MCD Elliott Wave Analysis Trading Lounge Daily Chart

In this Elliott Wave analysis report, we delve into the movements of McDonald's Corp. (MCD) on both its daily and 4-hour charts, aiming to provide insights for stock traders and investors.

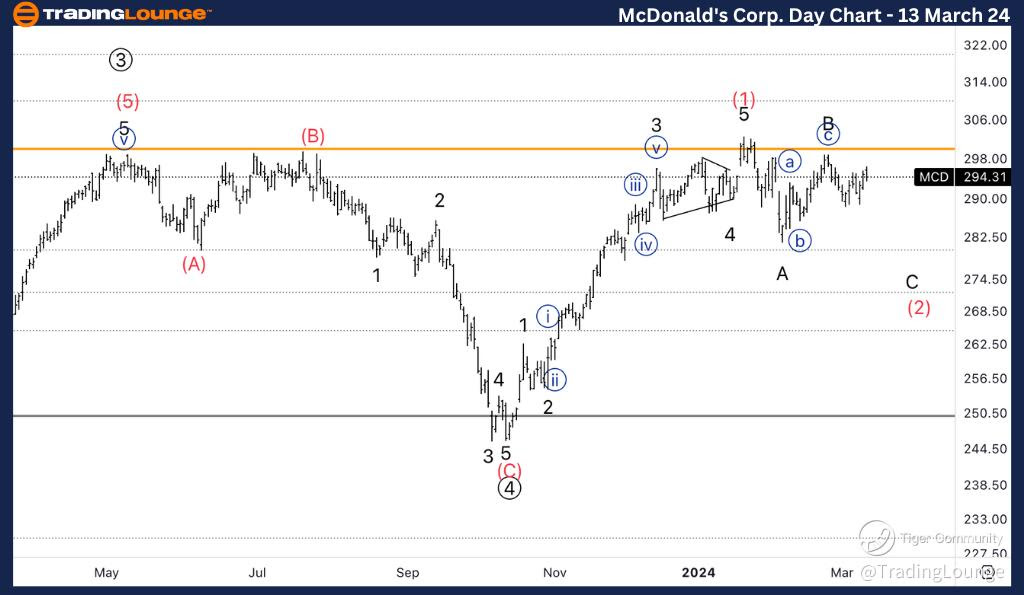

McDonald's Corp. (MCD) Daily Chart Analysis

MCD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave (2) of 3

Direction: Downside into wave C of (2)

After achieving an all-time high (ATH) at $300, McDonald's Corp. (MCD) experienced a pullback, which exhibits characteristics of a bullish corrective phase. This suggests a potential for a continuation higher once the pullback concludes.

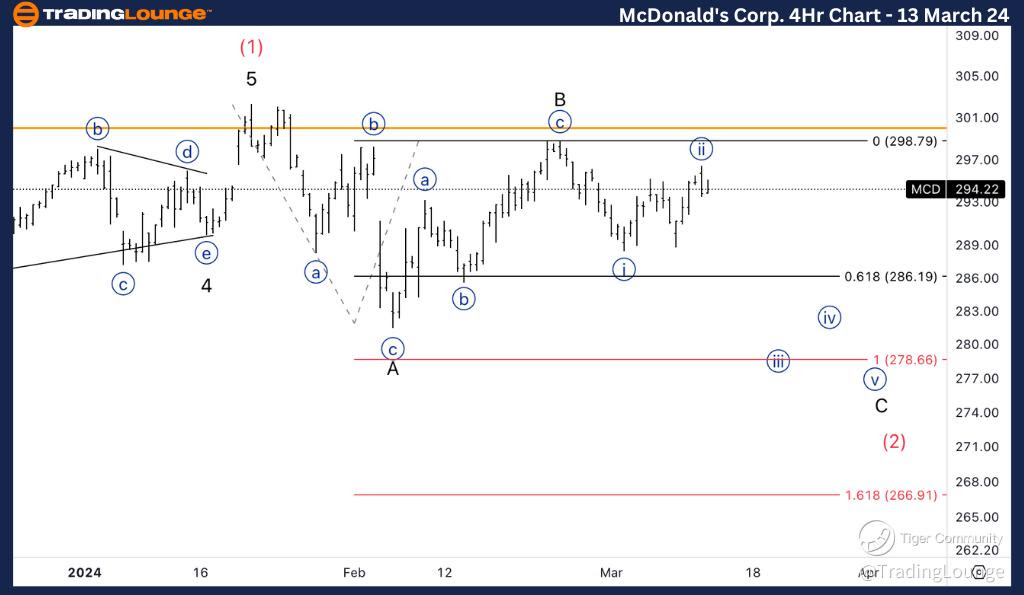

MCD Elliott Wave Analysis Trading Lounge 4Hr Chart, 13 March 24

McDonald's Corp. (MCD) 4Hr Chart Analysis

MCD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave C of (2)

Direction: Wave {iii} of C

On the 4-hour chart, we observe the progression of wave C of (2). Our analysis indicates a downside movement into wave {iii}, with a possibility of encountering a sideways wave B before the downward momentum resumes.

Key Takeaways for Traders

- McDonald's Corp. (MCD) is currently undergoing a corrective phase.

- Daily chart analysis suggests a bullish continuation following the completion of the pullback.

- On the 4-hour chart, wave C of (2) is in progress, with potential for a downward movement in wave {iii} of C.

Conclusion

Elliott Wave analysis offers valuable insights into the potential future movements of McDonald's Corp. (MCD). Traders and investors can use this analysis to make informed decisions, keeping an eye on the completion of the corrective phases and potential opportunities for entry or exit.

By staying updated with the Elliott Wave patterns, traders can navigate the market with enhanced precision and confidence, optimizing their trading strategies for better outcomes in the dynamic landscape of McDonald's Corp. (MCD) stock.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Exxon Mobil Corp., (XOM)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.