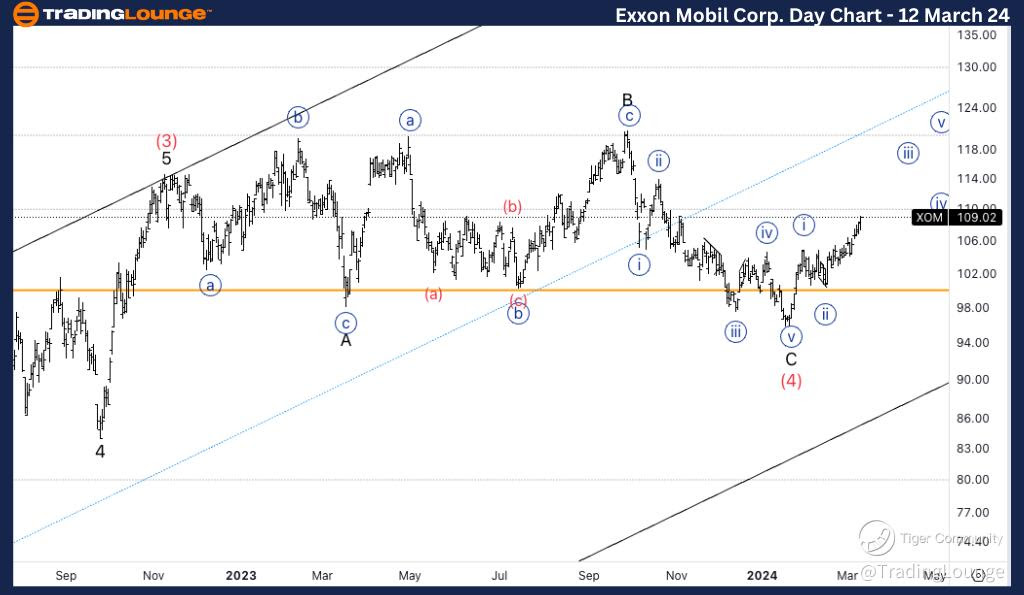

XOM Elliott Wave Analysis Trading Lounge Daily Chart

Welcome to our XOM Elliott Wave Analysis Trading Lounge, your go-to source for comprehensive insights into Exxon Mobil Corp. (XOM) using Elliott Wave Technical Analysis. Let's delve into the market dynamics as of the Daily Chart on 12 March 24.

Exxon Mobil Corp., (XOM) Daily Chart Analysis

XOM Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minor 1 of (5).

DIRECTION: Five waves up into wave 1.

DETAILS: We have seen a long-lasting correction in what could be wave (4), and we have now found support on 100$.

In our analysis, we identify a trending function characterized by an impulsive mode and a motive structure. Positioned in Minor wave 1 of (5), our focus lies on the completion of five waves up into wave 1. Notably, we have observed a prolonged correction, potentially indicating wave (4), with support found at $100.

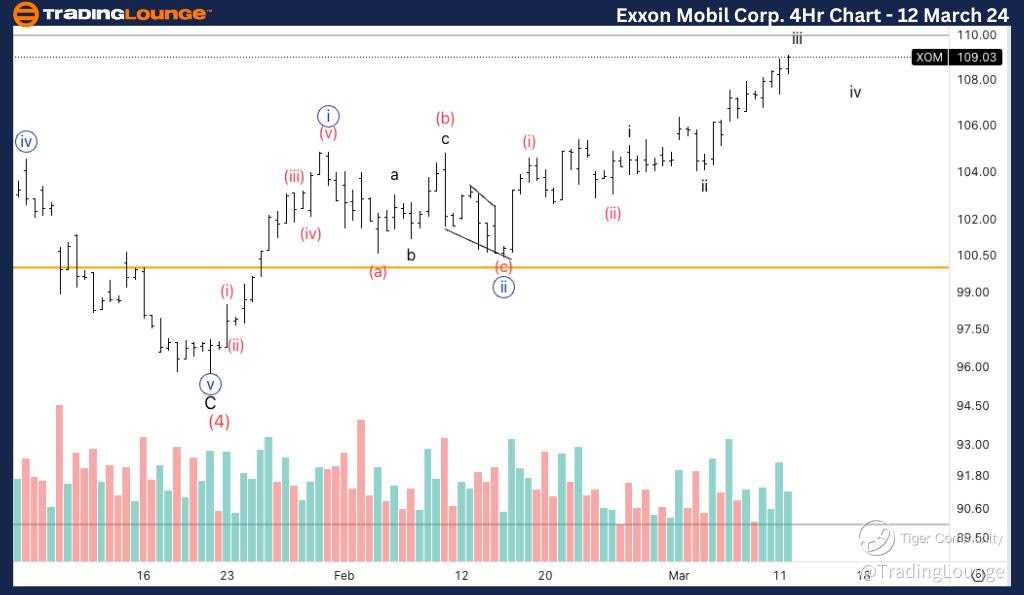

XOM Elliott Wave Analysis Trading Lounge 4Hr Chart, 12 March 24

Exxon Mobil Corp., (XOM) 4Hr Chart Analysis

XOM Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (iii) of {iii}.

DIRECTION: Completion in wave iii of (iii).

DETAILS: We are looking at acceleration higher, as we the move up starts to become parabolic. We are also seeing increasing volume on the most recent move higher suggesting more buyers are stepping into the market.

Here, we also observe a trending function marked by an impulsive mode and a motive structure. Positioned in Wave (iii) of {iii}, our attention is on the completion of wave iii of (iii). Noteworthy is the acceleration in the upward movement, with the trajectory beginning to exhibit a parabolic shape. Moreover, the recent surge in volume suggests an increasing number of buyers entering the market, further bolstering the bullish sentiment.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Apple Inc. (AAPL)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.