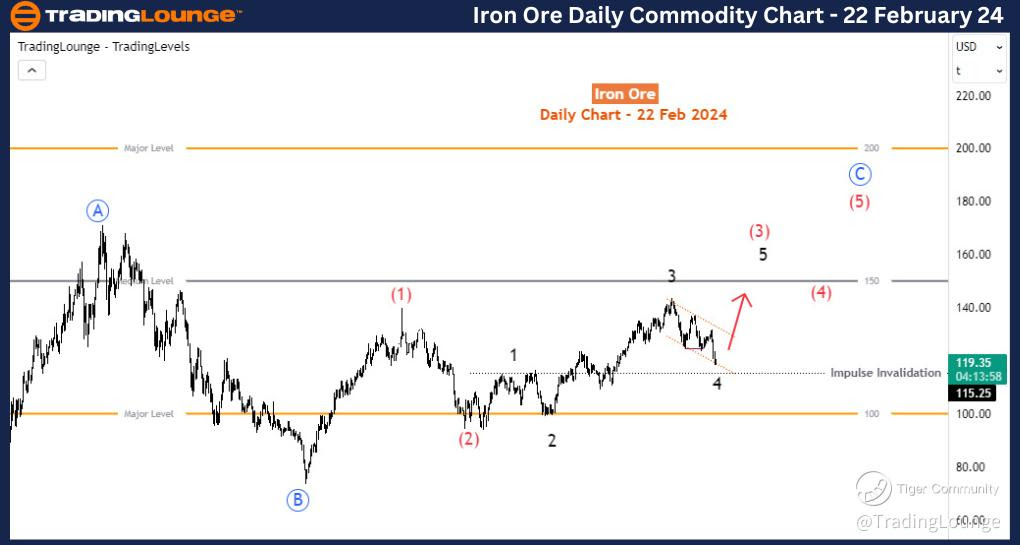

Iron Ore Elliott wave Analysis: bullish impulse could resume.

Iron Ore Elliott Wave Technical Analysis

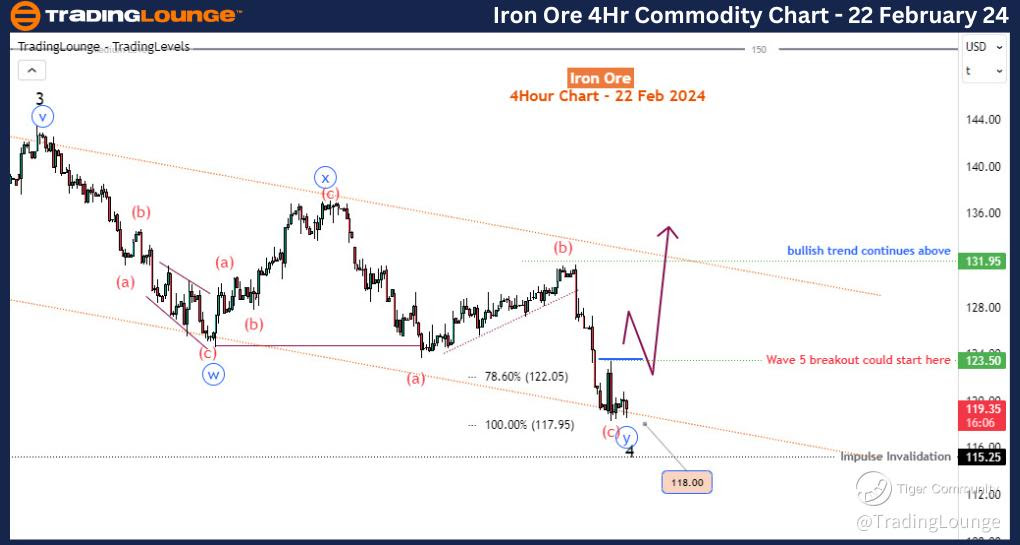

Function - Counter-trend

Mode - Corrective

Structure - Zigzag

Position - Black wave 4 of higher degree red wave (5)D

Direction - Black wave 5 of higher degree red wave (5)

Details - After the bears dragged this commodity to the marked 122.05-117.95 Fib-zone, a significant bounce could lead to a recovery to 150.

The function of the present market movement is identified as counter-trend, indicative of a corrective phase within the larger Elliott Wave cycle. This correction on the H4 is structured as a zigzag pattern, denoted as the black wave 4 within the context of the higher degree red wave (5) of an impulse.

Our focus shifts toward the anticipated direction of the market, which is poised for the initiation of the black wave 5, constituting a crucial phase within the broader red wave (3) on the daily time frame.

A notable aspect of the current market dynamics is the recent downturn that saw the commodity retreat to the Fib-zone ranging from 122.05 to 117.95. This is a zigzag corrective pattern. The implication is that, amidst this bearish onslaught, we expect this zone to provide support for a significant rebound, paving the way for a recovery rally towards the 150 mark.

At present, our analysis revolves around the ongoing counting of the black impulse wave pattern, with particular attention directed toward the completion of the 4th wave. This impending wave completion heralds the onset of the highly anticipated wave 5 of (3), representing a prized opportunity within the Elliott Wave framework.

Critical to our analysis is the pivotal support level situated at 115.25. The rejection of further decline below this threshold would solidify the outlook for the impending wave 5 of (3), reinforcing the bullish sentiment. If this bearish correction stays above 115.2 and the price breaks above 123.5, renewed bullish interests for wave 5 of (3) could be assumed especially if the bullish response is swift.

In summary, the present market conditions offer a nuanced landscape characterized by corrective movements within the framework of Elliott Wave theory. While the completion of the 4th wave sets the stage for the anticipated wave 5 of (3), traders are advised to monitor key support levels diligently. As such, astute observation coupled with a thorough understanding of Elliott Wave principles will be instrumental in navigating the complexities of the market as it unfolds.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa Commodity