Natural Gas Wave Patterns: A Comprehensive Elliott Wave Analysis

Corrective Phase in Natural Gas Markets: Insights into Wave 4

Natural Gas Technical Analysis

Mode: Corrective for Wave 4

Structure: Double Zigzag

Position: Wave (2)

Direction: Wave (3)

In-Depth Overview: The Natural Gas market is nearing the completion of Wave (2) in a key reversal zone, setting the stage for the onset of Wave (3) should prices exit this zone.

Since April 25, 2024, Natural Gas has demonstrated a significant rally, boasting a near 45% increase. This rally is part of a broader bullish correction that began in January 2024. Despite these gains, the long-term trend still leans bearish, with expectations leaning towards a return to this trend after the current bullish retracement completes.

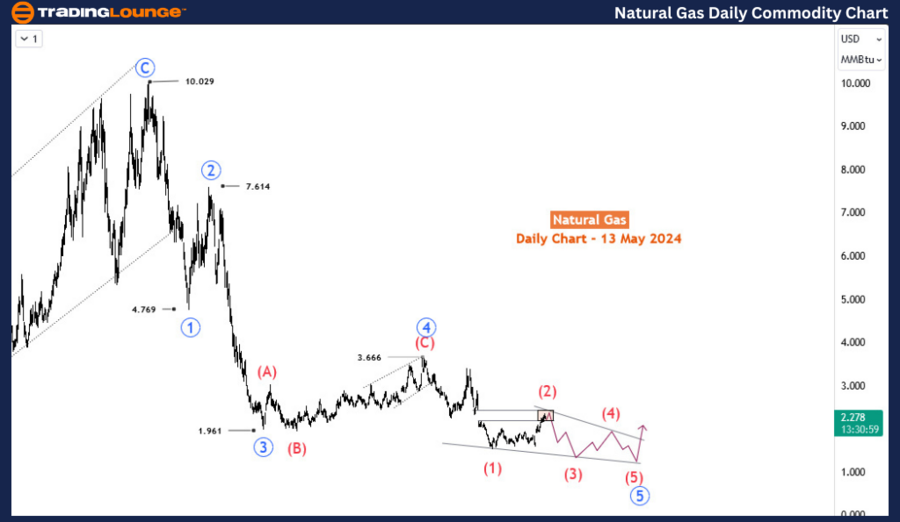

From Peaks to Troughs: The Journey of Natural Gas Prices The bearish impulse that began in August 2022 saw prices starting around $10. This cycle led to a drastic 85% drop in value by February 2024, with prices plummeting to as low as $1.52. The recovery phase post-February suggests a corrective pattern, possibly a zigzag or double zigzag, pending a stronger impulse to confirm a shift towards a recovery phase.

Wave 4 Dynamics and the Prospect of Wave 5 In October 2023, analysts noted the end of the 4th wave at a price point of $3.66, which preceded the 5th wave’s descent. The decline culminated in a three-swing movement by February 2024, hinting at an ending diagonal due to its three-swing initiation of the 5th wave.

Daily Chart Analysis: Identifying Waves within Natural Gas Trends

The descent to the February low is identified as wave (1) of the 5th wave, and the current upsurge as wave (2). Wave (2) is currently in a reversal zone, suggesting the potential start of wave (3). However, should wave (2) extend further, it will likely adopt an additional three-swing structure, if the descent from the zone proves to be corrective. It is crucial for the price to stay below 3.39 to confirm the completion of wave (2).

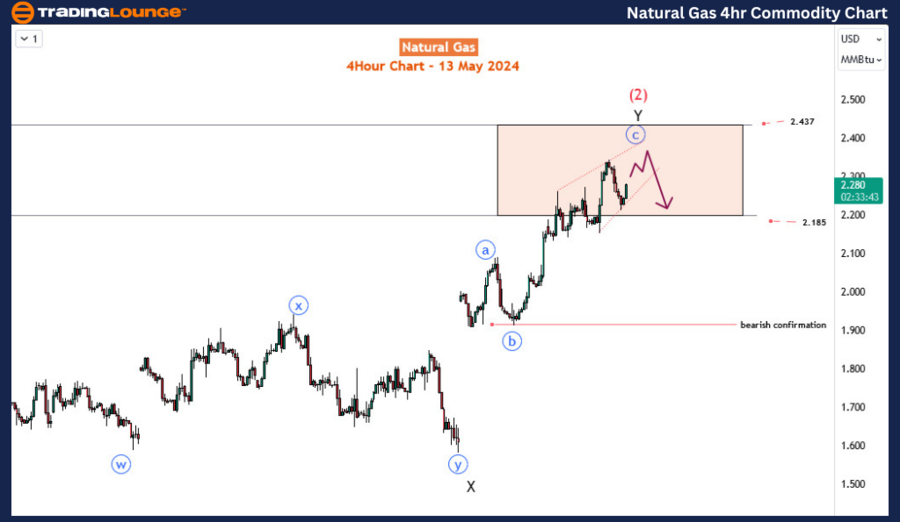

H4 Chart Examination: Double Zigzag Formation

On the H4 chart, wave (2) is evolving into a double zigzag pattern. The initiation of wave (3) would be confirmed by a bearish impulse departing from below 2.185, followed by breaking past the critical level of 2.00. This point could trigger increased selling activity, potentially driving prices to new lows not seen in over four years.

Conclusion: Natural Gas trading currently operates within a complex Elliott Wave structure, characterized by the interplay of bullish corrections and bearish impulses. Traders and analysts closely monitor these patterns to predict future movements effectively. Understanding these wave patterns is crucial for those engaged in trading, as it provides insights into potential price directions based on historical and current technical behaviors.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver XAGUSD Commodity Elliott Wave

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support