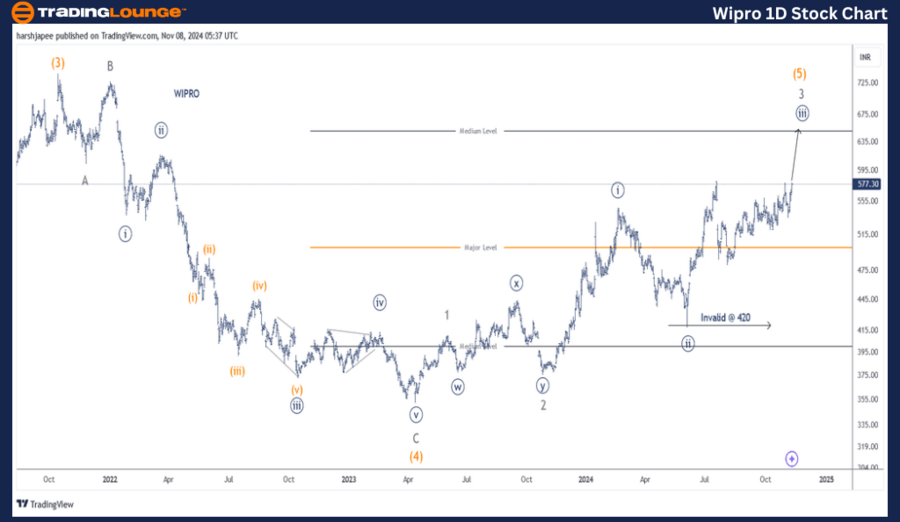

WIPRO – WIPRO Elliott Wave Analysis TradingLounge (1D Chart)

WIPRO Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((iii)) Navy.

Details: Minute Wave ((iii)) Navy is advancing within Minor Wave 3 Grey of Intermediate Wave (5) Orange against the invalidation point at 420.

Key Highlights:

WIPRO Daily Chart Technical Analysis and Potential Elliott Wave Counts

The WIPRO daily chart suggests a continued bullish rally as Minor Wave 3 of Intermediate Wave (5) progresses beyond the 420 low. The chart signals strong upward momentum, with bulls firmly in control as Minute Wave ((iii)) Navy potentially extends.

- Intermediate Wave (3) concluded near the 780 level in October 2021.

- A corrective zigzag (Intermediate Wave (4)) followed, reaching the 350 zone by April 2023.

- Bulls regained control from this point, leading to the development of Intermediate Wave (5).

Minor Wave 1 Grey, within Intermediate Wave (5), completed as an impulse, followed by a combination that ended Minor Wave 2 Grey near 375. Now, Minor Wave 3 is advancing, indicating further upside.

WIPRO – WIPRO (4H Chart) Elliott Wave Technical Analysis

WIPRO Stock Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((iii)) Navy.

Details: Minute Wave ((iii)) Navy is progressing higher within Minor Wave 3 Grey of Intermediate Wave (5) Orange. Additionally, Minuette Waves (i) and (ii) Orange may already be in place, with Minuette Wave (iii) currently advancing.

Key Highlights:

WIPRO 4H Chart Technical Analysis and Potential Elliott Wave Counts

The WIPRO 4H chart provides insights into the sub-waves following the completion of Minor Wave 2 Grey near the 380 mark in October 2023.

- Minute Wave ((i)) extended into the 545-550 range.

- Minute Wave ((ii)) concluded around 420.

- Minute Wave ((iii)) is now in progress, suggesting a potential extension above 420.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BHARAT ELECTRONICS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

WIPRO is trending higher within Minute Wave ((iii)) of Minor Wave 3 of Intermediate Wave (5) Orange, maintaining the 420 level as a key support and invalidation point. The current progression signals sustained bullish momentum, with further upside expected as the waves unfold.