Amazon Inc., Elliott Wave Technical Analysis

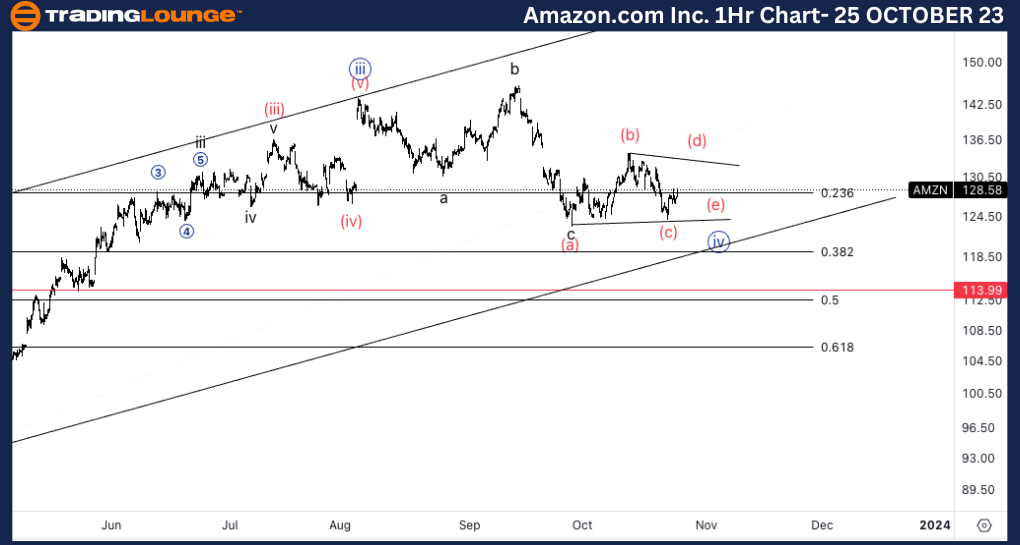

Amazon Inc., (AMZN:NASDAQ): 4H Chart, 25 October 23

AMZN Stock Market Analysis: We are monitoring the possibility of a wave {iv} to be in the making as we have been moving sideways ever since we topped in August of this year.

As we keep moving higher and lower in three wave structures we could assume they are corrective in nature.

AMZN Elliott Wave Count: Wave {iv} of 1.

AMZN Technical Indicators: 200EMA as support.

AMZN Trading Strategy: Looking for longs into wave {v}.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

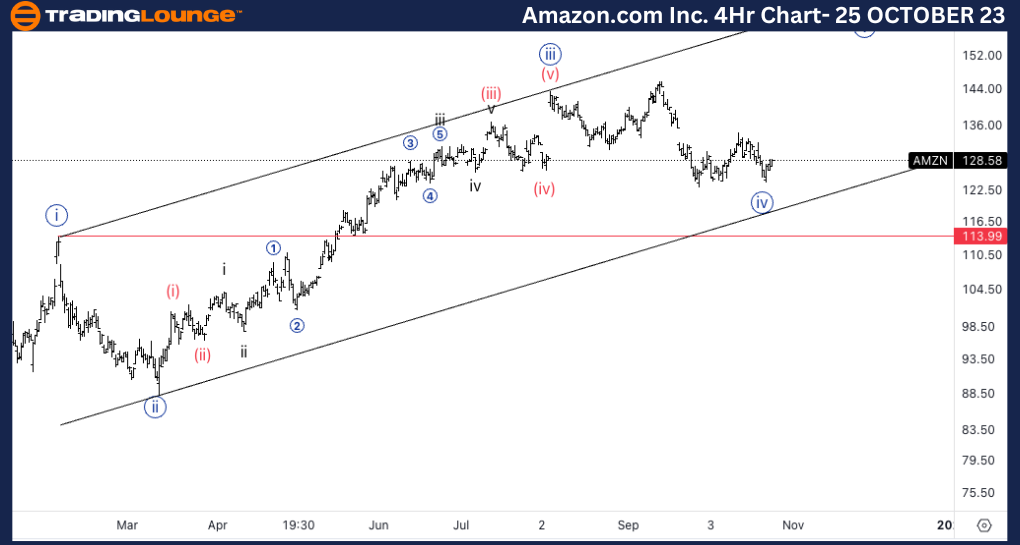

Amazon Inc., AMZN: 1-hour Chart, 25 October 23

Amazon Inc., Elliott Wave Technical Analysis

AMZN Stock Market Analysis: Here are looking at a potential triangle in wave {iv} as we are moving back and forth the 23.6% of the advance in wave {iii}.

AMZN Elliott Wave count: Wave (c) of {iv}.

AMZN Technical Indicators: In between averages.

AMZN Trading Strategy: Looking for longs in wave {v}.