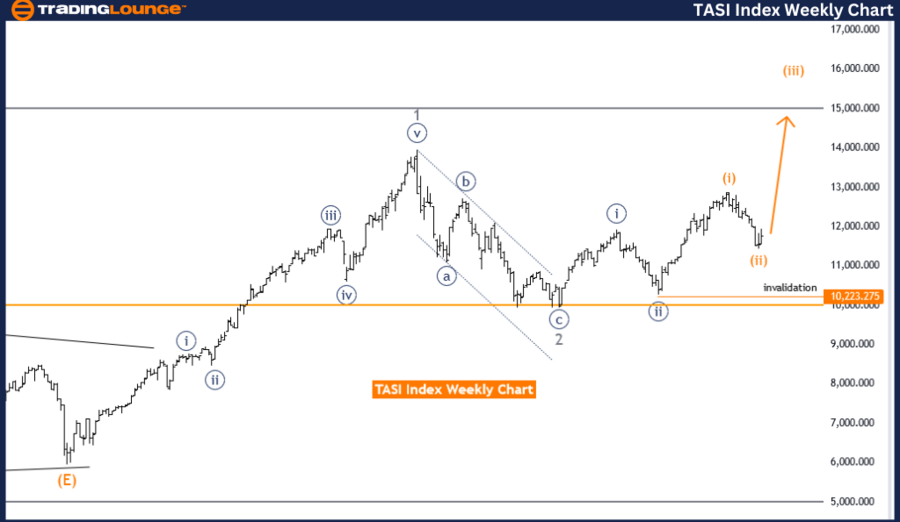

TASI Index Elliott Wave Analysis Trading Lounge Daily Chart

TASI Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction (Next Higher Degree): Orange Wave 3 (Started)

Details: Orange wave 2 looks complete between Fibonacci levels 50% to 61.80%. Now, orange wave 3 of 3 is in play.

Wave Cancel Invalid Level: 10223.275

The day chart's TASI Index Elliott Wave analysis focuses on identifying trends within an impulsive wave pattern. The structure being analyzed is orange wave 3, and the current position is within navy blue wave 3. This indicates that the market is experiencing a strong upward trend, characteristic of an impulsive wave movement.

The primary function of this analysis is to track and predict the continuation of the trend. The mode is identified as impulsive, signifying a powerful movement in one direction, typically associated with a robust market phase. Orange wave 3 represents the ongoing segment of this trend, suggesting that the market is currently in a significant bullish phase.

The current position within navy blue wave 3 highlights that the market is part of a larger upward movement. This wave is part of a broader trend, and the analysis indicates that orange wave 3 of this larger structure has commenced. This implies a continuation of the strong upward momentum.

The details provided in the analysis suggest that orange wave 2, the preceding corrective phase, appears to have completed its cycle between the Fibonacci retracement levels of 50 to 61.80 percent. This completion is crucial as it sets the stage for the next impulsive phase, orange wave 3 of navy blue wave 3, to be in play. This phase is expected to push the market higher, continuing the upward trend observed in the impulsive wave structure.

The wave cancel invalid level is set at 10223.275. This level is critical for maintaining the validity of the current Elliott Wave count. If the market price falls below this level, it would invalidate the current wave structure, necessitating a reevaluation of the wave analysis and potentially altering the expected market direction.

In summary, the TASI Index day chart analysis indicates that the market is in a strong upward trend within an impulsive wave structure. The completion of orange wave 2 between the Fibonacci levels of 50 to 61.80 percent sets the stage for orange wave 3 of navy blue wave 3, which is currently in play. The wave cancel invalid level at 10223.275 is essential for confirming the validity of this wave count and guiding future market predictions based on the Elliott Wave principles.

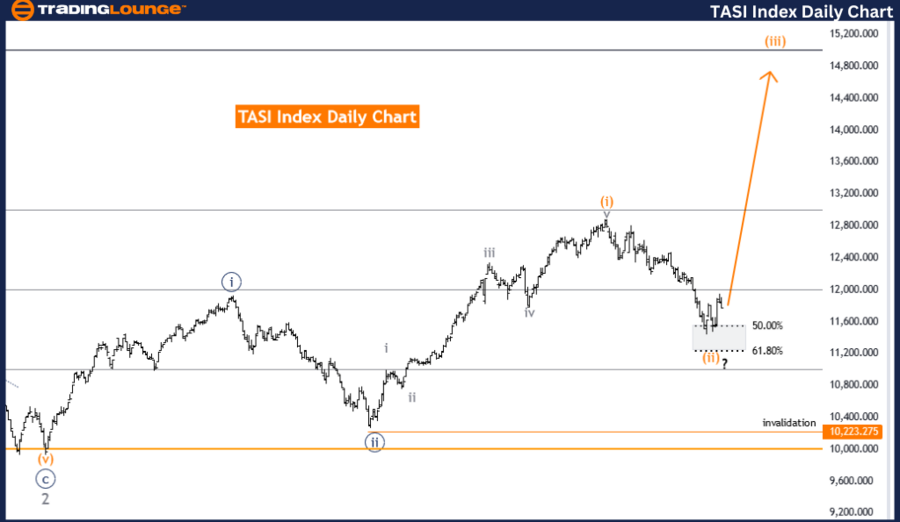

TASI Index Elliott Wave Analysis Trading Lounge Weekly Chart

TASI Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction (Next Higher Degree): Orange Wave 3 (Started)

Details: Orange Wave 2 looks complete. Now, orange wave 3 of 3 is in play.

Wave Cancel Invalid Level: 10223.275

The TASI Index Elliott Wave analysis on the weekly chart provides insight into the market's trend using the Elliott Wave theory. The analysis focuses on tracking the trend, which is currently identified as impulsive. This means the market is experiencing a strong, directional movement.

The primary structure under examination is orange wave 3, which is a part of a larger wave formation. The current position within this structure is navy blue wave 3, indicating that the market is in the third wave of a higher degree wave cycle. This is significant because the third wave in Elliott Wave theory is typically the strongest and most powerful wave in a trend, suggesting robust market activity and upward momentum.

The analysis highlights that the next higher degree direction is also orange wave 3, which has just started. This implies that the market is in the early stages of a new impulsive wave that is expected to continue the strong upward trend. The completion of orange wave 2 is noted, which was a corrective phase that sets the stage for the next impulsive move. Now, orange wave 3 of navy blue wave 3 is currently in play, reinforcing the continuation of the upward trend.

A critical level to watch is the wave cancel invalid level at 10223.275. This level is important because if the market price falls below this point, it would invalidate the current wave count. Such a scenario would require a reassessment of the wave analysis and could indicate a change in the market trend.

In summary, the TASI Index weekly chart analysis suggests a strong upward trend within an impulsive wave structure. The market is currently in navy blue wave 3, part of a larger orange wave 3, which has just begun. The completion of the previous corrective phase, orange wave 2,

supports the initiation of orange wave 3 of 3, indicating continued bullish momentum. The wave cancel invalid level at 10223.275 is crucial for maintaining the validity of this wave count and guiding future market predictions.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: Hang Seng Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support