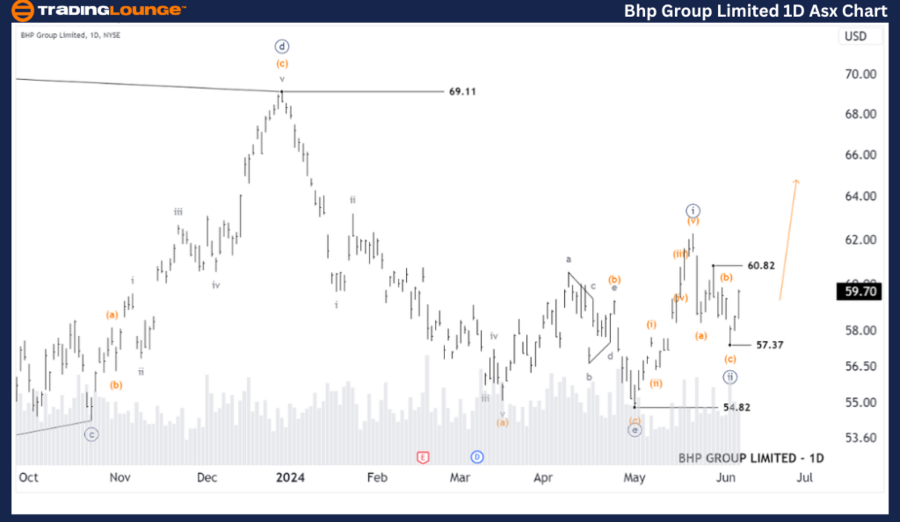

ASX: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with BHP GROUP LIMITED - BHP. Since the 54.82 low, a Five-waves pattern appears to be unfolding, indicating higher potential. Waves ((i)) and ((ii))-navy seem complete, setting the stage for wave ((iii))-navy to push even higher.

ASX: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis

ASX: BHP GROUP LIMITED - BHP 1D Chart (Semilog Scale) Analysis

Function: Major (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy

Details: The short-term outlook suggests that wave ((ii))-navy has ended. For confirmation, the price needs to rise above 60.82. If confirmed, wave ((iii))-navy will continue to push higher. The price must stay above 57.37 to maintain this outlook.

Confirmation point: 60.82

Invalidation point: 57.37

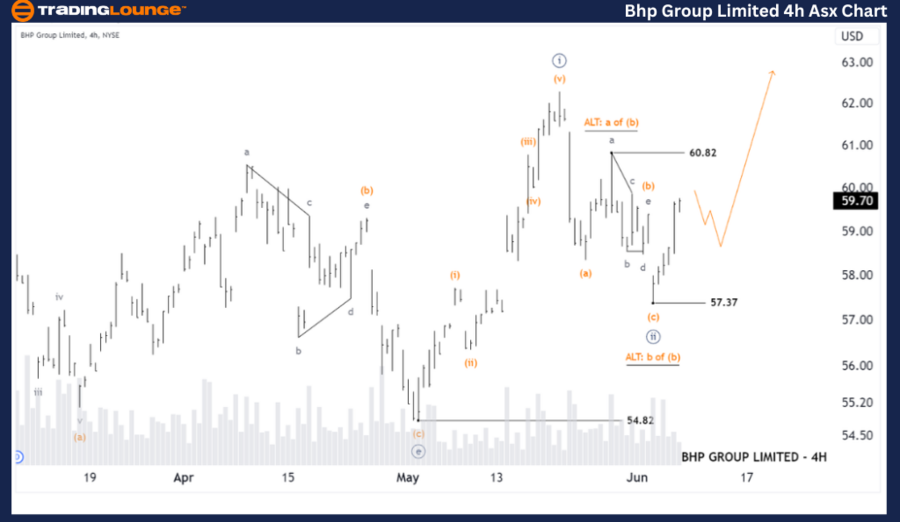

ASX: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis

ASX: BHP GROUP LIMITED - BHP 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((3))-navy

Details: The short-term outlook indicates that wave ((ii))-navy may have ended as a Zigzag. Starting from the 57.37 low, wave ((iii))-navy is likely unfolding to push higher. Be aware of the alternative wave count (ALT), suggesting wave (b)-orange of wave ((ii))-navy might still be unfolding, though this scenario is less probable.

Confirmation point: 60.82

Invalidation point: 57.37

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX LIMITED - ASX Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion:

Our analysis and forecast for ASX: BHP GROUP LIMITED - BHP aim to provide insights into current market trends and effective strategies to capitalize on them. We offer specific price points as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these factors, we strive to offer the most objective and professional view on market trends.