Mastercard Inc. (MA) Elliott Wave Analysis

This detailed analysis of Mastercard Inc.'s Elliott Wave positioning offers insights into possible upcoming trends based on the current wave structure and technical support levels.

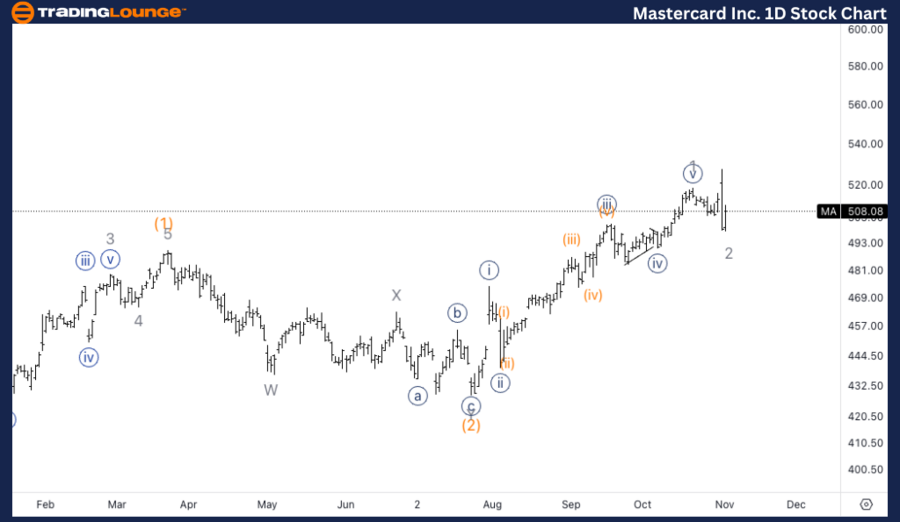

Mastercard Inc. (MA) Elliott Wave Analysis | Trading Lounge Daily Chart

MA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 2

Direction: Upside in 3 of (3)

Analysis:

If this Elliott Wave count is accurate, we can expect Minor wave 2 to be a shallow retracement, as it appears to be currently. A continuation to the upside is anticipated, leading into a third of a third wave, which often exhibits strong impulsive momentum, suggesting substantial bullish action.

MA Elliott Wave Technical Analysis – Daily Chart

On the daily chart, Mastercard is likely positioned in Minor wave 2 of a broader impulsive wave structure. Assuming this wave count holds, we should see a shallow correction phase, allowing for an upward move in wave 3 of (3). The third wave in such an impulsive structure often demonstrates significant momentum, so additional upward movement is expected.

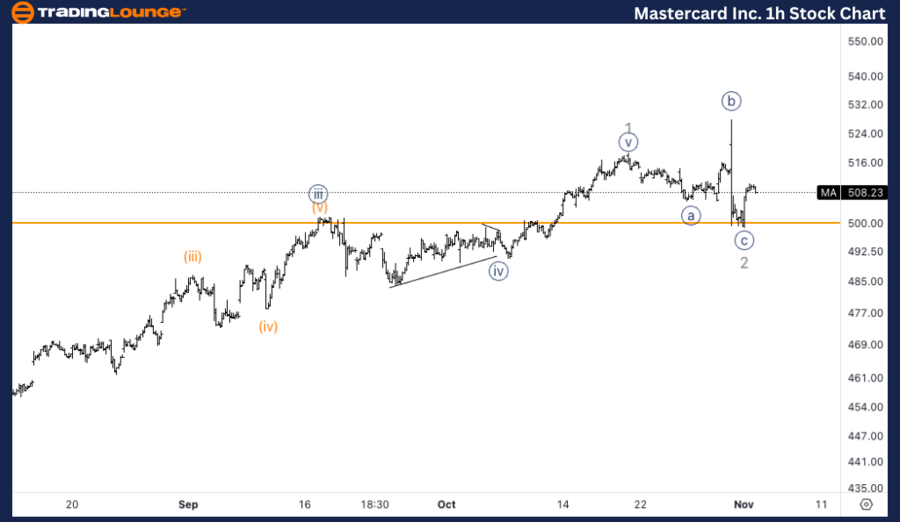

Mastercard Inc. (MA) Elliott Wave Analysis | Trading Lounge 1H Chart

MA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 3

Direction: Upside in {i}

Analysis:

In the 1-hour chart, Mastercard seems to have completed a flat correction in wave 2, with support found near the $500 level, corresponding to TradingLevel 5. As long as this support level remains intact, we can expect the trend to continue moving upward, initiating wave {iii} to the upside.

Summary of MA Elliott Wave Analysis

This Elliott Wave analysis for Mastercard Inc. (MA) evaluates both the daily and 1-hour timeframes, using Elliott Wave Theory to forecast potential future price movement.

MA Elliott Wave Technical Analysis – 1H Chart

The 1-hour chart analysis suggests that MA may have completed a flat correction in wave 2, with wave {i} now trending upwards. Support has been established at the $500 level, which corresponds to TradingLevel 5. Provided this support holds, further upward action in wave {iii} is likely to follow.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: MELI Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support