Welcome to Our Latest Elliott Wave Analysis for Texas Instruments Inc. (TXN)

This comprehensive report examines TXN's price action using Elliott Wave Theory, offering insights to help traders identify potential trading opportunities based on current market trends and wave structures. We analyze both the daily and 1-hour charts to provide a well-rounded view of TXN’s market behavior.

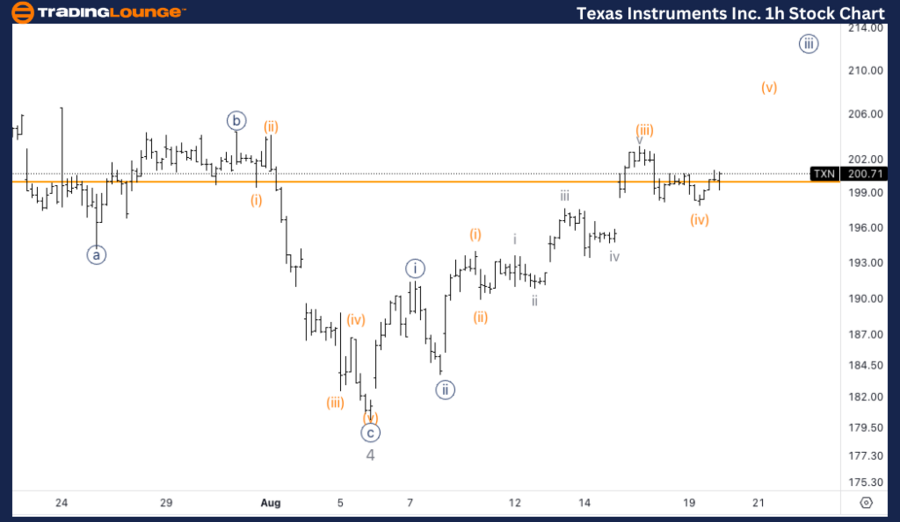

TXN Elliott Wave Analysis - TradingLounge Daily Chart

Texas Instruments Inc. (TXN) Daily Chart Analysis

TXN Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 5 of (1)

Direction: Upside in wave 5

Details: We observe a potential upside move into Minor wave 5, following a clear three-wave corrective move in wave 4. Since wave 3 was longer than wave 1, wave 5 could extend to the top of Minor Group 1 (MG1) at $230, with a possibility of reaching the Medium Level at $250 depending on the momentum strength.

TXN Stock Technical Analysis – Daily Chart

TXN is advancing in the final wave 5 of the current cycle, following a three-wave corrective structure in wave 4. With wave 3 surpassing the length of wave 1, wave 5 may extend toward significant resistance levels. The primary targets include the top of Minor Group 1 (MG1) at $230 and possibly further to the Medium Level at $250, contingent on the strength of the upward momentum.

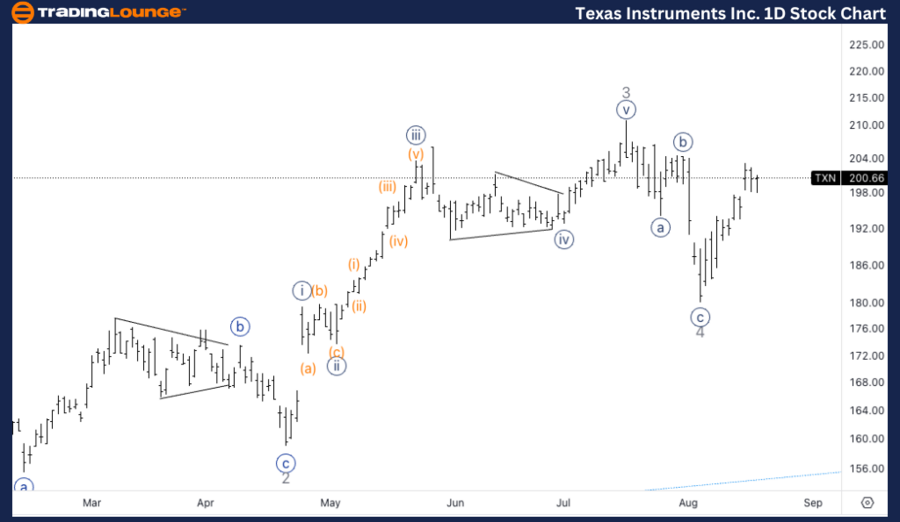

TXN Elliott Wave Analysis - TradingLounge 1H Chart

Texas Instruments Inc. (TXN) 1H Chart Analysis

Texas Instruments Inc TXN Stock Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 5

Direction: Upside in wave {iii}

Details: The current labeling of wave {iii} suggests a conservative approach within Minor wave 5, as TXN appears to be extending higher. The recent pullbacks are likely corrective in nature, supporting continued bullish momentum. This wave structure indicates further upside potential as TXN completes wave {iii}, prepares for a correction in wave {iv}, and resumes higher in wave {v}.

TXN Elliott Wave Technical Analysis – 1H Chart

The labeling of wave {iii} suggests a methodical progression within Minor wave 5, as the stock continues to show signs of upward extension. The nature of the recent pullbacks, which appear corrective, supports the likelihood of continued bullish momentum. This wave structure implies further upside potential as TXN aims to complete wave {iii}, before eventually correcting in wave {iv} and resuming higher in wave {v}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NVIDIA Corp. (NVDA) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support