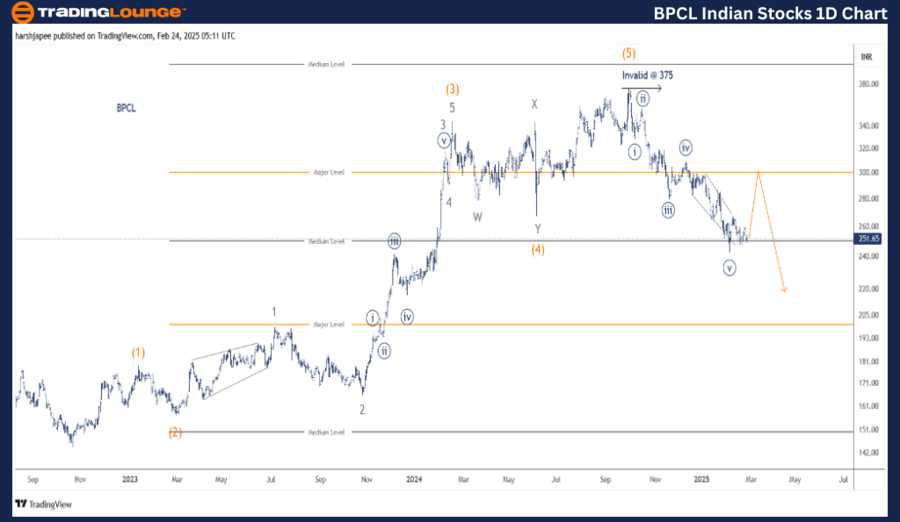

BPCL – BPCL (1D Chart) Elliott Wave Technical Analysis

BPCL 1D Chart Analysis

BPCL Elliott Wave Technical Analysis

Function: Counter-Trend (Intermediate Degree Orange)

Mode: Corrective

Structure: Potential Impulse within a Larger Degree Correction

Position: Minute Wave ((v))

Details:

- The lower-degree impulse wave appears complete around 243.

- Minute Wave ((v)) has developed as a diagonal formation.

- If accurate, a counter-trend rally could drive prices above the 300 level soon.

Invalidation Point: 375

BPCL Daily Chart – Technical Analysis & Elliott Wave Counts

The BPCL daily chart suggests a trend reversal following the stock’s decline from 375 in October 2024.

- A potential impulse lower appears to be completed, indicating a broader downtrend against the all-time high of 375.

- Previously, BPCL found support within the 140-145 zone (October 2022).

- Following this, an Intermediate Degree five-wave rally (Waves (1) through (5)) drove the stock to a peak of 375 in October 2024.

- Since then, bearish momentum has dominated, signaling the onset of a larger correction.

BPCL – BPCL (4H Chart) Elliott Wave Technical Analysis

BPCL Elliott Wave Technical Analysis

Function: Counter-Trend (Intermediate Degree Orange)

Mode: Corrective

Structure: Potential Impulse within a Larger Degree Correction

Position: Minute Wave ((v))

Details:

- The lower-degree impulse wave appears to have concluded around 243.

- Minute Wave ((v)) likely formed as an ending diagonal.

- If this count holds, a corrective rally above 300 is expected before a deeper downturn.

Invalidation Point: 375

BPCL 4H Chart – Technical Analysis & Elliott Wave Counts

The BPCL 4H chart breaks down sub-waves following the stock’s 375 peak in October 2024.

- The drop from 375 to 243 resembles an impulse wave at the Minute Degree.

- Minute Wave ((v)) may have completed as an ending diagonal, hinting at a temporary corrective rally.

- If the structure is valid, BPCL could see a retracement toward 306 before bearish pressure resumes.

- A deeper correction toward 144 may unfold in the coming months.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous:ADANI POWER Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

BPCL remains in a downtrend below 375, and after a potential corrective rally, a deeper correction could follow.

Key Resistance Levels:

- 300-310 range – Potential selling pressure may emerge in this zone.