven by a Motive Wave structure. The stock is advancing within Minor wave 3 of the larger Intermediate wave (5), indicating a bullish market. Support around $675, which aligns with the previous ATH, is holding, reinforcing the potential for further upside in this wave 3 scenario.

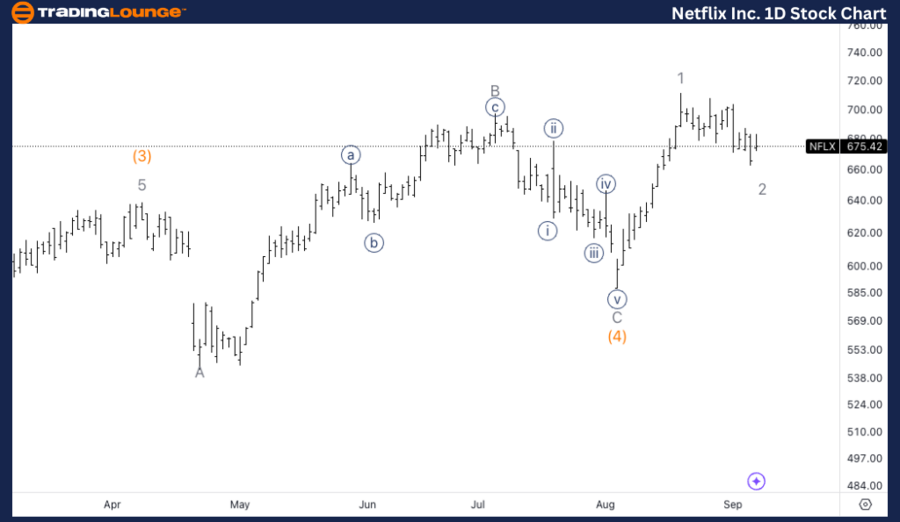

NFLX Elliott Wave Analysis - TradingLounge 1H Chart

Netflix Inc. (NFLX) 1H Chart Analysis

NFLX Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 3

Direction: Upside in wave 3

Details: Expecting a three-wave corrective move in wave 2 to complete soon, with support tested around $680, which will boost confidence in further upward movement.

NFLX Elliott Wave Technical Analysis – 1H Chart

In the 1-hour chart, NFLX is in the early stages of an impulsive rally, moving within wave {i} of 3. The chart indicates that wave 2, a corrective phase, is nearing completion. A three-wave corrective move has occurred, and the price has tested key support at $680. If this level holds, it strengthens the case for further upside momentum, increasing confidence in the bullish outlook.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NVIDIA Corp. (NVDA) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support