Wheat Market Trends: A Comprehensive Elliott Wave Analysis

Wheat Elliott wave Technical analysis

Function: Trend

Mode: Trend

Structure: Diagonal (D1)

Position: Blue wave 'x'

Direction: Downward for blue wave 'y' of Y of (5)

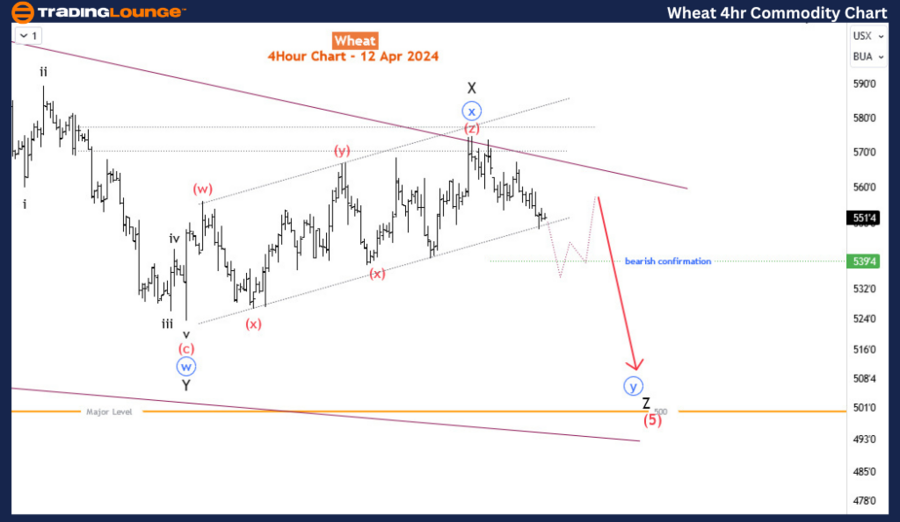

Details: Post completion of the triple three for wave X, the market is gearing towards a downturn to commence the sub-waves of wave Z. A bearish trend is confirmed below the 540 mark.

During the period from March 11th to April 8th, 2024, the wheat market experienced an upward movement, recording gains of over 9%. Despite this positive movement, it served as a corrective phase, indicating an impending return to a bearish trend that began in March 2022. The rally faced resistance in the critical range of 570-577, after completing a triple zigzag correction pattern. Currently, the market shows scant resistance, setting the stage for a potential decline towards the key 500 level.

Wheat Day Chart Analysis

On the daily chart, a bearish impulse wave has been active since March 2022, nearing its conclusion. This phase is expected to lead to a significant bullish correction, with wave (5) of a higher degree, marked as blue '5', gearing up to take place. Notably, wave '5' (in blue) is concluding an ending diagonal, or wedge pattern, a strong reversal signal in technical analysis. Moreover, wave (5) is in its latter stages, having completed a triple zigzag pattern, as visible on the H4 chart.

TradingLounge Commodities Elliott Wave Analysis of Wheat

Wheat 4-Hour Chart Analysis

Focusing on the H4 chart, wave X of (5) ended with a triple zigzag, facing resistance in the 570-577 zone as previously noted. A move below the lower limit of wave X would signify the start of wave Z, which is likely to split into a zigzag (simple, double, or triple) and fall towards the 500 mark.

To summarize, the wheat market is nearing the end of the bearish impulse phase that started in March 2022. While a corrective upswing is imminent, there's room for further decline towards 500 before a substantial bullish correction takes place. Traders are advised to stay alert and keep an eye on crucial levels to adeptly manoeuvre through the shifting market dynamics.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold Commodity

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE