JPM Elliott Wave Analysis Trading Lounge Daily Chart, 22 February 24

Welcome to our JPM Elliott Wave Analysis Trading Lounge, your premier destination for comprehensive insights into JP Morgan Chase & Co. (JPM) using Elliott Wave Technical Analysis. As of the Daily Chart on 22nd February 2024, we explore significant trends shaping the market.

JPM Elliott Wave Technical Analysis – Daily Chart

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minor wave 3 of (3).

DIRECTION: Upside in wave {iii} of 3.

DETAILS: After a series of ones and twos around Medium Level 150, we are looking for continuation higher within wave 3 as we seem to be moving higher, with increasing volume, but a concerning RSI bearish divergence.

In terms of wave dynamics, we observe a dominant impulse function with a motive structure. The current position is in Minor wave 3 of (3), indicating upside momentum in wave {iii} of 3. Despite a series of consolidations around Medium Level $150, we anticipate further upside continuation within wave 3. Although we observe increasing volume, a bearish divergence in the RSI warrants attention.

Technical Analyst: Alessio Barretta

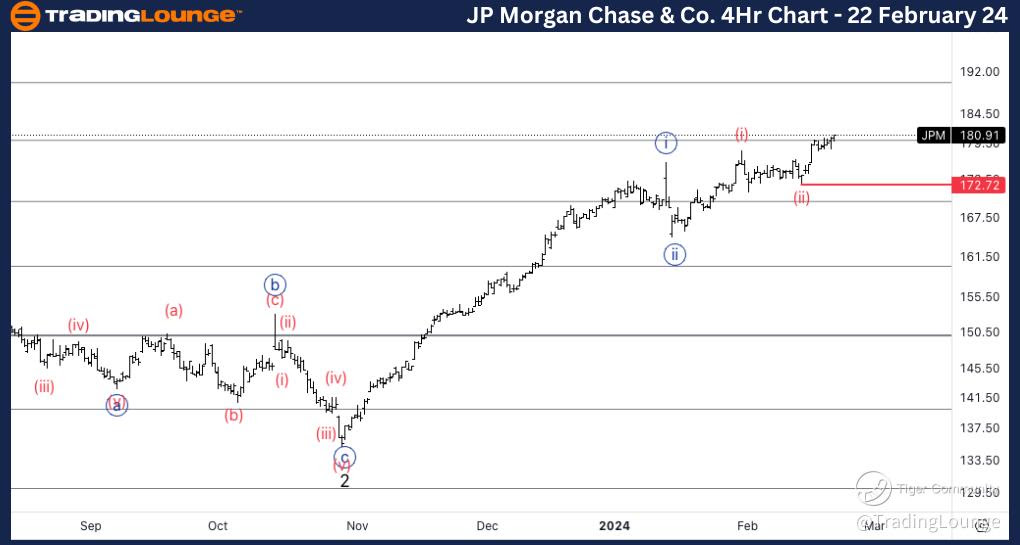

JPM Elliott Wave Analysis Trading Lounge 4Hr Chart, 22 February 24

JPM Elliott Wave Technical Analysis – 4Hr Chart

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (iii) of {iii}.

DIRECTION: Upside into wave {iii}.

DETAILS: Looking for acceleration higher into wave (iii) of {iii} as if the count is correct, we should accelerate higher aggressively and a break south of 172$ would invalidate the count.

Here, the wave function maintains its impulsive mode with a motive structure. The present position is in Wave (iii) of {iii}, signaling further upside movement into wave {iii}. We anticipate acceleration higher into wave (iii) of {iii}. It's important to note that a break below $172 would invalidate this count.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NVIDIA Corp. (NVDA)