ADANI POWER – ADANIPOWER Elliott Wave Technical Analysis (1D Chart)

ADANIPOWER Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate Degree, Orange)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Zigzag

Position: Minute Wave ((iv)) Navy

Details:

- Minute Wave ((iv)) Navy appears to have completed near the 600 level within Minor Wave 1, facing resistance at 800.

- If this wave structure is correct, Minute Wave ((v)) is now unfolding.

- Invalidation Point: 800

ADANI POWER – Daily Chart Technical Analysis & Elliott Wave Counts

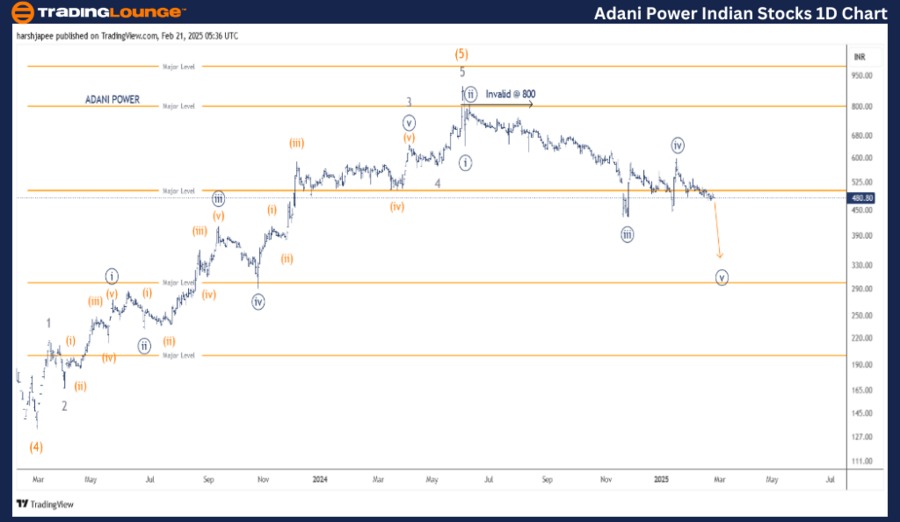

The ADANI POWER daily chart suggests that a significant top was formed at 900 in Intermediate Wave (5) Orange around June 2024.

- A downward impulse wave is currently in progress at Minute Degree, pushing prices lower towards 300 as bearish pressure sustains below 800 resistance.

- The stock previously declined to 130 in February 2023, marking the completion of Intermediate Wave (4) Orange.

- A Minor Degree impulse wave (Waves 1 through 5) then pushed prices up to 900, followed by a sharp reversal.

- Currently, the stock is in a downward trajectory, nearing its first impulse termination at Minor Degree.

ADANI POWER – ADANIPOWER Elliott Wave Technical Analysis (4H Chart)

ADANIPOWER Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate Degree, Orange)

Mode: Corrective

Structure: Potential Impulse within Larger Degree Zigzag

Position: Minute Wave ((iv)) Navy

Details:

- Minute Wave ((iv)) Navy might have completed around 600, within Minor Wave 1, facing 800 resistance.

- If the wave count remains intact, Minute Wave ((v)) is now in progress, with a potential target at 306.

- Invalidation Point: 800

ADANI POWER – 4H Chart Technical Analysis & Elliott Wave Counts

The ADANI POWER 4H chart showcases sub-waves following the Intermediate Wave (5) Orange completion around 900 in June 2024.

- Minute Waves ((i)) through ((iv)) have formed at 640, 800, 430, and 600 levels, respectively.

- If the wave count holds, prices are expected to stay below 600 and continue declining towards 306, where Minute Wave ((v)) is anticipated to complete.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BAJAJ FINANCE Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

ADANI POWER remains in a downtrend, moving towards 306, where Minute Wave ((v)) is expected to terminate.